Staying on

Editor's Note:

Zhou Xiaochuan, governor of China's central bank since December 2002, has just reached the retirement age of 65, but was elected Monday vice chairman of China's top advisory body during the two sessions. This new title has been seen as a way to allow Zhou to continue as governor of the central bank, to ensure the continuity of China's financial reform and monetary policy.

He is often described by the media as a pragmatic banker, a firm reformer, and a scholarly official known for writing essays about economics.

Zhou Xiaochuan has earned respect by making progress in the country's financial reforms, but has also been criticized for lessening people's purchasing power and allowing the property market to overheat during his tenure over the past 10 years.

About a month ago, there was market speculation that Zhou would step down when he reached the compulsory retirement age of 65. And he was not included in the new Central Committee of the Chinese Communist Party during the once-in-a-decade leadership change in November last year.

However, Zhou's election to the position of vice chairman of the National Committee of the Chinese People's Political Consultative Conference, the top government advisory body, clears the way for him to continue as governor of the People's Bank of China (PBC) by giving him a rank that exempts him from compulsory retirement at 65 in cabinet minister-ranked posts.

Media reports have cited sources saying that Zhou will remain in the post, and an official announcement will be made by the National People's Congress on Saturday.

Good to keep him?

Zhou will become the central bank governor with the longest tenure since the establishment of the People's Republic of China in 1949, if he continues in the position.

His continued role as head of the central bank would be good for continuity of monetary policy, Wu Xiaoling, a senior lawmaker and former vice head of the central bank, told the media Wednesday.

"By keeping Zhou as central bank governor, the new leaders are endorsing what he has achieved in the past and showing that they wish to continue China's financial reforms," Lu Ting, a Hong Kong-based economist at Bank of America-Merrill Lynch, wrote in a recent research note.

"It is a signal that the new leaders are serious about liberalizing the Chinese market, and opening the economy further," Dariusz Kowalczyk, a Hong Kong-based economist at Credit Agricole CIB, told the Global Times Tuesday.

Global recognition and influence makes Zhou irreplaceable for now, Yu Yongding, a former adviser to the central bank, was quoted by the Wall Street Journal as saying on Monday.

Washington DC-based Foreign Policy magazine ranked Zhou in the fourth spot in its Top 100 Global Thinkers list in December 2010, given his effort to push forward a new international reserve currency to challenge the dominance of the US dollar.

Euromoney named Zhou the world's best central bank governor in 2011 in recognition of his success in steering a steady course between maintaining growth and taming inflation.

Criticism

In February, the consumer price index (CPI), a major gauge of inflation, reached a 10-month high of 3.2 percent year-on-year and 1.1 percent month-on-month, reminding people of a previous spike in CPI after the government's 4 trillion yuan stimulus package to boost the economy in 2009-10.

Under the stimulus package, the government encouraged commercial banks to lend to local government financial vehicles, which led to record lending of 9.6 trillion yuan in 2009. Though loose monetary policy boosted the economic recovery, it also brought risks of massive bad debts in the future.

There have been growing complaints over rising food prices, the overheating property market and the increasing gap between the rich and the poor, and some believe the central bank's loose monetary policy and rigid exchange rate policies are partially to blame.

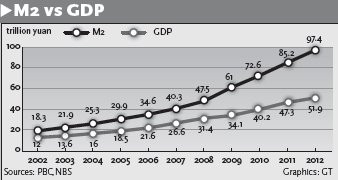

M2, a broad measure of money supply, has been soaring over the past decade. By the end of February 2013, total M2 hit almost 100 trillion yuan, according to PBC data, double China's GDP and more than five times the level in late 2002. This led to Zhou being nicknamed "Mr hundred trillion."

To keep the exchange rate stable, the central bank has been forced to buy foreign currency and release additional yuan into the domestic market, leading to inflationary pressure.

However, China's M2 to GDP ratio is lower than some other economies such as Japan, and a high ratio may not necessarily lead to high inflation, Zhou said at a press conference on Wednesday.

It is unfair to attribute all the problems to the central bank, as important monetary policies are decided by the State Council, and decisions are made based on the interests of different government agencies, Zhang Ming, a researcher at the Institute of World Economics and Politics under the Chinese Academy of Social Sciences, wrote recently in his blog.

Global Times

Stellar resume

Zhou Xiaochuan, born in 1948, is a native of Yixing, Jiangsu Province. He graduated from Beijing Chemical Engineering Institute with a Bachelor's Degree in 1975 and Tsinghua University with a PhD in economics in 1985.

2013-now Vice chairman, National Committee of the Chinese People's Political Consultative Conference

2007-2012 Member, 17th CPC Central Committee

2003-now Chairman, Chinese Monetary Policy Committee

2002-now Governor, People's Bank of China

2002-now Secretary, CPC Committee of the People's Bank of China

2002-2007 Member, 16th CPC Central Committee

2000-now Member, Monetary Policy Department of the People's Bank of China

2000-2002 Chairman, China Securities Regulatory Commission

1998-2000 President, China Construction Bank

1996-1998 Deputy governor, People's Bank of China

Milestones of the PBC

July 2005 Reform of the exchange rate regime from a system of being pegged to the dollar to a market-driven managed floating exchange rate regime, with reference to a basket of currencies.

May 2007 The yuan trading band against the US dollar widened, from a daily range of 0.3 percent to 0.5 percent.

July 2009 Cross-border trade settlement in yuan allowed in pilot cities.

April 2012 Resumption of exchange rate regime reform. The yuan trading band against the US dollar widened further to 1 percent from 0.5 percent.

June-July 2012 Interest rate reform. Greater flexibility granted for banks in offering interest rates to depositors.