HOME >> BUSINESS

CSRC opens door for HK funds

By Wang Xinyuan Source:Global Times Published: 2014-1-21 0:03:01

Commuters cross a footbridge in the central business district in Hong Kong. Photo: CFP

The securities regulators on both sides have reached a basic agreement on mutual recognition of funds, which means that Hong Kong incorporated fund companies can sell funds to mainland customers directly, and vice versa, said Tong Daochi, director general for the Department of International Affairs at the CSRC.

"It also means that foreign fund companies that are eager to invest in the mainland can register in Hong Kong, which will support Hong Kong in becoming an international asset management center," Tong said.

"We are waiting for the two sides to publish the details. We think it will be a win-win initiative for fund companies and investors, both in the mainland and Hong Kong," Sally Wong, CEO of Hong Kong Investment Funds Association, told the Global Times via phone Monday.

International investors and Hong Kong investors are all glad to see the gradual opening of the mainland capital market, Wong said.

The initiative will provide a good platform for mainland companies to go global, and will also help international fund companies to participate in the mainland market and provide services to mainland investors, she noted.

"It is a good thing for investors [in the mainland], as it provides more investment options and Hong Kong firms usually have a good reputation," Zhang Chengbao, a Beijing-based investor, told the Global Times Monday.

The securities regulator has also made it easier for Hong Kong institutions and residents to invest in the mainland capital market, either indirectly through the Qualified Foreign Institutional Investor (QFII) or RMB Qualified Foreign Institutional Investor (RQFII) programs, or by directly opening A-share stock trading accounts.

The CSRC lowered the threshold for Hong Kong investors to apply for the QFII program, enabling smaller Hong Kong institutional investors to get access to the mainland stock market, said Tong.

QFII is a certification system launched in 2002 allowing licensed professional foreign investors to invest in the mainland's equities market.

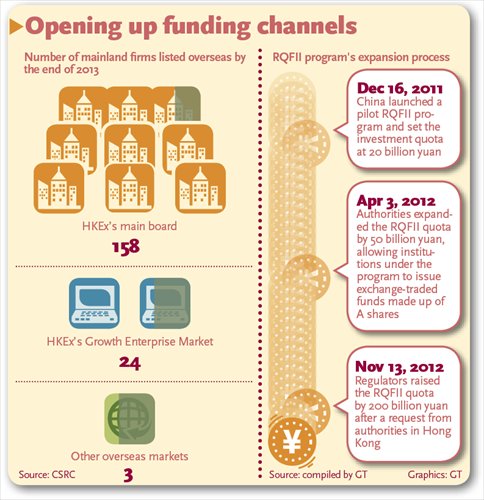

Hong Kong investors can also invest in the mainland market through the RQFII scheme, which was launched in 2011 and allows overseas investors to bring yuan from offshore centers to invest in the mainland.

The RQFII quota has increased from 20 billion yuan ($3.28 billion) in the pilot program to the current 270 billion yuan, Tong said.

By the end of 2013, 61 institutions had been given access to RQFII, and 60 of them are Hong Kong financial institutions.

Measures aimed at opening the capital market are part of the Mainland and Hong Kong Closer Economic Partnership Arrangement, Tong said.

Since April 2013, Hong Kong, Macao and Taiwan residents working and living in the mainland have been able to open accounts and invest in the A-share market.

Hong Kong residents have opened 27,491 A-share accounts, accounting for 53 percent of all the A-share market accounts opened by people from Hong Kong, Macao and Taiwan.

The CSRC also eased the investment limits for Hong Kong investors in securities brokerage firms, fund companies and securities advisory firms formed jointly with mainland partners.

Foreign companies are currently subject to a 49 percent equity cap in fund company JVs, while Hong Kong investors can have a stake of over 50 percent in these JVs, Tong said.

The regulator also said it had made it easier for mainland companies to raise funds in Hong Kong.

By the end of 2012, the CSRC had lowered the financial requirement for mainland firms to get listed in Hong Kong. In 2013, the CSRC approved eight firms to float in Hong Kong, raising $11.5 billion.

By the end of 2013, a total of 182 mainland incorporated companies had listed in Hong Kong and three in other overseas markets.

Posted in: Economy