Art, misunderstood

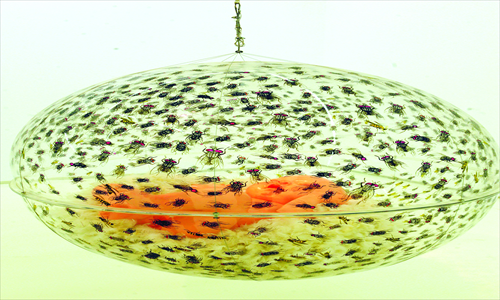

Yue Minjun's Contemporary Terracotta Warriors Photo: CFP

Despite a drop in sales, the art market is still hot with a number of exorbitantly priced works sold at this year's spring auction.

But industry insiders are wondering if the domestic art market is taking a hit, for the worse. Guy and Myriam Ullens, the founders of the Ullens Center for Contemporary Art (UCCA), sold 106 pieces of their Chinese contemporary art collections during Sotheby's spring auction last year. Swiss collector Uli Sigg donated 1,463 pieces from his personal collections to M+, a visual art museum opening in Hong Kong in 2017.

The donated pieces include art from artists Fang Lijun, and Zhang Xiaogang, totaling an estimated value of $167.6million.

The art museum will purchase an additional 47 pieces from Sigg's collections to complete the series. Some view this sudden inclination to sell as a sign that the domestic art market is on the decline.

Changing attitudes

Many Western collectors realized the value of contemporary Chinese arts long before the art market was developed. Sigg, for example, started paying attention to the market in the 1970s when he first arrived in China.

The Ullens became interested in contemporary and modern Chinese art in the late 1980s. For a while, foreign collectors like Sigg and Ullens were the dominant players.

In March 2006, Sotheby's in New York officially introduced Chinese oil painters to the world through their Contemporary Asian Art fair.

Oil paintings from Zhang Xiaogang, Fang Lijun, Yue Minjun and Wang Guangyi appeared during the auction and were well received by Western buyers. The price of paintings from these artists sharply increased after the auction.

In October 2007, the collector Howard Farber and his wife Patricia, along with Phillips de Pury & Company held a special fair in London, selling 45 pieces of their contemporary Chinese art collection. Although Farber describes these pieces as the tip of the iceberg in his collection, he still collected about $20 million.

In April 2008, Michael Goedhuis brought 200 pieces of his contemporary Chinese art collection from his Estella Art Foundation to sell at Sotheby's spring auction. In 2009, Charles Saatch sold 180 pieces from his contemporary Chinese art collection.

Some critics say that since the economic crisis in 2007, many Western collectors are eager to sell their collection, waiting for the price to rise to earn profits.

Developing framework

In an interview with Oriental Morning Post last year, art critic Zhu Qi said that Western art investors are losing confidence in the contemporary Chinese arts scene. He attributes Ullens' decision to the lack of systemic support in China, as relevant laws have not fully developed yet to regulate business activity.

As the market hardly reflects the real value of an artwork, he questions the quality of recently produced art works.

Hong Kong collector William Chak explains that Western collectors are not necessarily trying to finance themselves. Many see art transactions as a way of communication.

Gu Zhenqing, a curator and art critic argues that it is necessary to separate Sigg from other collectors.

"Sigg donated his collection, which is different from others who gain large profits from auctions."

Gu views Sigg as a real collector who loves Chinese contemporary and modern arts and wants to dedicate his resources to the research of this field.

Real value

A report released by Ministry of Culture in June this year shows that the total transaction volume of China's art market in 2011 reached 210.8 billion yuan ($33.2 billion), 30 percent of the global market share.

Similar results are projected in Artprice's 2011 Annual Art Market Report, stating that China's growth has profoundly changed the geographical structure of the global art market.

Gu said the fast growing market contains many bubbles. He criticizes art foundations and auction companies for ignoring the real value of art, merely taking advantage of the market. He finds that the market price seldom reflects artistic value.

Artist Zhang Xiaogang said he never expected a price over $2 million. He sold his Tiananmen Square to a Western collector in the late 1990s for $5,000. "Since then the work does not belong to me."

Farber parallels contemporary Chinese artists to American artists in the 1920s, as they both experienced massive social and economic changes. But he said compared to artists like Andy Warhol and Damien Hirst, the price of Chinese contemporary art is still low.

Sigg tried to separate between market tastes and academic and cultural tastes by founding the Chinese Contemporary Art Award (CCAA) in 1997.

"The market is the dominant way to validate artworks. To balance and enrich this debate, an institution such as the CCAA plays an important role," he said in 2008.

But without a formal organization to critique contemporary Chinese art, many doubt the award's authenticity.

Gu was the art director of CCAA in 2004. He said the award is influential for insiders and the winners are artists with potential.

He told Global Times that Sigg invites top artists and curators in the world to be on the jury committee each year.

Talking about the future, Sigg once told sohu.com that with globalization and the development of Internet, Chinese artists will have more opportunities to go abroad and learn from Western mainstream arts.

Farber disagrees Chinese art market has reached its peak. He finds the Chinese contemporary art scene in its infancy, compared to top contemporary artists in the world.

Gu believes that with the development of China's arts, the value of contemporary works will continue to grow.