HOME >> BUSINESS

CNOOC to close new energy unit

By Chen Tian Source:Global Times Published: 2014-1-5 23:48:04

Graphics: GT

Graphics: GT

China's third-largest national oil company decided to end one of its renewable energy subsidiaries, according to media reports, as the country's lackluster new energy market continues to struggle with limited demand and high production costs, analysts said Sunday.

China National Offshore Oil Corp (CNOOC) plans to dissolve its subsidiary CNOOC New Energy Investment Co, a Beijing-based firm which mainly explores and produces several forms of renewable energy including wind power, coal-based clean energy and biomass energy, the Beijing-based Economic Observer newspaper reported Friday.

The newspaper cited an unnamed source close to the senior management of CNOOC who said that the company's top executives have lost confidence in the new energy company, which has incurred huge financial losses since its establishment in 2007.

The parent company, the source said, also decided to sell the unit's projects and transfer the firm's equity without specifying who would take the projects and shares.

Employees of CNOOC New Energy Investment can choose to quit, or be transferred to the parent company's Synthetic Natural Gas (SNG) companies in North China's Shanxi Province and Northwest China's Xinjiang Uyghur Autonomous Region, the newspaper reported. SNG is also a clean energy product.

CNOOC was not available to comment on the issue as of press time.

Many of China's large energy companies, including China Petrochemical Corporation and China National Petroleum Corp, have developed clean energy branches. That is more of a strategy to create a positive and socially responsible image for the firms themselves, and less of a means to make money, said Lin Boqiang, director of the Center for Energy Economics Research at Xiamen University.

Lin told the Global Times Sunday that the financial performances of China's renewable energy companies are highly dependent on the amount of subsidies from the central government.

"It is very costly for companies to develop clean energy businesses. Without the authorities' financial support, the price of electricity produced by renewable energy will be very expensive and consumers will not purchase it," Lin said.

CNOOC New Energy Investment Co is not a listed company, so its earnings reports are not accessible by the public.

The renewable subsidiary suffered losses for five consecutive years since its launch, the Economic Observer reported, though the firm made a profit for the first time in 2012.

The firm earned a profit of 9.93 million yuan in 2012 and its total assets stood at 7.15 billion yuan at the end of 2012, the newspaper said, while the parent company has invested more than 10 billion yuan in its renewable energy businesses.

Lin said CNOOC is selling its Beijing new energy subsidiary after it made a profit in 2012 because it could fetch a higher price now. "If CNOOC New Energy Investment announces a loss in 2013, it would be very difficult for the company to sell its unit."

Zhang Ping, president of China Renewable Energy Industry Association, told the Global Times Sunday that CNOOC is closing its new energy unit because the firm focused on developing wind power, which is not well developed in China.

"China's northern regions have abundant wind energy, but they lack upgraded power grids and strong market demand. Wind power cannot be fully absorbed," he said.

Yang Fuqiang, senior adviser on climate and energy at the Beijing Office of New York-based Natural Resources Defense Council, told the Global Times that China's new energy market has gone through a low point and will gradually recover in 2014.

"The economies of the US and Europe are getting stronger, and the governments and financial institutions in the developed countries are supporting clean energy," Yang said. "Influence from overseas will help China further strengthen its clean energy market."

The State Council said Saturday that the Ministry of Industry and Information Technology was taking measures to promote the development of the photovoltaic industry, in the latest move to support China's renewable energy market.

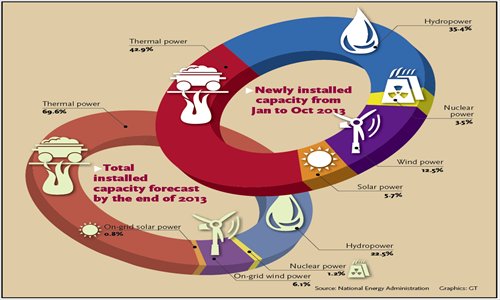

China added 35.95 million kW of new energy and renewable energy installed capacity from January to October last year, doubling the amount recorded during the same period in 2012, according to the National Energy Administration's forecast released in December.

Posted in: Companies