HOME >> BUSINESS

Glass half full

Source:Global Times Published: 2013-11-7 21:03:01

Following years of cultivation of the domestic market, red wine has gradually become more popular, and is even regarded as a replacement for the more traditional Chinese baijiu at banquets or dinner parties.

However, the Chinese government last year launched a campaign to rein in lavish spending by officials, which has impacted wine consumption and caused a decline in imports and sales.

Amid the drop in government spending and the country's moderate GDP growth, wine dealers have started focusing on lower-priced brands in an effort to develop a larger, if less affluent, market.

Disappointing results

Late in October, the Shanghai-listed Changyu Pioneer Wine Co, a leading domestic wine producer, released its third-quarter report, showing revenue of 3.35 billion yuan ($549.78 million) in the first three quarters, down 18.8 percent year-on-year. Profits also fell by 25.28 percent year-on-year to 869 million yuan.

In the third quarter alone, the company's revenue reached 809 million yuan, a sharp fall of 27.19 percent year-on-year, with profit falling by 46.94 percent to 128 million yuan, the report said.

Changyu is not alone. China Great Wall Wine Co, a subsidiary of Hong Kong-listed China Food, also reported a 34 percent year-on-year decline in sales in the first half of this year, and the company made a loss of 69 million yuan during the same period.

Across the whole domestic wine industry, output declined by 10.52 percent in the first three quarters, with total income for the sector falling by 3.95 percent, and average profit dropping by 2 percentage points, according to a report released in October by Changjiang Securities.

Yantai-based Changyu attributed the decline to the sluggish economy, the curbing of extravagance at official galas, and competition from imported wine.

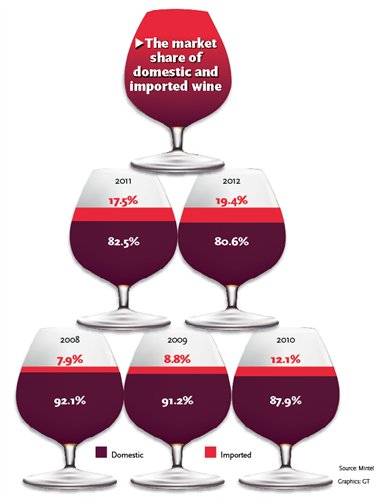

According to a report released in May by market research firm Mintel, consumers are more likely to choose imported wine if it is priced at a level similar to domestic products, indicating that consumers still have a higher opinion of wine from abroad.

A man surnamed Lin, who works in the finance industry, told the Global Times Wednesday that he doesn't normally buy domestic wine, because he prefers foreign brands. Lin said he buys wine from France, Spain, Italy, Chile and South Africa costing around 200 to 300 yuan per bottle.

The wine market is more "chaotic" than the market for baijiu since most people know less about wine, and also the supply of wine exceeds demand, Yu Mingyang, a professor at Antai College of Economics & Management at Shanghai Jiao Tong University, told the Global Times Tuesday.

Cheaper wine, please

According to a report released by Wine Australia Corporation in May this year, China currently accounts for approximately 2.4 percent of global wine production. China produced 1.09 billion liters in 2010, and plans to increase the output to 2.2 billion liters by 2015, according to the Ministry of Industry and Information Technology.

In 2011, China's wine expenditure reached 45 billion yuan, making it the world's fifth-largest wine consuming country, and consumption increased by 25 to 30 percent in 2012, said the report.

However, the government drive to curb official spending has cast something of a shadow over the market, particularly for high-end wines.

Xia Qijia, a sales manager at the Jiangsu branch of Shanghai Grand Echo International Trade Co, told the Global Times Tuesday that the sales growth of their high-end wine has slowed down significantly.

According to Xia, from 2009 to 2011, the company's total wine sales maintained a 100 percent year-on-year increase or even more. But last year it was just 50 percent, Xia said, adding that sales of imported high-end wine accounted for 50 percent of its total sales before the end of 2012, but now account for less than 30 percent.

However, Xia said that the market for more affordable wine is still strong, especially in second- and third-tier cities.

Insiders said that consumers are becoming more price-conscious and less willing to pay for the more expensive wines.

Drink up

Although the slowdown in sales growth is a worry for the wine industry, the wine market in China has expanded significantly in recent years and is still seen as having great potential, partly due to people's increasing disposable incomes and also the relative health benefits of wine, compared to stronger spirits.

Debra Meiburg, a wine judge and the first recipient of the Master of Wine title in Asia, told the Global Times in October that the move away from high-end wines in China is actually a positive sign.

Only a small number of people can afford the best wine, so if the market is moving more toward affordable wine, it means that more people are starting to enjoy it, said Meiburg.

Eddie Chew, regional Greater China director for Ocean Glass Public Co, told the Global Times on October 25 that the company plans to raise the sales of its Lucaris crystal wine glasses in China from the current 1 million units per year to 5 million in three years time, and boost its market share from the current 5 or 6 percent to 10 to 15 percent, or even higher.

"High-end wine consumption has definitely been decreasing in 2013, but the sales growth of wine glasses has not been affected. If people drink more inexpensive wine, it still means that wine culture is developing and more people will buy wine glasses for their home use," Chew said.

Xia from Shanghai Grand Echo said that the company's sales target for this year is 350 million yuan, nearly as high as for last year.

"We can achieve the goal for this year," said Xia, adding that the market has become stronger in cities in Shandong and Fujian provinces since 2011.

Global Times

Posted in: Insight