HOME >> BUSINESS

The US seriously distorts market economy

By Liu Zhiqin Source:Global Times Published: 2019/6/12 21:03:40

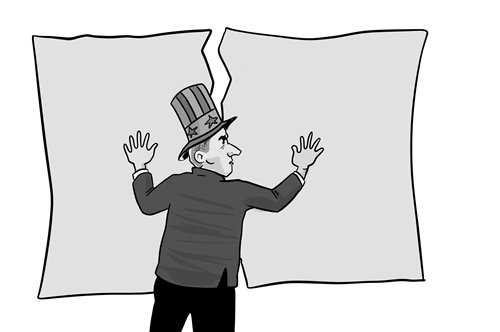

Illustration: Luo Xuan/GT

Many have been thinking the same questions: What kind of country is the US? Is it still a "normal market economy?" The eccentric behavior of the US has sparked people to re-examine the world's largest economy. What is its problem?

First, the US has gotten "political fever." Every policy centers around "America First" and serves US political purposes.

Since US President Donald Trump came to power, his only contribution has been tearing off the fig leaf of the country, which has marketed itself as a "true free-market economy." The US relentlessly criticizes what it views as "non-market economies" and points fingers at their economic policies. The US is trying to pin the blame of a sluggish world economy on the business conduct of these so-called "non-market economies." All kinds of sanctions and punitive measures have been brought out against them. This way, the US removes its own responsibility, shifting the crisis to other countries and holding them accountable.

When people calm down and organize their thoughts, questions are raised. Who has been deceiving the world to gain a good reputation? Who has been acting at its own will, wielding a sword against the so-called "non-market economies" and attacking its partners on the global value chain?

The conduct of the US has laid bare that the US itself is a non-market economy. Its actions have nothing to do with the laws and principles of the market.

The Trump administration has turned the US into a "limited market economy with US characteristics," which has basically lost traditional features of market economies and added arbitrariness and bullying. A country like this is not qualified to discuss market issues with the majority of countries that abide by market rules.

The US is diagnosed with "market wobbler syndrome." The country has lost confidence and capability to engage in competition. It resorts to solving problems through non-market means. The trade frictions between the US and many other countries have proved the point.

The reason, rooted in the current chaos of the world economic order, is that the US, as an "abnormal market economy," is trying to play the leading role of the "normal market economies." The move has fundamentally devastated the operation of the market mechanism.

Since the Section 301 of the Trade Act of 1974, the US has drifted away from a market-oriented model. The "invisible hand" is no longer in the leading role as the country has applied more "visible hand" to control the market. The more advantages it gains from market intervention, the more it relies on it. The US has gone further down the road of "abnormal market economy."

Besides Section 301, the US uses other "innovative" means to confine free competition and defy cooperation with others. Through its appalling blockade against Huawei with state power, the US has stripped off the guise of a free market economy and turned into an "abnormal market economy" while behaving like a xenophobic tyrant.

This kind of country can deal greater damage to the world economy since it is being deceptive and undermining the rules and order of global economy and trade. The biggest impairment will be implementing hegemony while waving the market economy flag.

China needs to be wary of some Western countries creating division within the WTO, marking countries as "market" or "non-market."

Its intention is obvious. China will have to pay attention to the tendency and be prepared for it.

It also needs to analyze public opinion and expose the "abnormal market economy" traits of the US. In this way, the two countries can find a way out of the trade friction on a fair and just basis.

However, the US has never been introspective. US politicians and economists are unwilling to admit the fact that the US has become an "abnormal market economy."

The US is not a true market economy. This is a hard fact that more countries and enterprises should realize.

More people knowing the truth can help build a community of shared destiny with fair competition.

The author is a senior fellow of the Chongyang Institute for Financial Studies at Renmin University of China. bizopinion@globaltimes.com.cn

Posted in: INSIDER'S EYE