Anti-dumping on Aussie wine not ‘trade war,’ but Canberra urged to ‘grow up’ or face more pain

By GT staff reporters Source: Global Times Published: 2020/11/27 20:05:44 Last Updated: 2020/11/27 22:47:11

Canberra urged to ‘grow up’ or face more pain

Photo:VCG

China announced on Friday it would raise tariffs on Australian wine to 212 percent as a temporary anti-dumping measure, a decision that Chinese experts said was made in accordance with WTO regulations and not a shot for a so-called "trade war" with Australia amid deteriorating ties. Instead of staging a political performance or making "sweet talk," Canberra needs to grow up and reflect on its wrong deeds that damage bilateral ties, and make concrete moves for a better trade environment before it is too late.

According to a preliminary ruling of the Ministry of Commerce (MOFCOM) on Friday, significant dumping of Australian wine had occurred, and those imports had caused substantial damage to Chinese producers. Starting Saturday, China will impose provisional anti-dumping measures in the form of deposits on wine imported from Australia, with the deposits ranging from 107.1 to 212.1 percent.

The decision came after an investigation which started in August and had been conducted strictly in accordance with China's related laws and regulations, and rules of the WTO, MOFCOM said.

The Ministry of Commerce (MOFCOM) Photo: VCG

China is Australia's number one wine export market by value. Despite theCOVID-19 pandemic, China imported AU$3 billion ($2.2 billion) worth of Australian wine in the first three quarters, up 4 percent year-on-year, Australia's public broadcaster ABC reported, citing industry reports.

The Friday anti-dumping measures will have a serious impact on Australia's exports to China, a Chinese wine importer named Chen Wei said.

"With this anti-dumping measure, we have to get suppliers from other countries," Chen told the Global Times on Friday. "We are talking to suppliers from Europe and South America, such as Spain and Chile," he said, adding that he had found their wines to be cheaper.

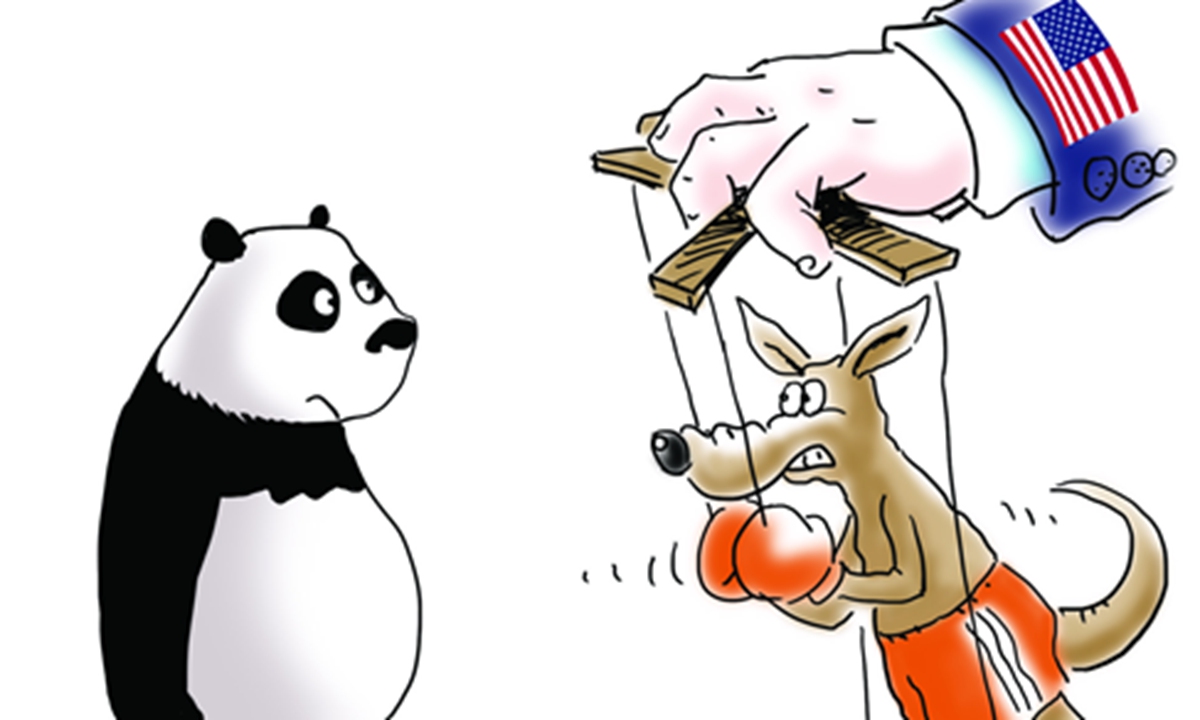

Against the backdrop of worsening bilateral tensions between China and Australia, as the latter acts like a pawn of the US in provoking China on its core interests such as China's Hong Kong, Xinjiang and Taiwan, China's announcement on Friday has been interpreted as a "shot" of trade war. Australian Trade Minister Simon Birmingham was cited by media as saying that Canberra would seek WTO intervention.

