Reining in culture of debt

By Chen Tian Source:Global Times Published: 2013-8-12 21:23:01

In terms of the debt' long-term economic influence, while some experts are concerned that they might cause a financial crisis in China, others say the debt problem will not bring about systemic risks to the economy.

Reasons for massing debt

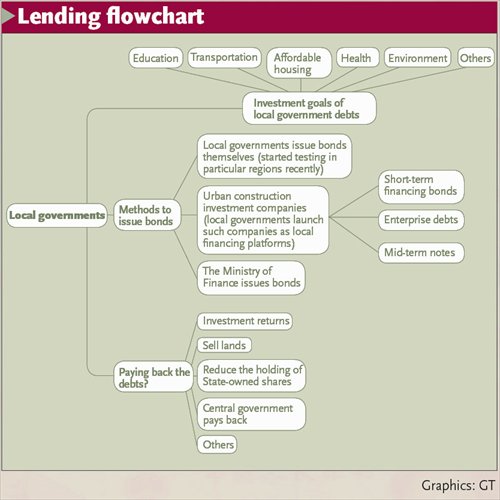

China's local governments usually set up financing companies, which seek funding from commercial banks to feed the authorities' hunger for infrastructure construction. In return, the governments pay back the debt directly or offer up collateral such as land and bonds.

However, because sometimes the companies "operate inappropriately," the local authorities "violate policies or manipulate the collaterals," and the banks "lack the credit management of the financing firms," the amount of local debt has rapidly soared, according to an announcement the State Council released in June 2010, right before the National Audit Office (NAO) conducted its 2011 audit.

Zhu Lixu, an analyst with Xiangcai Securities, told the Global Times Sunday that local governments do not own sufficient capital for them to invest in the infrastructures they desire, thus forcing them to borrow a large amount of money from commercial banks.

"While local governments are responsible for investing in building highways and railroads, they do not have the proper tax income to support their investments," Zhu said.

For example, China's central government claims 75 percent of any given region's value-added tax, while the local government only takes the remaining 25 percent, while part of the income taxes from State-owned enterprises (SOE) also goes to the central government.

"The lack of tax income forces local governments to set up financing companies to seek funding. The mass of debt is accumulated that way," Zhu said.

Zuo Xiaolei, chief economist at China Galaxy Securities, told the Global Times Thursday that the debt also result from insufficient planning.

"The local officials are too obsessed with lifting GDP growth rates by investing in real estate and in unnecessary infrastructure. However, they usually fail to make thorough plans to avoid defaulting before they borrow," Zuo said.

Zhu agreed with Zuo, adding that local officials are over-investing because they are eager to make as many political achievements as possible while in office.

"A city or province's economic development is now a crucial criterion to evaluate local officials' political achievements, so they have a great incentive to raise the GDP growth levels, even though the cost is to leave the government in a quagmire of debt," Zhu said.

Potential influences

Several observers worry that the amount of local government debt might mire China's already slowing economy in a real financial crisis.

"If the governments or its financing companies default, commercial banks will suddenly have a large amount of bad debt," Zuo said. "This could create many risks and raise the possibility of a financial crisis."

Local officials turn to selling limited land resources to raise funds when they realize they might default on their debt, but that method is not sustainable, Zuo said.

"One day local governments will run out of land to sell and home prices will keep surging. Then the consumers' money will continue flooding into the real estate market making the housing bubble even bigger," she said. "This way, the debt problem could be an underlying cause not only for a bad debt crisis, but for a burst housing bubble as well."

"In the end, the central government will help local authorities out if they can no longer pay back the debt," Zhu said. "Considering this, local officials are likely to expand the scale of their borrowing, which will heap further pressure onto the central government."

Furthermore, mounting debt may prevent local governments from investing more in livelihood improvement such as rail transport and other important public projects, Zhu said. And if the consumer price index (CPI) increases, the interest rate will be raised and local governments will face more pressure to pay the debt back, he added.

However, Chen Naixing, a research fellow with the Institute of Industrial Economics at the Chinese Academy of Social Sciences, told the Global Times Thursday that he does not believe the local government debt problem will create tough challenges for China's economy.

"Although local governments indeed are facing a large amount of debt, they have used it well in effectively strengthening livelihood construction," Chen said. Still, authorities should use the money more carefully and frugally while trying to avoid corruption, he added.

"Having no or little debt is not a good thing. Local governments at least are raising money to boost development," Chen said.

"Our concern is that the increase of the debt is coming faster than economic development," said Terry Gao, associate director of international public finance at Fitch Ratings. "If the problem continues, the lower level governments may suffer from a weak cash chain."

Mounting debt in Caofeidian

Stalled projects in Caofeidian Industrial Zone, located about 80 kilometers from Tangshan, North China's Hebei Province, have shown that the zone is on the brink of a debt crisis, according to recent media reports.

