HOME >> BUSINESS

The right Balance

By Li Qiaoyi Source:Global Times Published: 2013-6-30 22:43:05

The 5,000-pound and 3.2-meter-high Bund Bull statue in the Bund Financial Square in Shanghai Photo: IC

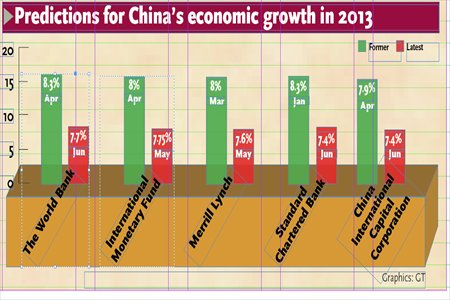

Predictions for China's economic growth in 2013 Graphics: GT

On June 24, the 100th day of the new government led by President Xi Jinping and Premier Li Keqiang, China's stock markets suffered their heaviest daily loss in nearly four years.

It overshadowed what should have been a day of celebration for the new administration's reforms, which are aimed at pushing toward a new, more sustainable economic model.

There are high hopes that Li, the country's first Premier to hold an economics doctorate, will be able to lead the world's second-largest economy through a much-needed structural reform that is likely to be painful at times.

The new government took office in mid-March.

Since then, the State Council, the country's cabinet, presided over by Li, has announced a raft of policies and regulations to implement sweeping administrative reforms.

More moves aimed at revitalizing the economy through opening the financial, railway and energy sectors to private capital have also been urged by the new cabinet.

The announcements strengthened hopes for a healthier, more sustainable economic path, but recent economic indicators have dealt a blow to China's growth outlook, with a number of investment banks and economists lowering their projections for the nation's GDP growth in 2013 and onward.

But the central bank has taken a hard-line stance and is resisting the traditional move of funneling more liquidity into the banking system.

Consequently, concerns have arisen over whether the new government may have gone too far in its efforts to address economic problems.

"Monetary policy decisions are now probably made at the highest level. China is set to go into a structural reform phase that many of us have not seen before," Chris Leung, a Hong Kong-based senior economist at DBS Bank, said in a research note sent to the Global Times on Tuesday.

"A good cause does not preclude market volatilities in the near term. This in turn will inevitably undermine investor confidence, particularly in the equity markets," Leung said.

A dose of Likonomics

Summarizing the new government's economic policy framework, presided over by Premier Li Keqiang, as "Likonomics", Barclays Capital economists led by Huang Yiping said a in research note sent to the Global Times Thursday that there are three key aspects to it: no stimulus packages, de-leveraging efforts and advocating structural reform.

"We think 'Likonomics' is exactly what China needs to put its economy on a sustainable path," they said.

Over the next decade, China's annual economic growth will be lowered to around 6-8 percent, and policymakers will only resort to aggressive fiscal and monetary policies at a time of urgent need, according to the economists.

A statement issued by the central bank late Tuesday suggested there would be no shock therapy, said Lu Zhengwei, Shanghai-based chief economist with Industrial Bank Co, noting that the economic restructuring will be gradual.

Reiterating his earlier comments that the overall economic conditions are stable, Premier Li said at a cabinet meeting on Wednesday that development of urban slum areas would generate new growth opportunities for the economy.

"But the implementation of Likonomics could point to further downside risks for both economic growth and asset prices," the Barclays economists warned.

The current tight credit conditions could represent good timing for the government to allow private investment into the financial sector, Zhou Dewen, vice president of the China Association of Small and Medium Enterprises, told the Global Times late Wednesday.

But, "we have yet to see any actual progress," Zhou said.

There are a total of 27 banks operating in Wenzhou, but the number is dwarfed by the more than 400,000 enterprises in the local market, said Zhou, who is also director of the Wenzhou Council for the Promotion of Small and Medium-sized Enterprises.

He expressed concern that the current credit squeeze could hurt the private sector.

"The new leadership has fully demonstrated its determination in pushing forward the reform, but now the question is how it can strike a balance between deepening reforms and avoiding systemic risks," Zhou said.

Voices:

If the cash crunch continues for a long period of time, the property sector will certainly take a hit. Cash-thirsty property developers that cannot find financing will be incapable of continuing land purchases, and the market supply may consequently deteriorate. Home prices will soar as a result.

Ren Zhiqiang, chairman of Hua Yuan Real Estate Group.

The central bank is now facing a dilemma over whether to inject liquidity or not. To stabilize liquidity and control monetary aggregates may exacerbate the cash squeeze problem and threaten economic stability, while an injection of liquidity into the market could impact the credibility of the government, which has stood by a prudent monetary policy stance.

Li Zuojun, a deputy director at the Development Research Center of the State Council.

Posted in: Insight