HOME >> BUSINESS

Beijing’s response to escalating trade war needs to focus on long-term needs

Source:Global Times Published: 2019/6/17 21:28:40

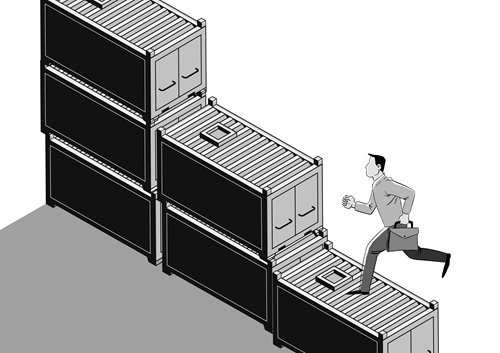

Illustration: Luo Xuan/GT

Amid the escalating trade war, the US has not only imposed punitive tariffs on Chinese goods, but also implemented discriminatory policies against Chinese companies. In response, China has had to take some countermeasures and retaliate by increasing tariffs on US goods and compiling a list of unreliable entities that seriously undermine legitimate interests of Chinese companies. But in addition to these steps, what else should China do?

A recent report by the Asia Securities Industry & Financial Markets Association (ASIFMA) may offer an answer. The report urged China to accelerate the reform of its capital markets, relax foreign ownership rules, and create a level playing field between domestic and foreign companies. It also said that even if the trade war triggers concerns about capital outflows and the yuan depreciation, China should still relax capital controls. "The Chinese authorities are well aware that they need to create transparent, non-discriminatory access to the market and not allow politics to influence its policy decisions because that actually undermines everything they are trying to do toward developing their financial markets," ASIFMA CEO Mark Austen was quoted by Reuters as saying.

It is worth noting that since announcing plans to further open up the financial industry in April 2018, China has made continuous breakthroughs in this regard. On November 25, 2018, the China Banking and Insurance Regulatory Commission announced that Allianz (China) Insurance Holding Co would be China's first ever insurance company wholly owned by a foreign insurer. Recently, the China Securities Regulatory Commission approved the purchase of stake in Morgan Stanley Huaxin Fund Management Co by Morgan Stanley, which therefore made it the top shareholder of the fund management company.

While the ASIFMA report may only focus on how China should open up its market under trade war pressure from the perspective of the financial industry, the same approach can be applied to the rest of the Chinese economy. Since China's accession to the WTO, it became part of the global division of labor to become the world's factory with its comparative advantages. At present, as China is transitioning from a "world factory" to "world market," it needs to further open up its domestic market to allow more companies to enter and to use international capital to further improve it. Only in this way can it withstand the downward pressure on the economy and allow international capital to share the dividends of the Chinese market, thus stabilizing and attracting capital inflows.

It is urgent that China cope with the current trade war; however, it has also become clear that the competition between the US and China will be a long-term and complicated one. For this reason, China should have more long-term plans and arrangements in place. While dealing with the trade war in the short term, all the reforms, adjustments and innovations made today should go beyond the trade war, taking into consideration China's long-term development needs.

Recently, China said that it will establish a list of unreliable entities, which will include foreign companies, organizations and individuals that do not comply with market rules, violate the spirit of the contract, block or cut supplies to Chinese companies for non-commercial purposes, and seriously damage the legitimate rights and interests of Chinese companies. Some observers have suggested that the current approach is targeted at US companies, as a form of retaliation by China. But it should also be pointed out that market rules and the spirit of the contract should be the rules that all companies abide by. According to past surveys, transparency, the rule of law, and a predictable market environment are what foreign companies want most in an investment environment. Objectively speaking, the domestic market still lags behind that of developed countries in these aspects. And these are exactly the issues that China needs to improve upon in the context of the trade war.

Amid rising anti-globalization sentiments, the world is expected to undergo changes against the backdrop of the trade war, and China needs to be prepared for future long-term developments. In this sense, it needs to maintain the resolve of reform and opening-up, while also having the ability to implement them as well as the systemic improvements. China's reform and opening-up should go beyond the US-China trade war to focus on how to get along with the whole world in the future, how to help the open Chinese market maintain long-term attractiveness to foreign investment, and how to make China better recognized as a big country with globalization responsibilities.

The article was compiled based on a report by Beijing-based private strategic think tank Anbound. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT