HOME >> BUSINESS

Concern expressed over rising debt risk

By Chen Tian Source:Global Times Published: 2014-1-2 23:23:01

Staff work at a railway station in Qingdao, East China's Shandong Province. Photo: IC

China's top economic planner has said that local government financing vehicles (LGFVs) can borrow money to repay their maturing loans and finish ongoing construction projects, but this is likely to worsen the country's local government debt problem, analysts said Thursday.

If the LGFVs are short on cash and are not able to finish their projects on time, they could consider issuing new bonds to repay their loans and finish the construction, the National Development and Reform Commission (NDRC) said in a notice released Tuesday.

The local governments need to ensure all projects are finished, the NDRC said.

The LGFVs were founded by local governments to seek funding for urban infrastructure construction projects by selling bonds to investors. However, some of them have been used by local governments to borrow large amounts of cash to fund unnecessary projects to boost local GDP figures.

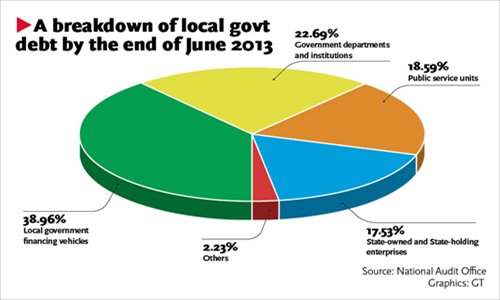

The NDRC's statement came after the release Monday of a report by the National Audit Office on the size and the risks from local government debt. The report said that China's 7,170 LGFVs owe 6.97 trillion yuan ($1.15 trillion) to investors, a rise of 40.2 percent from 4.97 trillion yuan in late 2010.

"[The central and local authorities] need to firmly curb the disorderly expansion of local government debt, and manage the various debts in different ways," the NDRC said.

Lian Ping, Shanghai-based chief economist at Bank of Communications, told the Global Times Thursday that it is highly risky for the central government to allow LGFVs to borrow money to ease liquidity shortages.

"This is an emergency measure [for] when a large-scale debt problem has occurred," Lian said. "If the borrowing activities are not scrutinized closely, however, the burden of local government debt will definitely become heavier."

The central government and regulators have to ensure that the LGFVs' borrowing and repaying activities are tightly monitored and highly transparent, Lian noted.

The NDRC said that an unusually large number of bonds will mature in the near future, and LGFVs will need to repay some 100 billion yuan in loans this year.

Zhu Lixu, a Shanghai-based analyst with Xiangcai Securities Co, told the Global Times Thursday that issuing new bonds to repay old loans is a risky, short-term method to deal with liquidity shortages.

"The local governments cannot default on their loans, as it would do too much damage to their reputation. So they can only borrow new money to fill the void," Zhu said.

"This, however, is highly risky since urban infrastructure usually yields financial returns years after being completed. So the financing vehicles need to issue a lot of short-term bonds with high interest rates to repay the loans, which can be very costly," he said.

The central government will have to help local authorities repay the loans if the LGFVs are no longer able to find fresh funding, Zhu noted.

The only long-term solution for local governments is to levy a property tax, Zhu said, or they will have to push up real estate prices in order to be able to repay their debts.

Before LGFVs are allowed to seek new loans, the China Banking Regulatory Commission will probably impose strict requirements for them to meet, Lian said.

The central and local authorities need to increase their regulatory efforts with LGFVs to ensure the loans are properly paid and to prevent regional risks from happening, the NDRC also said.

Posted in: Economy