Banks see slower growth in assets

A bank employee processes customer account transactions at a bank outlet in Haikou, South China's Hainan Province. Photo: CFP

With growth in China's banking sector assets having slowed to the lowest level in a decade, the risk from bad debts is expected to rise amid the country's efforts to tighten controls on credit expansion, analysts said Monday.

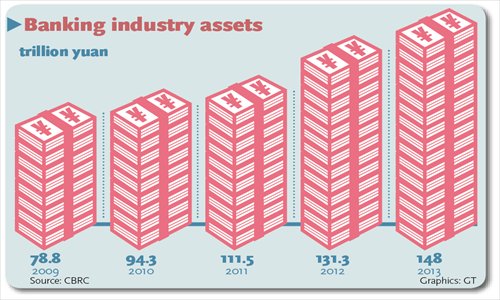

Assets of the banking industry totaled 148 trillion yuan ($24 trillion) by the end of 2013, up 12.8 percent from a year earlier, according to data released Sunday by the China Banking Regulatory Commission (CBRC). The growth rate was the lowest since 2003, when the CBRC first started revealing such data.

Banking assets mainly refer to financial institutions' lending assets. Meanwhile, total liabilities reached 137.9 trillion yuan.

"The asset growth of the banking institutions is consistent with the slowdown in growth of overall money supply as the authorities guard against a credit bubble," Jin Lin, a banking analyst at Orient Securities, told the Global Times Monday.

There have been concerns about a growing credit bubble following the 4-trillion-yuan stimulus package launched in 2008 to revive the economy, and the country has been trying to deleverage the banking sector and slow down growth in credit in recent years.

The banking sector's assets have increased by $14 trillion since 2008, which is equal to the entire size of the US commercial banking sector.

China's banking sector is facing a tough situation in 2014, with the cost of attracting depositors set to rise amid interest rate liberalization, Jin said. Involvement in shadow banking activities will also expose banks to rising nonperforming loans (NPLs), he noted.

Listed banks have not yet disclosed their 2013 annual reports, but the "Big Four" banks' reports for the third quarter of 2013 showed their largest increase in NPLs since 2010, with bad debts up 3.5 percent quarter-on-quarter to a combined 329.4 billion yuan, Bloomberg reported October 31, 2013.

China CITIC Bank Corp, the country's seventh largest lender by assets, said in December that it wanted to more than double the amount of bad loans that it can write off to 5.2 billion yuan, with NPLs having risen sharply amid slower economic growth.

The increasing write-offs of bad debts is just a start, with NPLs expected to keep rising, Sun Peng, an analyst at BOCI China, told the Global Times Monday.

China's economic growth slowed to a 14-year low of 7.7 percent in 2013, according to official data. And GDP growth in 2014 is expected to be 7 to 7.5 percent, according to market estimates.

As the country pursues interest rate liberalization, banks will engage in high-yield and more risky shadow banking activities, Sun said.

A large amount of credit remains outside formal banking channels, with banks having moved interbank loans off balance sheets to reduce reported levels of lending.

The regulators are mulling new rules to curb shadow banking activities, including risky off-balance sheet loans, which will narrow their profit margins and also lower revenues from intermediary services, Sun said.

The property sector and companies affiliated with local governments have been the major recipients of shadow banking loans so these are the two major areas that could see a rise in bad loans, he noted.

Property prices in smaller cities may fall owing to oversupply, so developers could default on loans, according to analysts.

With the central government tightening its curbs on local government borrowing, some loans may turn sour, Sun noted.

Banks might see a surge in NPLs in some regions, he said.