Virtual bonanza

Photo: CFP

A former software company manager surnamed Yang spent years saving up 700,000 yuan ($114,868) in order to buy a new apartment for him and his wife.

However, Yang changed his plan in April after reading news and various Weibo postings about Bitcoin. He decided to spend all of his savings on buying the digital peer-to-peer currency at some 600 yuan for each Bitcoin.

"My friends and colleagues told me that I had lost my mind," Yang told the Global Times Sunday. "But I believed that the way Bitcoin works made sense and I knew I would make money by entering the game early."

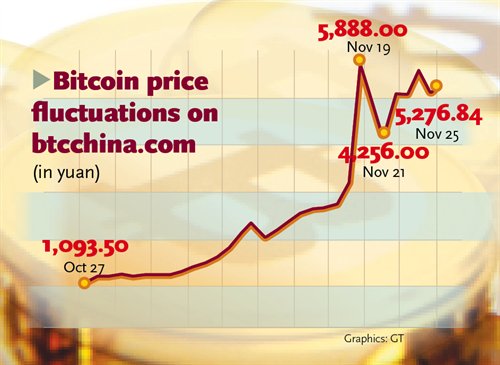

So far, Yang's plan appears to be working. The price of Bitcoin has surged by some 613 percent since April, hitting a value of around 5,300 yuan per Bitcoin as of late Monday. Yang now owns 3,800 Bitcoins, with a total value of more than 20 million yuan.

"I never thought that I would make this much money in my life," said Yang, a resident of Suzhou, East China's Jiangsu Province. "I later quit my job, bought two new apartments, and traveled for three months before I became a full-time Bitcoin investor."

Bitcoin is a virtual currency that functions without the intervention of a central authority and is traded in a 24-hour global market. It was introduced in 2008 by a pseudonymous developer known as "Satoshi Nakamoto." The currency is generated, or "mined," through complicated computer calculations and the total number of Bitcoins that can be mined is capped at 21 million.

While the digital currency is quickly becoming a popular tool for speculation in China, it can also be used to buy tangible products and even pay tuition fees in some Western countries. However, although Bitcoin has made some investors such as Yang rich, it carries high risks that other traditional currencies do not have.

Booming popularity

China has recently surpassed the US as having the most active Bitcoin transaction network in the world, according to a research project sponsored by the Bitcoin Foundation. And US virtual currency research center Genesis Block said in early November that more than half of the global Bitcoin transactions are now conducted in yuan.

The price of a Bitcoin stood at 63.99 yuan in early January this year, but it has soared by more than 80 times since then, reaching around 5,300 yuan late Monday on Chinese Bitcoin trading platform btcchina.com.

Yang said he manages five chat groups on QQ, an instant messaging service offered by Tencent Holdings, for Bitcoin investors to share their experiences and prospects in the market. The groups have a total of more than 5,000 members, with their investments in Bitcoin ranging from a few hundred yuan to millions of yuan, Yang said.

An information technology industry practitioner surnamed Jiu, who lives in Wuhan, Central China's Hubei Province, told the Global Times Sunday that he bought 12 computer graphic cards for 1,199 yuan each in April and made his own "mining" machines.

"I kept my miners on 24 hours a day, and they mined some 2.5 Bitcoins for me each month by late summer," Jiu said. "But as more and more people started to use professional miners to get Bitcoins, it got increasingly difficult for me."

Many stores on taobao.com, an online marketplace run by Alibaba Group, sell professional miners, which are priced from 2,400 yuan to as much as 150,000 yuan. The most popular machine, which is priced at 14,200 yuan, is able to mine 0.09 Bitcoins a day.

High risks

Bitcoin's fast-increasing popularity has caught the eye of the People's Bank of China. Yi Gang, deputy governor of China's central bank, said Wednesday that the country will not recognize the virtual currency anytime soon, but will allow Chinese citizens to freely participate in buying and selling Bitcoins online.

The US Department of Justice said in the country's first-ever congressional hearing on virtual currencies on November 18 that Bitcoins offer a "legitimate" financial service and digital currencies could "promote more efficient global commerce," the Wall Street Journal reported.

The authorities' cautious approval has boosted investors' confidence in the virtual currency. Yang said the value of Bitcoin will keep soaring. "Despite some short-term swings, Bitcoin will see its price surge above $10,000 one day."

However, because the Bitcoin market is completely decentralized, the price of the virtual currency can swing up and down dramatically.

For instance, the price on btcchina.com soared by 82.6 percent to 5,888 yuan on November 18, and then tumbled by 32 percent to 4,000 yuan the next day.

Lian Ping, Shanghai-based chief economist at Bank of Communications, told the Global Times Sunday that Bitcoin investments are highly risky because the currency is not backed by any authority.

"No central governments can stabilize the value of Bitcoin and prevent the price from fluctuating wildly. And if the value plummets suddenly, there is no way for investors to get compensation," Lian said.

Li Chao, an analyst with Internet service consultancy iResearch, told the Global Times Sunday that Bitcoin, unlike company shares or futures, are not backed by any tangible assets, which also adds to the risk involved.

Hard to supervise

The anonymous and unsupervised nature of Bitcoin has also made it a useful currency for criminals, such as drug dealers and traffickers. In early October, the FBI cracked down on the Silk Road online marketplace, which allowed users to trade in illegal drugs and required transactions to be made using Bitcoins, according to the BBC.

China so far has no rules to regulate the use of or transactions of Bitcoins.

Li said that it is very difficult for governments to regulate transactions in digital currencies, because traditional means of supervision cannot be applied. "Bitcoin is a disruptive innovation, and central banks cannot use traditional methods such as adjusting interest rates to regulate the digital currencies market," he said.

The government needs time to figure out measures to regulate such currencies, Li said. And the authorities also need to be aware that although Bitcoin is now mostly a tool for speculation, it may be used to buy tangible products or services in the future, Li said.

Currently, domestic search engine Baidu Inc allows customers to buy its website safety and acceleration services with Bitcoins, and a Shanghai residential real estate developer reportedly accepts Bitcoins from homebuyers.

Li noted that the government will have to find ways to deal with digital currencies, as they are set to be an irreversible trend.