HOME >> BUSINESS

Financial defense important in US-China trade war

By Mei Xinyu Source:Global Times Published: 2019/8/12 18:18:40

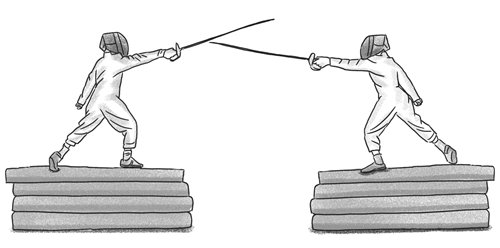

Illustration: Xia Qing/GT

On March 22, 2018, US President Donald Trump signed a presidential memorandum imposing large-scale tariffs on Chinese goods, a decision which prompted speculation in the global financial market until now. In fact, the US-China trade war has already spread to the global financial market. In early August, when the US once again unilaterally declared new tariffs and officially named China a "currency manipulator," the yuan's exchange rate against the dollar weakened for several consecutive trading days in the foreign exchange market, intensifying trade war tensions.

We should pay great attention to the financial market during the US-China trade war. Why? Because finance is the core of the modern economy. As the world's two largest economies, China and the US also have the biggest financial markets in the world. Their trade, investment, financial and external markets are linked closely, which means that while the trade war has a significant impact on the financial market, the financial market's reaction may also affect the trade disputes. Both sides have tended to make use of financial market reactions to strike blows against the other party.

In view of this, one of the most important characteristics of the US-China trade war is its impact on the financial market, which has reacted much more strongly compared with any previous trade disputes between China and other countries. Financial institutions at home and abroad have also paid more attention to the trade war this time than any previous trade war in past 20 years.

Even in the narrow sense of trade disputes that only involve the trade of goods, we still need to consider the financial market as a potentially promising tool for the trade war. No matter how fierce the verbal arguments and threats are, how large the published tariffs and trade embargo lists are, or how important the industrial fields involved are, as long as the tariffs or embargoes are not officially imposed, the trade of relevant goods and services will not see any actual impact. However, all these verbal arguments, threats, and releases of tariffs and embargo lists are sufficient to shake up the financial market.

In this sense, we should attach importance to the mutual influence of trade disputes and financial markets so as to achieve the following targets: to minimize the impact of trade disputes on China's financial market, to contain any harm to the rival's side in the trade war, and to prevent the opponent from using the trade war to manipulate and attack the domestic financial market.

For the prevention of the opponent and international hot money from manipulating and attacking China's financial market, domestic discussion is generally concerned with the following potential risks: the decoupling of US and Chinese capital markets, including but not limited to directly or indirectly forcing Chinese companies to delist from the US stock market and prohibiting US institutional investors from investing in Chinese listed companies; decoupling Chinese companies and financial institutions from the US dollar-based settlement system; seizing and freezing Chinese assets, including investments of Chinese companies and residents as well as official reserves assets in the form of US debt or others.

Under normal circumstances, the probability of the above risks is very low because the US itself, including its government, companies and society, will have to pay a very heavy price, and some policy risks may even push the country to the verge of war. Yet, planning for the worst and striving for the best, we must adhere to bottom-line thinking to prepare to prevent and handle extreme situations.

With the trade war having lasted for more than a year, China has never taken the initiative to stir up trouble. This does not, however, mean that the US' extreme pressure can coerce China to give in to its demands, or that China can only passively take hits without any counterattack.

The US, to a large extent, has misunderstood that as a trade surplus country, China has an "inborn asymmetry weakness" in the trade war: China's exports to the US are about three times those of the US to China. If the trade war were only limited to the goods trade, the US could hit three times more Chinese goods. This is the main reason why certain parties took for granted at the beginning of the trade war that they could continuously put pressure on China, and assumed that China wouldn't fight back.

But in a trade war, the form of counterattack is not determined by the other party. The US financial sector and financial market are the most developed in the world, and they are far more sensitive to their national economy and environmental changes compared with their peers in China. US stocks are currently at high levels. By comparison, the impact of stock market volatility on the Chinese economy is far lower.

In the face of US provocation, we are forced to fight so as to stop the trade war. For this purpose, adequate defense and appropriate counterattacks are equally important.

The author is a research fellow with the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce. The article was first published on yicai.com. bizopinion@globaltimes.com.cn

Posted in: EXPERT ASSESSMENT