Profits of reform

As the Third Plenary Session of the 18th Communist Party of China (CPC) Central Committee approaches, investors are gearing up to cash in on stocks that will likely benefit from the country's newest reform policies.

The Development Research Center of the State Council (DRCSC), one of China's highest-level government-backed think tanks, released a "383" reform plan in late October. The plan received a lot of attention from the public, because it is likely to resemble the final reform plans that the central government will announce during the Third Plenary Session that will convene from Saturday to Tuesday.

The 383 plan, which is considered to be very bold among analysts and market watchers, suggested three broad ideas for overhauls, eight major areas of reform and three related areas for change. The plan proposed reforms in areas including the land system, the financial sector and the pension regime

How the plan will influence the central government's decisions remains to be seen, but it has already had an effect on China's stock market, lifting the share prices of companies in industries such as environmental protection, real estate and clean energies.

Bold new measures

The reform of land policy is one of the most highly anticipated topics for the upcoming Third Plenary Session. The 383 plan suggests the government launch land reform to give rural and urban landowners equal rights, and set up a unified land market, in which rural collective land resources can be traded.

Real estate companies - which own abundant land resources, construct city infrastructure and possess urban land that could be turned into commercial properties - will benefit from the land reform, according to a report Thursday by news portal qq.com.

China Wuyi Co, which develops commercial and residential real estate projects and constructs bridges, airports and roads, has seen its share price increase to 8.39 yuan ($1.37) on Tuesday, 3 percent up from 8.14 yuan at the end of September.

The news portal said that companies specializing in production of daily necessities, natural gas processing and pipeline construction will also see their share prices increase.

The share price of Shenzhen-listed PetroChina Jinhong Energy Investment Co, which is mainly engaged in the construction and operation of city gas pipeline networks, rose by 13.5 percent from 31.08 yuan on October 8 to 35.27 yuan at close of trading Tuesday.

Huang Jianzhong, a professor of finance at Shanghai Normal University, told the Global Times Sunday that real estate companies that are developing affordable housing in urban areas will also benefit from the land reform.

High-tech benefits

Hong Kong-based Wing Fung Securities said in a research note published on October 12 that prices of stocks in fields such as environmental protection, the cultural and media industries and those related to the Tianjin Port Free Trade Zone, have been surging as the Third Plenary Session approaches.

The 383 plan said the government should be generous in its treatment of companies in fields such as e-commerce, new energies, electric vehicles and telecommunications. It said that the government should give the enterprises enough time and space to introduce innovations in new technologies and business models.

Dong Dengxin, director of the Financial Securities Institute at Wuhan University of Science and Technology, told the Global Times Sunday that the central government's policies to be announced during the Third Plenary Session will probably suggest the same thing, which will lead to a rise in the shares of companies operating in the high-tech sector.

"The economy will be transformed and upgraded, and the government will promote entrepreneurship and innovation. The government will give policy, financial and social support and benefits to those who start up companies, especially in the high-tech and new energy sectors. So the share prices of companies in these fields will jump," Dong said.

Shares in Shenzhen-listed Hengdian Group DMEGC Magnetics Co, which manufactures electronic components and solar photovoltaic products, rose by 7.5 percent from 17 yuan on October 8 to 18.27 yuan on Tuesday.

Also, Hong Kong-listed China Longyuan Power Group Corporation Ltd, which designs, develops and manages wind power plants has seen its share price jump by 16.5 percent from HK$8.05 ($1.04) on October 2 to HK$9.38 by close of trading Tuesday.

Uncertainty remains

Despite the boost that the 383 plan and the upcoming Third Plenary Session might bring, the performance of both the Shenzhen and the Shanghai stock markets has been flat over the last month.

The Shanghai Composite Index dropped by 1.9 percent from early October to 2,157.24 Tuesday, and the Shenzhen Component Index fell by 2.6 percent from early last month to 8,451.73 Tuesday.

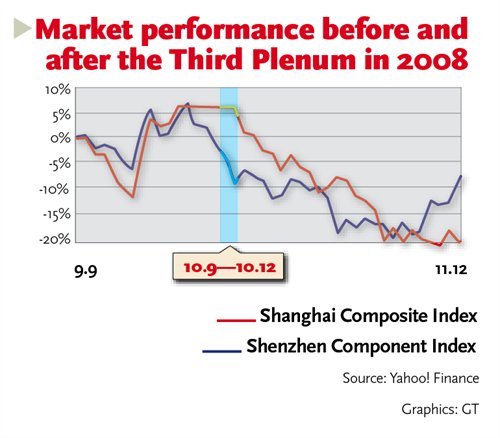

In fact, the Shanghai and Shenzhen markets have not performed well before or after Third Plenary Sessions historically.

The Shanghai Composite Index, for example, dropped by 7 percent from early September to November 14, 2003, with the Third Plenary Session of the 16th CPC Central Committee having ended on October 14, 2003. And the Shenzhen Component Index dropped by 8.3 percent from the month before to the month after the Third Plenary Session of the 17th CPC Central Committee in 2008.

Dong said that reform policies can usually lift share prices of particular companies in the short run, but the performance of the whole market is ultimately determined by investors' confidence and the laws of the market.

However, Li Bo, an analyst with GF Securities, told the Global Times Sunday that he was confident that the Shanghai and Shenzhen markets will experience a major boost after the upcoming Third Plenary Session.

"I think this year's session will be as important as the one in 1978, which initiated China's landmark reform and opening-up policy," Li said.

"As long as the policies announced meet the public's needs and can fundamentally upgrade China's distorted economic structure, the stock market will be on a steady rise at least for the next decade," he noted.