IMF growth forecast for China slashed

Potential home buyers look at model buildings at the Beijing Spring Real Estate Trade Fair Saturday. The fair attracted 210 overseas property companies from 25 countries and regions, many of which advertised investment in real estate as a potential path to immigration. Photo: CFP

Graphics: AFP/GT

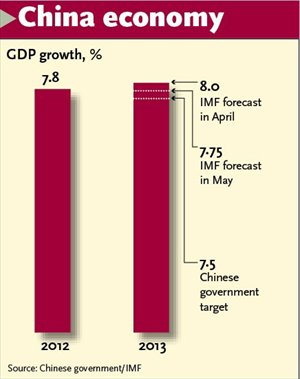

The International Monetary Fund (IMF) Wednesday joined a number of economists and institutions to cut China's economic growth forecast this year to 7.75 percent, prompting questions over whether policymakers will maintain their tolerance for slower growth to foster a sustainable economy.

Speaking in Beijing after the IMF completed its annual assessment of China's economy, IMF First Deputy Managing Director David Lipton said the fund had trimmed the forecast for this year to 7.75 percent from the 8 percent forecast in April, citing a weak global economy that hurts China's exports.

The update is still higher than the government's target of 7.5 percent.

Lipton said the pace should pick up moderately in the second half, as the recent credit expansion gains traction and is in line with a projected mild pick-up in the global economy.

A raft of macroeconomic data released recently showed China's economy has been recovering slowly. The disappointing data prompted economists, investment banks and institutions to cut China's growth forecasts.

The Organization for Economic Co-operation and Development (OECD) also slashed its forecast for China's growth to 7.8 percent from a previous 8.5 percent in a Wednesday report.

Earlier this month, Bank of America Merrill Lynch also downgraded forecasts for growth to 7.6 percent in 2013 from 8.0 percent while JPMorgan Chase & Co lowered its forecast to 7.6 percent from 7.8 percent.

Previously, when China's economic growth faltered, the government would roll out stimulus measures. The slowdown this time, coupled with the rise in unemployment, has led analysts to debate whether China should merely observe.

"If growth were to slow sharply below this year's target, then on-budget fiscal stimulus should be used, focusing on measures that support household incomes and consumption," Lipton said.

The OECD said growth will remain strong in China, where scope remains for policy stimulus to support activity if growth were to weaken.

China now needs a moderate stimulus package - not a very large one as in 2008 but definitely a moderate one, which could be sufficient to halt the present decline in growth, said John Ross, a senior fellow at the Beijing-based Chongyang Institute for Financial Studies, Renmin University of China. "China's rate of productivity increase is very fast and therefore its economy has to grow fast simply to create enough jobs," he said.

Earlier this month, Chinese Premier Li Keqiang acknowledged China faces a tough employment situation due to the slower growth in the past few months, and called for efforts to help college graduates to find jobs.

"There has never been a shortage of stimulus measures since the global financial crisis, but it seemed the more stimulus plans were used, the more problems there were," said Li Youhuan, an economist at the Guangdong Academy of Social Sciences. "If maintaining 8 percent growth causes a crisis but 7.75 percent brings benign development, we'd better accept the latter."

The IMF also cautioned against the rapid growth in social financing, a broad measure of credit, which it said raises concerns about the quality of investment and its impact on repayment capacity, especially since a fast-growing share of credit is flowing through less well-supervised parts of the financial system.

"The less well-supervised parts refer to the shadow banking and underground banks. The long-existing problem is now becoming more prominent, leading to capital chain disruptions and breakdowns," said Tian Yun, editor-in-chief of the China Macroeconomic Information Network, a website sponsored by a government think tank.

"A fair market environment to allow more participation of private capital could help ease the problem," Tian told the Global Times.