HOME >> SOURCE

Recession hits HK economy

By Chen Qingqing, Bai Yunyi and Fan Lingzhi in Hong Kong Source:Global Times Published: 2019/12/3 21:33:40

City's future as finance center hangs in balance as violence persists

Pedestrians cross a road in the Central district of Hong Kong in October. Photo: VCG

While black-clad protesters in Hong Kong waved American flags and chanted "President Donald Trump, let's make Hong Kong great again," the city has been plunging into its deepest recession in a decade.

Carrie Lam, Chief Executive of the Hong Kong Special Administrative Region (HKSAR) said on Tuesday that officials would soon roll out a fourth round of relief measures as the city now faces a "severe economic situation."

She revealed that unemployment was expected to further rise from the current 3.1 percent.

The city recorded its biggest retail slump in October, a drop of 24.3 percent year-on-year, and the HKSAR government is poised to experience the first budget deficit in 15 years in the fiscal year that ends in March 2020.Some raised questions about whether protesters expect a recession, and several prominent economists predicted that Asia's financial hub is quite likely to see an economic contraction in 2020, which will take a toll on financial market.

Hong Kong's economy is expected to contract 1.3 percent year-on-year in 2019 due to external pressure and social unrest, Financial Secretary Paul Chan Mo-po told the Panel on Financial Affairs of Legislative Council on Monday. A sharp economic deterioration and recession, in addition to months of violence, has weakened investment confidence, affected local consumption and will further weigh on people's livelihoods, he said.

Tension returned to Hong Kong's streets during the weekend as clashes between rioters and police broke out in different districts such as Mong Kok and Whampoa. Rioters trashed stores and beat up innocent residents who disagreed with their behavior. There were major clashes barely after a week-long "truce," especially during the District Council election.

Some local residents and tourists from the Chinese mainland said they are still worried about their personal safety when they walk the streets and local businesses, which have been suffering amid months of social unrest, see a dim future.

The latest figures from the Hong Kong Tourism Board showed that visitor arrivals dropped 43.7 percent year-on-year in October, casting a shadow over industries including retail, services, restaurants, hotels and so on. It was the sharpest drop in a single month since an outbreak of SARS in 2003, and it has turned some tourist sites like Disneyland into "ghost towns," according to media reports.

Some Hong Kong economists worried that months of protests would have long-term consequences on the local economy. The city has also been hit by the China-US trade war because of its role as a major a trading hub. When asked whether Hong Kong risks losing its advantages as a global business and trade window, Francis T. Lui, professor emeritus of the Hong Kong University of Science and Technology, noted that many illegal acts occurred amid political and social unrest and this weighed heavily on Hong Kong's business reputation.

"A major reason the city became an international business hub was its stable social order and respect for the rule of law, the spirit of contract that business values the most," Lui told the Global Times, raising questions about whether the city could maintain those advantages.

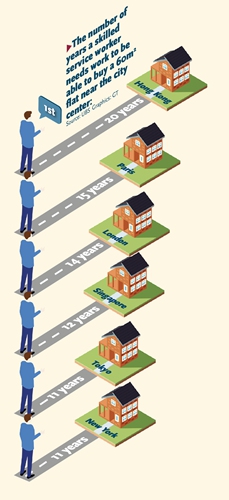

Graphics: GT

Financial woes

Although anti-government protests have lasted for nearly six months, investors retained confidence in Hong Kong financial markets, which have not become casualties amid the trade war and social unrest.

The mainland's internet giant Alibaba held an IPO on the Asian region's largest financial market, a strong endorsement of the city's unshakeable role as global financial hub and the mainland's gateway to the global markets, analysts said.

Paul Chan said in a blog post on Sunday that though social unrest has hit the local economy hard and seriously affected livelihoods, its consequences on Hong Kong's financial market are still limited.

"The financial market has been operating smoothly and orderly," Chan said, noting that the Hong Kong stock market entered a new phase of development following Alibaba's listing.

However, if violence and chaos continue, the financial market will also be hurt, as the city would lose its attractiveness to both talent and investors, according to analysts.

As protests raged in recent weeks, some financial firms urged employees to work at home, as their offices are located in places like Central where regular illegal gatherings were held from time to time. Some banks also shut branches to avoid collateral damage following clashes between police and protests that usually turned violent.

Among the workers in the financial hub, some are expats and mainland employees, and some are considering moving away. Prolonged disruptions to work and daily life also pushed more Hong Kong workers in the sector to think about the possibility of moving abroad, Bloomberg reported in November.

"In the near future, financial talent won't consider working here in Hong Kong, while more foreign businesses will move away and investment will continue declining. Whether the city could maintain the global financial status, that's indeed a worry," Chan Kin-por, the chairman of the Legislative Council (LegCo)'s Finance Committee, told the Global Times.

"As Hong Kong declines, mainland cities like Shanghai and Shenzhen have been accelerating the development of their financial services, which would also narrow the distance between them and Hong Kong," he said.

Deep-rooted issues

Observers said that tackling the city's economic woes should be preceded by handling social issues such as legislative reform, providing more opportunities for Hong Kong youth and resolving deep-rooted land supply problems, observers said.

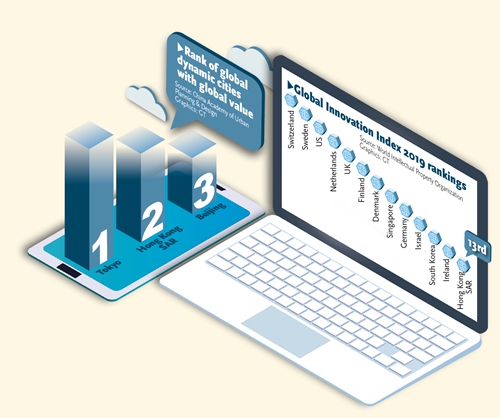

Graphics: GT

Considering the city's lack of effectiveness in handling riots, Lui suggested that Article 18 of the Basic Law could be an option to end riots and chaos.

If the Standing Committee of the National People's Congress decides to declare a state of war or, by reason of turmoil within the HKSAR, which endangers national unity or security and is beyond the control of the HKSAR government, the central government may order the application of relevant national laws in the city, according to the article.

Young people in a highly politicized society may pay less attention to their own development, as a major focus in the recent District Council election shifted from improving livelihoods to supporting the political agenda of opposition groups. "Only when deep-rooted issues are handled, will Hong Kong people shift their focus again to an economic recovery," LegCo's Chan told the Global Times.

For some local residents who are considering moving out of the city amid social turmoil, the Guangdong-Hong Kong-Macao Greater Bay Area could offer new opportunities to start businesses, find jobs, find schools for their children and so on. "This is likely to be a chance for further integration in the area too," he said.

Graphics: GT

Posted in: INDUSTRIES,MARKETS