Revamping local financing system

China's central government is expected to bail out local governments on the verge of default, preventing Detroit-like bankruptcies from taking place in the country, experts said.

But determining the exact nature and extent of the local government debt is critical for policymakers to make decisions and prevent the buildup of a crisis, Zhang Guangtong, vice dean of the School of Taxation with Beijing-based Central University of Finance and Economics, told the Global Times on Thursday.

While local government officials should be held accountable for their hasty and reckless debt decisions, it is more important to control and prevent the bubbling risks, Zhang said.

Grapics: GT

New performance barometer

The performance of officials must not be linked with the economic barometers such as the GDP growth, otherwise local governments will continue to intervene in the economy as much as possible - a feature of planned economy which leads to low productivity and distorted resource allocation, Zhang noted.

To achieve an impressive economic performance, local officials have tended to rely on and push the development of certain sectors which in turn has led to overcapacity, as is the case with the photovoltaic industry in Wuxi, East China's Jiangsu Province.

To encourage solar sector's development, the local government extended undue support in terms of government allowances, favorable policy, cheaper loans as well as land.

Suntech, LDK and Trina Solar were among 12 solar cell makers that obtained more than $43.2 billion in credit pledges from China Development Bank, Bloomberg reported in March.

That led to doubling of production at each of the country's top five panel producers.

Wuxi Suntech Power, which became the world's top solar panel manufacturer on the back of the government support to the solar power industry, declared bankruptcy in March mainly due to overcapacity, over-reliance on overseas market and weaker global demand, reportedly leaving at least 10 billion yuan ($1.62 billion) in bad debts to the banks that offered loans to the company.

One of the key goals of China's new leadership is to redefine the relationship between the government and enterprises and reduce government's intervention in the economic activities.

"The government should let the private capital to participate in economic activities and focus on the provision of public services such as transportation and welfare," Zhang said.

Moreover, the assessment of officials' performance should be based on residents' income, environmental protection and public security, rather than solely on economic growth, he noted.

Adjusting growth model

One solution is to ensure that the local governments have adequate resources to deliver the necessary social and infrastructure spending by aligning revenue responsibilities with expenditure mandates and adjusting revenue sharing arrangements, the IMF said.

Currently the central government takes 52 percent of the fiscal revenues while the local governments retain the remaining 48 percent. Unlike the central government, local governments have many levels from city to village, therefore the fiscal revenues seem inadequate, Zhang said.

Faced with a revenue allocation that does not match the expenditure mandates and a general prohibition on borrowing, local governments have turned to off-budget activity, including land sales, to help finance social and infrastructure spending, the IMF said.

China must change its growth model from relying on property market and land sales, Anbound Consulting said in a research note in April.

Real estate investment accounted for 12.5 percent of China's GDP in 2012, according to an IMF report released in July.

Under the current growth model, the local governments use land as collateral to get loans from banks, and as long as property prices keep rising, the debt repayment can be assured by land sales, that is why local governments were unwilling to cool the property market .

Normally tax revenues should account for 90 percent of all fiscal revenues of the local governments, however, nowadays land sales account for 30 to 50 percent and in some cases as much as 80 percent, Zhang said.

As a measure to control the soaring home prices, the government is piloting a property tax scheme which is likely to be expanded to more cities, which will also reduce the reliance of local governments on land sales, he noted.

Fiscal discipline

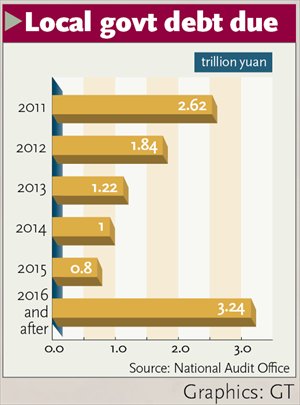

China's ballooning yet murky local government debt should amount to at least 20 trillion yuan, Kang Tao, chief consultant of Nanjing Boda Investment & Management Consulting and a consultant to local government investment projects, told the Global Times on Thursday.

In order to find out the real situation of the local government debt, the policymakers need to audit not only provincial-, city-, county-, and township-level local governments but also village-level financing vehicles which have exposure to large debts, Kang said.

Local governments also incur invisible debt through the "build, operate and transfer" projects, in which investors build infrastructure projects, operate them for a specific period of time and eventually transfer ownership of the project to the government.

In most cases, the investors are State-owned enterprises which finance local infrastructure projects such as highway construction for local governments, and eventually this kind of investment will be added onto to the local government debt, he noted.

Allowing private capital to participate in the establishment of local government financing vehicles and diversification of the shareholders of the financing vehicles will serve as a check and restraint to borrowing decisions currently solely made by the local governments, Kang said.

The local government debt risks are manageable if China imposes fiscal discipline by putting local government-backed financing vehicle's debts into budget review, according to Goldman Sachs/Gao Hua Securities report.

"To ensure China's fiscal soundness, a top priority is to strengthen the management, transparency, and overall governance framework of local government finances," the IMF said in the July report.