Evergrande buys into Huaxia Bank

A man counts cash at an outlet of Huaxia Bank in Shenyang, Northeast China's Liaoning Province. Photo: CFP

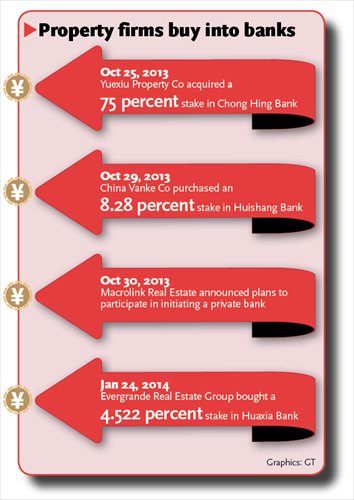

Guangzhou-based Evergrande Real Estate Group has paid 3.3 billion ($545.9 million) for a 4.522 percent stake in Huaxia Bank, and experts said Sunday it will help with financing and further diversification.

The purchase was completed between November 13, 2013 and January 24, 2014, according to a statement the company filed with the Hong Kong Stock Exchange on Friday.

The statement said the deal would build a win-win relationship between the two companies.

The strong financial performance of Huaxia Bank is another reason for the investment, according to the company's statement.

The acquisition made Evergrande the fifth largest shareholder in Huaxia Bank, the Beijing News reported on Sunday.

Evergrande is not the first property developer to invest in the banking industry, Chen Guoqiang, deputy director of the China Real Estate Society, told the Global Times Sunday.

China Vanke Co, China's largest real estate company in terms of revenue, invested $419 million in Huishang Bank in October 2013, becoming the biggest shareholder in the Hong Kong-listed bank.

Becoming a stakeholder in a bank can offer convenience and even preferential conditions for financing, which is crucial for real estate companies, Chen said.

Hui Jianqiang, research director with real estate information provider Beijing Zhongfangyanxie Technology Service, agreed with Chen, noting that property developers rely on land provided by the government and the ability to raise capital from different sources including bank loans.

Property developers have been facing greater difficulty with financing recently, Hui said, noting that it is not as easy as it used to be for real estate companies to get loans from banks.

Evergrande has not revealed why it became a shareholder in Huaxia Bank, but Chen speculated that it might develop financial services for the residential communities it builds, similar to what Vanke did after investing in Huishang Bank.

By investing in Huishang, Vanke planned to provide financial services for its communities, news portal sina.com reported Saturday, noting that the services included setting up banks in communities and selling asset management products.

Partners of property developers such as suppliers also need financial services, so cooperation with banks could bring these clients to the banks, according to Chen.

Investment in Huaxia Bank is the latest step in Evergrande's diversification strategy. It is already the owner of Guangzhou Evergrande Football Club, and has set up animation companies and launched its own bottled water brand, Evergrande Spring.

Evergrande Spring was launched on November 9, 2013, just after Guangzhou Evergrande won the 2013 Asian Football Confederation Champions League. From then to January 12, Evergrande has received orders for the water worth 5.7 billion yuan, according to its website.

Selling bottled water appeared to have little connection with the real estate industry, but Evergrande utilized its resources by building sales outlets in its real estate projects, Chen said, suggesting that diversification should be built around a company's existing advantages.

Diversification will also be a trend for property developers to hedge against risks in the real estate market, with further moves expected in promising areas such as finance and cultural projects, according to Hui.