Going home

On August 30, 14 South Korean jewelry and accessories companies based in Qingdao, Shandong Province announced they would be moving some of their facilities to South Korea next year. And 36 more South Korean companies are expected to join the move by 2015 if the relocation proves successful.

The companies' departure has added to concerns of a serious drop in foreign direct investment (FDI) in China. In July, FDI fell 8.7 percent year-on-year to $7.6 billion.

The South Korean companies are not alone. Some other foreign companies such as GE, adidas and Nike have also moved some of their production facilities out of China recently. But the fact that the South Korean firms are relatively small manufacturers throws a light on the difficulties facing labor-intensive industries in China.

The largest of the 14 companies, Hanshin Art, came to Qingdao in 1996. In the late 1980s, labor costs in South Korea started to increase by double digits every year.

Hanshin left South Korea and set up a manufacturing base in Qingdao, to take advantage of China's lower production costs. It was soon joined by numerous other jewelry companies. But now, 16 years later, the companies are having similar problems in China to the ones they faced back home.

Labor issues

When Hanshin came to China, the average monthly salary for its workers was around 250 yuan ($39.47), which helped it become competitive again. Now the company has more than 1,300 employees and annual sales worth 30 billion won ($26.6 million) mainly from exports to the US and European Union.

But now, however, the average monthly wage is around 3,450 yuan.

Labor costs in China increased by an average of 19 percent a year between 2005 and 2010, according to a report by Boston Consulting Group. Yet there is still a shortage of workers.

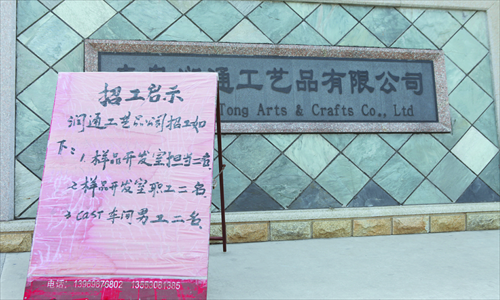

In Wali village near Qingdao's Liuting Airport, numerous recruitment ads can be seen in front of the jewelry factories. "Recruiting workers. Female, aged between 18 and 30. Please come into the office," one ad reads.

A Korean-Chinese manager surnamed Park at a Chinese jewelry company told the Global Times that it has been difficult to find workers for a while.

Her company pays workers around 2,700 yuan per month because the firm has managed to find employees that do not request social insurance. The firm, which currently has around 20 employees, is trying to recruit 30 more, but without success so far.

In addition to the cost of labor, the efficiency of labor is another issue, mainly due to the high rate of staff turnover.

"The turnover rate is between six months and one year for the industry," Kwon Yong-suk, executive director of the Korea Business Center of Korea Trade-Investment Promotion Agency (KOTRA) in Qingdao, told the Global Times.

Costume jewelry companies in Qingdao were also hit hard by the financial crisis in 2008, which forced many companies to close.

The difficulties facing the jewelry companies prompted the South Korean government to act earlier this year. On April 26, it announced new measures to encourage the country's firms to return to South Korea, in the hope of boosting local investment and creating jobs.

"Reshoring" effort

South Korea's government was following in a trend started by the US, which began what it called a "reshoring" initiative in 2010, hoping to bring homegrown companies and manufacturing jobs back to the country. The EU has also launched similar measures.

Master Lock, a US company that entered China in 1993, pulled its production back to the US last year, citing increasing production costs in China.

Not many people thought that it would be possible to go back to South Korea, Kwon said, but the South Korean government and the local government of Jeonbuk Province in particular pushed hard. Ik-san city in the province, once dubbed a city of jewelry, has offered various incentives and tax benefits to the returning companies.

While manufacturers in China grapple with rising labor costs and yuan appreciation, firms in South Korea benefit from the country's free trade agreements with the EU and the US.

South Korean jewelry companies, which export most of their products to the US and the EU, enjoy a zero tax rate. However, costume jewelry companies in China have to pay a duty of 11 percent when exporting to the US market.

Impossible to leave

But despite the rising costs, there is unlikely to be a massive exodus from China.

Gu Bon-hang, the CEO of Hanshin and also president of the South Korean Fashion Jewelry Association in China, believes that it's impossible to pull out completely from China, according to the KOTRA Qingdao office.

"The company's current manufacturing facility will be remaining in China," said Kwon. But the high-value jewelry facility will move to South Korea to overcome the problem of high staff turnover, so that quality control can be maintained.

The average job cuts at the 14 Qingdao jewelry companies will be around 10 percent of their total workforces, according to the KOTRA Qingdao office.

It's also unlikely a mass relocation like the one being undertaken by the 14 South Korean jewelry firms will be seen in other industries, said Kwon.

The jewelry industry tends to concentrate in particular regions or cities. And Ik-san still has infrastructure left behind in the 1990s.

A spokesman for the Chinese Ministry of Commerce said Thursday that no large-scale exodus of foreign companies has been observed, according to xinhuanet.com. The ministry's spokesman Shen Danyang said that China is still one of the top global destinations for foreign direct investment.

But while the government has rolled out supportive policies that have attracted investment to sectors such as IT, services and green energy, lower-end manufacturing industries have been somewhat left behind.