"China has always opposed countries using trade as leverage or coercive measures for political gains. China never wages trade wars with any country. China's investigations on the wine dumping is thorough and clear in accordance with the WTO rules and procedures," Chen Hong, a professor and director of the Australian Studies Center at East China Normal University, told the Global Times.

Illustration: Liu Rui/GT

More pain awaits

At least seven categories of Australian commodities, including barley, sugar, wine, timber and lobsters have been reportedly halted in China, and 50 boats carrying coal from Australia were reportedly lingering around Chinese ports, Australian media reported, claiming this is China's trade retaliation.

Although China does not mix trade with politics, it is undeniable that the deteriorating China-Australia ties do affect the business environment for Chinese companies' investment in Australia, and Chinese consumers' confidence in Australian products, Chen said.

Australia is not an irreplaceable source country of many products for China. The world today is undergoing enormous changes, in particular with the world economy seriously impinged by the COVID-19 pandemic. China needs to make adjustments to its international trade patterns, diversify import channels, fulfil its pledge to reduce carbon emissions, and implement the Phase I trade deal with the US, Chen said.

Deteriorating bilateral ties would also dampen down Chinese customers' enthusiasm toward Australian products. And once they switch to products of the same or similar quality from other sources, Australian suppliers would find themselves in fiercer competition.

Take wine as an example. A brand director with an Australian wine supplier based in the state of South Australia told the Global Times about concerns over Chinese consumers' losing interest if prices of Australian wine rise, and they may switch to brands from other countries.

A sales staff at Guangzhou Yang Wei Zhong International Trade Co which sells foreign wine told the Global Times that French wine is more popular in China than that from Australia due to the trade frictions between the latter and China.

"Once we sell out these Aussie wine, we won't import more," the sales person said.

Photo:Xinhua

China is Australia's top wine export market by value, and purchases about 37 percent of Australia's total wine exports worth over $800 million, reports said. Treasury Wine Estates, a leading wine company based in Melbourne, saw its share price tumble 11 percent on Friday.

The company did not offer detailed comments on Global Times' inquiry through email, saying that it will be issuing an announcement on Monday.

Agricultural products account for about 13 percent of Australia's exports, but once other pillar industries are affected, Australia would feel more pain, and this is why we call on Australia to act like an adult instead of behaving like impulsive, tempestuous juveniles, Chen said.

Data from Australia's Department of Foreign Affairs and Trade shows China imported goods worth over AU$118.4 billion in 2018, with iron ore and concentrates topping the list at AU$51.4 billion, followed by coal, natural gas and gold.

Coal is also one of the Australian exports which have seen a sharp drop in China. Australia’s exports of both coking and thermal coal to China were 3.35 million tonnes in October, up slightly from September’s 3.31 million, but dramatically down from 12.33 million in June, the strongest month so far this year, the Reuters reported, citing vessel-tracking data compiled by Refinitiv.

An Anhui Province-based coal importer who requested anonymity told the Global Times that Australian coal has not been on their import list since 2019 to avoid risks brought about by accelerating tensions between the two countries.

"We import coal primarily from the US and Canada," he said, noting that cutting Australian coal has no impact on their operations. "We are holding talks with suppliers from Indonesia," he said.

Time waits for no one, Chinese experts warned, and said Canberra should take more concrete steps to improve ties before it is too late.

Australian Prime Minister Scott Morrison Photo:Xinhua

"The ball is actually in Australia's court. Morrison should be sensible enough not to expect his sweet talks would remove the all-round and profound damages brought by Canberra's anti-China moves during the past four years. Instead of putting up media stunts, Australia needs to be truly independent and grown up in handling international affairs, and become a mature country of responsibility and accountability," Chen said.

Upholding the Cold War mentality and skewed ideology, Canberra has been siding with the US and closely following the US' anti-China campaign. Canberra has drastically dragged down its relations with China, Song Wei, an associate research fellow at the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce, told the Global Times.

It is hoped that Canberra could shake off the shackles of geopolitical thinking, and not tie itself to the chariot of US unilateralism to provoke China and constantly undermine China-Australia relations, Song noted.

China recently issued an unreliable entity list mechanism and the Export Control Law to protect its legitimate economic interests. The country has been improving its legal system and optimizing policy tools, aiming to make all partners realize that China has the tools and means to safeguard its interests.

Newspaper headline: Anti-dumping measures on Australian wine not ‘trade war’

RELATED ARTICLES:

Posted in: INDUSTRIES,MARKETS