Secondhand housing transaction surges in China

Source:Xinhua Published: 2013-3-8 18:12:52

Drowsy housing agents and house owners wait for being called in due order after standing in a line all night long outside the Sixth Taxation Office of Chaoyang District Local Taxation Bureau in Beijing, capital of China, March 8, 2013. Secondhand housing transaction surges in Beijing these days as buyers and sellers are rushing to "catch the last bus" and complete their deals before the new measures are fully implemented. According to the statement from the State Council, homeowners selling property will have to pay a capital gains tax of 20 percent of the profit they make on the transaction. Homeowners were previously taxed 1 percent to 2 percent of the total sale price. (Xinhua/Luo Xiaoguang)

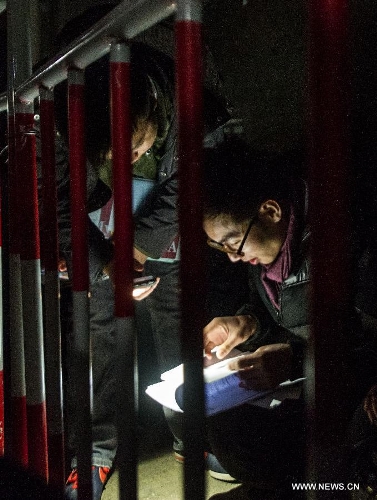

Housing agents look through clients' information by the light of cellphones at around 10 p.m. as they stand in a line for housing transaction next morning outside the Sixth Taxation Office of Chaoyang District Local Taxation Bureau in Beijing, capital of China, March 7, 2013. Secondhand housing transaction surges in Beijing these days as buyers and sellers are rushing to "catch the last bus" and complete their deals before the new measures are fully implemented. According to the statement from the State Council, homeowners selling property will have to pay a capital gains tax of 20 percent of the profit they make on the transaction. Homeowners were previously taxed 1 percent to 2 percent of the total sale price. (Xinhua/Luo Xiaoguang)

A staff member of taxation bureau sends hot water to people who have stayed up all night long for standing in a line at 7 a.m. outside the Sixth Taxation Office of Chaoyang District Local Taxation Bureau in Beijing, capital of China, March 8, 2013. Secondhand housing transaction surges in Beijing these days as buyers and sellers are rushing to "catch the last bus" and complete their deals before the new measures are fully implemented. According to the statement from the State Council, homeowners selling property will have to pay a capital gains tax of 20 percent of the profit they make on the transaction. Homeowners were previously taxed 1 percent to 2 percent of the total sale price. (Xinhua/Luo Xiaoguang)

Citizens conduct housing transactions at the Housing Transaction Center in Shijiazhuang, north China's Hebei Province, March 8, 2013. Secondhand housing transaction surges in the city these days as buyers and sellers are rushing to "catch the last bus" and complete their deals before the new measures are fully implemented. According to the statement from the State Council, homeowners selling property will have to pay a capital gains tax of 20 percent of the profit they make on the transaction. Homeowners were previously taxed 1 percent to 2 percent of the total sale price. (Xinhua/Zhu Xudong)

Citizens conduct housing transactions at the Housing Transaction Center in Shijiazhuang, north China's Hebei Province, March 8, 2013. Secondhand housing transaction surges in the city these days as buyers and sellers are rushing to "catch the last bus" and complete their deals before the new measures are fully implemented. According to the statement from the State Council, homeowners selling property will have to pay a capital gains tax of 20 percent of the profit they make on the transaction. Homeowners were previously taxed 1 percent to 2 percent of the total sale price. (Xinhua/Zhu Xudong)

A citizen fills in a housing information form at the Housing Transaction Center in Shijiazhuang, north China's Hebei Province, March 8, 2013. Secondhand housing transaction surges in the city these days as buyers and sellers are rushing to "catch the last bus" and complete their deals before the new measures are fully implemented. According to the statement from the State Council, homeowners selling property will have to pay a capital gains tax of 20 percent of the profit they make on the transaction. Homeowners were previously taxed 1 percent to 2 percent of the total sale price. (Xinhua/Zhu Xudong)

Posted in: Society, China