Unfinished buildings are common scenery in the industrial zone. The halting of construction projects, some since the second half of last year, is mainly due to a lack of funds, the National Business Daily (NBD) reported Wednesday, citing staff members from several local construction companies as saying.

Since the industrial zone plan was approved by the government a decade ago, Caofeidian has expanded from a sand island less than 4 square kilometers to an industrial district that is twice the size of Hong Kong.

A total of 352 projects worth more than 100 million yuan have been started in Caofeidian since 2003, totaling an investment of 561.12 billion yuan. Among them, 217 ones are currently still under construction, official data from the industrial zone showed.

The money to fund these projects mainly comes from LGFVs such as Tangshan Caofeidian Development Investment Group and Caofeidian Holding Co, which borrow money from banks.

The Caofeidian Industrial Zone needs to pay off about 10 million yuan as interest every day, the NBD cited an unnamed official from the industrial zone as saying. A local official admitted that the industrial zone is facing a cash-flow crunch, but said the debt risk remains controllable.

"The outstanding loans of Caofeidian Industrial Zone currently amount to 36.8 billion yuan, which will come due by 2024, while the total interest will amount to 9.37 billion yuan," Zhang Heqing, head of Caofeidian Industrial Zone's finance bureau, told China News Service Thursday.

Zhang said the industrial zone's debt risk is controllable, as its income mainly comes from the local government's fiscal revenue, land sales revenue, assets income and fiscal subsidies, which amount to 100 billion yuan, far higher than the debt and interest it needs to pay off.

Global Times

Guangzhou debt close to warning line

The debt level of Guangzhou, capital of South China's Guangdong Province and which has the third-highest GDP after Shanghai and Beijing, is close to an international warning line.

Guangzhou government plans to add 38.28 billion yuan ($6.25 billion) worth of new debt in 2013, which will be used for urban rail transit, government-subsided housing and land development, said Yuan Jinxia, head of Guangzhou Municipal Bureau of Finance.

Yuan disclosed this when he delivered a report to the Standing Committee of the Guangzhou Municipal People's Congress on July 30.

By the end of this year, the city government's debt ratio will reach 99.52 percent. It also needs to pay off debt worth 26.1 billion yuan by year-end, which would account for 19.37 percent of the city government's projected fiscal revenue for 2013.

According to the standard the city government set in 2011, the government's debt ratio should remain below 100 percent, and the debt the government needs to pay off should be less than 20 percent of its fiscal revenue.

These levels are also international warning lines for local government debt levels.

Experts said the city's high debt levels can be traced back to the large spending in the run-up to Guangzhou hosting the 2010 Asian Games.

To fund the infrastructure built for the Asian Games, the city government set up seven local government financing vehicles in 2008, which are responsible for funding projects for transportation, water and waste treatment.

To repay its debt, local authorities have already speeded up land sales.

Land sales revenue in Guangzhou reached 36.97 billion yuan in the first half of 2013, up 368 percent from the same period a year earlier, data from property brokerage bacic5i5j.com showed.

Global Times

Sichuan tops local govt bond issuance

The amount of local government bonds issued by Southwest China's Sichuan Province is the highest across all provinces, regions and municipalities nationwide, according to data from the Ministry of Finance (MOF).

The MOF gave its approval for Sichuan to issue a total of 83 billion yuan ($13.6 billion) in local government bonds from 2009 to 2013, higher than for other parts of the country, mainly due to the high cost of repairs to damage caused by the 8.0-magnitude Wenchuan earthquake.

The money the province collected through the bond issuance has been put into post-earthquake reconstruction, affordable housing and infrastructure projects, according to the provincial finance bureau.

Last year the provincial government paid off 18 billion yuan in bonds issued in 2009, but this year it will need to pay off another 12.6 billion yuan, Wang Yihong, head of the provincial finance bureau, said in May.

During the country's "two sessions" held in March, Wang said Sichuan's debt level was generally controllable but noted that some local authorities had excessive levels of debt and managed them poorly.

In China, as most authorities such as Sichuan are forbidden from borrowing money directly, they create local government financing vehicles (LGFVs) to fund their infrastructure spending.

Bonds issued by Sichuan's LGFVs have amounted to 64.51 billion yuan so far, with half of them due between 2015 and 2017, financial weekly Moneyweek reported on August 5.

The report said about 23 percent of the money borrowed by LGFVs such as Sichuan Expressway Construction & Development Corporation are used to pay off bank loans, signaling local governments' preference to raise new debt to repay maturing loans.

Sichuan Expressway posted a loss of 141 million yuan in the first quarter of 2013, after reporting an annual loss of 559 million last year. The company's debt-to-asset ratio now stands at more than 70 percent.

Global Times

Posted in: Economy, In-Depth