HOME >> BUSINESS

Tencent to launch its own fund products

By Liang Fei Source:Global Times Published: 2014-1-14 22:53:01

Graphics: GT

Tencent Holdings, China's largest Internet company by revenue, is about to launch its own monetary fund products in cooperation with a fund company, a Beijing-based newspaper reported Tuesday, citing sources close to the matter.

Tencent's monetary funds, WeChat Tenpay, which will mainly target users on its mobile instant messaging service WeChat, are expected to make its debut as early as Wednesday, the Beijing Business Today reported, though some other media reported Tuesday that the launch could be on any day this week.

The Beijing Business Today report said Tencent is cooperating with leading fund firm China Asset Management Co Ltd (ChinaAMC) in launching the fund products, and later Tencent will cooperate with another three fund firms in selling fund products.

The report did not mention the investment return rate of Tencent's new monetary fund product.

Both Tencent and ChinaAMC were not available for comment on Tuesday.

After Alibaba Group, China's largest e-commerce company in terms of market share, started to offer money management products through its Yu'ebao service in June 2013, many Internet companies also began to eye the promising sector.

In October, search engine provider Baidu launched its online wealth management service Baifa, also in cooperation with ChinaAMC. Appliances retailer Suning Corp is also set to launch its own Yu'ebao-like service - Lingqianbao on Wednesday.

"Among all the players in Internet finance, Tencent may pose the biggest threat to Yu'ebao, given its large user base," Feng Lin, a senior analyst at China E-Commerce Research Center, told the Global Times Tuesday.

Feng noted that Tencent's fund may not grow very fast at the beginning, given that the mobile payment service of WeChat is still in its nascent stage, but in the long run, it will be very competitive in the Internet finance sector.

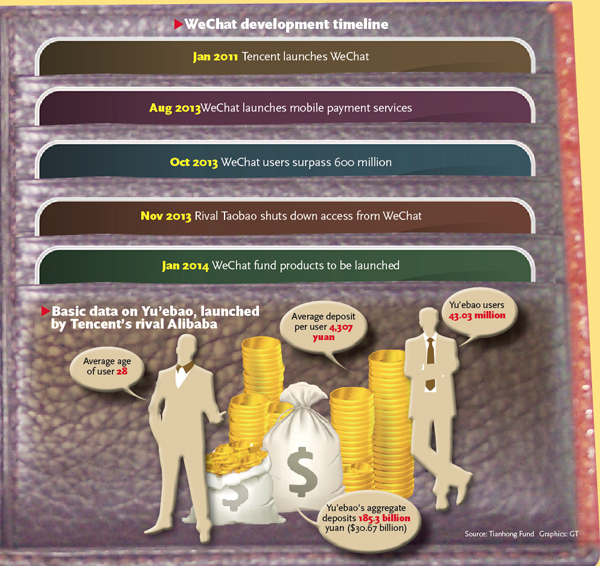

Launched in January 2011, Tencent's mobile messaging service WeChat so far has gained over 600 million users.

In August 2013, WeChat launched mobile payment services - at present users could pay for mobile phone charges, taxi fees, or online purchases through WeChat by linking their bank account to the software.

Feng noted that like the online third-party payment market, the Internet finance sector will be highly concentrated.

"The top eight players in the sector are expected to account for over 90 percent of the market," Feng said.

So far Alibaba's Yu'ebao still has absolute dominance in the Internet finance sector. Until the end of December, Yu'ebao has gained 43.03 million users with aggregate deposits of 185.3 billion yuan ($30.67 billion).

Given the fast growth of Yu'ebao, Alibaba's partner Tianhong Asset Management Co now has become the second-largest fund company in China in terms of the capital it manages, after ChinaAMC.

Zheng Yi, a 28-year-old university teacher in Beijing, only started to use Yu'ebao in December, but so far she has put 13,000 yuan of her savings in the fund, given that "Yu'ebao's return is higher than that of banks."

"I will consider putting some money into WeChat's fund products if the return is attractive enough," Zheng said.

Yang Wenbin, chairman of Shanghai Howbuy Fund Sales Company, told the Global Times Tuesday that Internet companies had done a very good job in popularizing the money management products in the past year.

"It is very possible that banks will increase its interest rates or launch some attractive wealth management products to avoid further capital outflow," Yang noted.

The practice by some firms of promising very high profit returns by making subsidies to users may involve some risks of breaking related regulations, Yang said.

China's securities authorities said in October that the advertised 8 percent annual return in Baidu's promotion of its fund products did not conform to certain regulations.

Posted in: Companies