HOME >> BUSINESS

Top private firms see profit drop

By Zhao Qian Source:Global Times Published: 2013-8-30 0:03:01

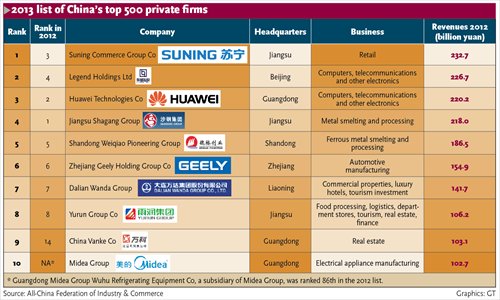

2013 list of China's top 500 private firms

The total net profits of the top 500 Chinese private enterprises saw a 3.39 percent decline year-on-year in 2012, the All-China Federation of Industry & Commerce said Thursday, mainly because of a sluggish global market, rising production costs and overcapacity in some sectors.

Suning Commerce Group Co, Legend Holdings Ltd and Huawei Technologies were the top three enterprises in terms of sales revenue among the top 500.

The top four enterprises in terms of net profit last year were real estate developer China Vanke Co, telecom equipment supplier Huawei Technologies, property firm Dalian Wanda Group, and Internet services company Baidu Inc.

"It is not surprising to see their net profits decline as a whole," Lu Dongbin, a professor at the School of Business at Renmin University of China (RUC), told the Global Times Thursday.

Lu ascribed the profit decline to sluggish global markets and the slowdown in the domestic economy.

Chinese heavy industry giant Sany Group Co saw an 18.18 percent decline last year in its net profit year-on-year, while property developer Suning Universal Group saw its net profit slump by 24.02 percent, and Yangzijiang Shipbuilding (Holdings) suffered a fall of 23.68 percent.

These three enterprises saw the most dramatic declines in profit, the federation said.

A total of 11 of the top 500 private enterprises suffered losses last year, nine more than in 2011, with most of them from the ferrous metal smelting, wholesale and retail trade and manufacturing sectors, according to the list.

"Weak demand under the current economic conditions was the main cause of their profit declines or losses," Zhang Zhengjun, a researcher at the State Council's Development Research Center, told the Global Times Thursday.

Zhang noted that the companies, especially those facing serious overcapacity situations, need to transform their business model.

The number of companies from the iron and steel industry in the top 500 declined by 10 last year to 55, largely because of the sector's overcapacity problem.

Since half of the enterprises in the top 500 list are in capital and technology-intensive sectors such as real estate, chemicals and oil, Lu of RUC said they should "seize the current opportunity to expand their businesses overseas, based on their technological and capital strength."

Zhang of the State Council said the private enterprises could focus more on innovation of their technologies and product design. "The era of fast, extensive expansion for them is over," Zhang noted.

The minimum annual sales revenue for companies in the list was 7.77 billion yuan ($1.27 billion) last year, 1.2 billion yuan higher than in 2011, or up 18.31 percent year-on-year.

Posted in: Companies