HOME >>

Everbright blames trading frenzy on computer error

Source:Globaltimes.cn Published: 2013-8-18 17:57:00

| Latest News |

'Design flaws' blamed for market spike

The China Securities Regulatory Commission (CSRC) said Sunday that "design flaws" in Everbright Securities Co's trading programs were the reason for a major spike in the Shanghai Stock Exchange on Friday.

Design flaws blamed for Everbright trading errors: CSRC

It was not human error, but design flaws in a trade unit of China Everbright Securities that triggered the anomalous trades on August 16, according to the China Securities Regulatory Commission (CSRC) on August 18.

'Trading error' leads to stock market spike

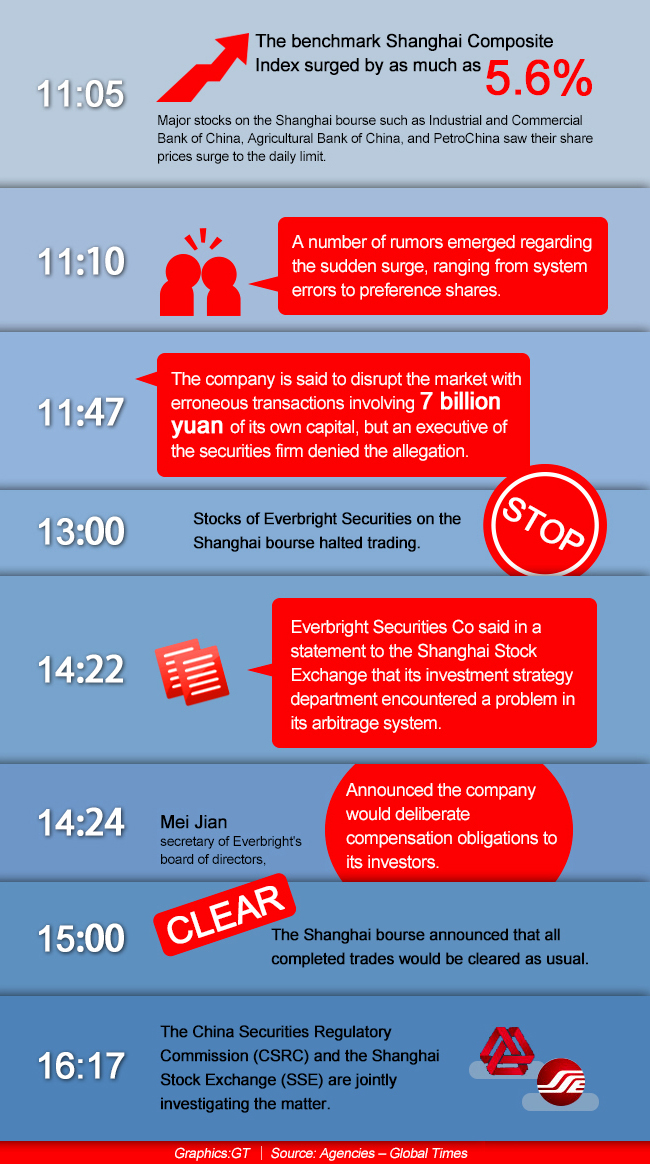

A trading error by Everbright Securities Co on August 16 triggered a surprising spike in the Shanghai Stock Exchange in the morning session, with more than 50 weighted stocks surging to the daily limit of 10 percent before paring gains.

Everbright response:

Mei Jian, secretary of Everbright's board of directors, said Everbright uses its own funds for trading, so the incident did not result in the loss of clients' capital.

"We are probing the case and have seen some developments. But it will take more time to come to a correct and complete conclusion," Mei said.

Impacts:

The sudden surge of the stock market may cause heavy losses for investors in short positions and tie up some retail investors.

The total declaration for buying totalled 23.4 billion yuan ($3.8 billion) and the actual transactions topped 7.27 billion yuan.

| Timeline |

| Viewpoints |

Chinese media:

Shanghai Securities News

Supervision department insiders predict that the surprise stock market spike on August 16 may lead to further regulations of the securities industry.

Xinhua News Agency

Supervision departments and institutional investors need to further strengthen risk management and prevention measures.

Southern Metropolis Daily

The August 16 case reveals that Everbright Securities’ risk control measures are not effective. The situation quickly worsened because their supervision department did not immediately respond.

Foreign media:

Financial Times: ‘Fat finger trade’ suspected in China market spike

If a trading error is confirmed, it is likely to be a fresh blow to the reputation of China’s securities trading industry.

Bloomberg: China Trading Error Reduces Investor Confidence in Stocks

“The timing is bad” for big market swings given low levels of investor confidence, said Ronald Wan, a committee member at the Hong Kong Securities & Investment Institute.

Experts:

Li Daxiao, director of research at Yingda Securities, said on his Sina Weibo that brokerages should consider adding limits to traders' rights and setting up a mechanism to supervise abnormal trading to avoid future "fat finger" errors.

Huang Jianzhong, a finance professor at Shanghai Normal University, noted that the "trading error" is very suspicious, as it occurred on the settling day for stock index futures. "I hope the CSRC can investigate the matter thoroughly and provide a clear result to investors," Huang told the Global Times.

| Related Reports |

CSRC blames Everbright Securities for abnormal stock market spike

CSRC probes abnormal stock market spike

SSE confirms Everbright Securities problems

Proprietary trading unit error triggers a stock spike: China Everbright Securities

China Everbright Securities suspended trading after index flash rally

Surprise A-share surge followed Everbright trading error

Probe launched over insurance dealer for sales fraud

| News Vocab |

内幕交易 nèimù jiāoyì

“内幕” n. inside facts/knowledge/story(Source: 《新世纪汉英大词典》)

“交易” v. buy and sell; deal; trade; transact business(Source: 《新世纪汉英大词典》)

“内幕交易” n. insider trading

Webeditor: guwei@globaltimes.com.cn

Posted in: