Higher returns

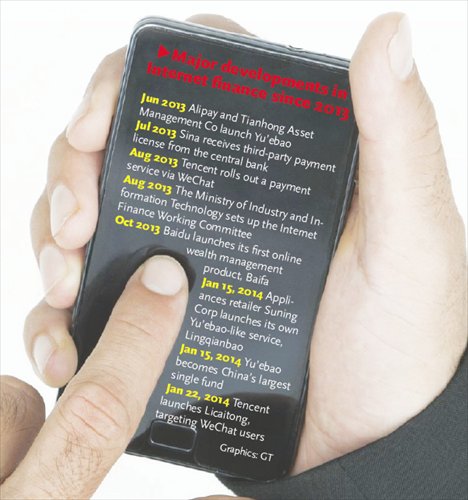

Major developments in Internet finance since 2013 Graphics: GT

Zhao Zhenyu, a 37-year-old IT engineer in Beijing, transfers his salary of 8,000 yuan ($1,323) each month into his Yu'ebao account. Including other funds, he has put a total of 100,000 yuan into the account in the past six months, which offers him a return of about 6 percent annually.

Yu'ebao, which literally means "leftover treasure" in Chinese, is a monetary fund launched jointly in June 2013 by Tianhong Asset Management Co and Alipay, an online payment service owned by e-commerce giant Alibaba Group.

"I can get a return of around 16.88 yuan each day from Yu'ebao, and in the last two days the return rose to more than 17 yuan," Zhao said.

Zhao said he puts all his spare cash into Yu'ebao because the return it offers is much higher than the 3.8 percent annual interest rate from a fixed deposit account at a bank.

"Besides, it's convenient to use Yu'ebao to pay bills and shop online. I can withdraw money any time, and can draw up to 60,000 yuan daily if I need to," Zhao said.

Internet finance boom

By January 15, Yu'ebao had attracted 49 million users with aggregate deposits of 250 billion yuan. It saw an increase of 6 million users within 15 days from mid-December to the end of the month, with the subscription value having reached 3 million yuan every minute.

The success of Yu'ebao has allowed Tianhong Asset Management Co to overtake China Asset Management Co (China AMC) to become China's largest fund company in terms of assets.

Zhu Jian, a senior manager in the Alipay PR department, told the Global Times on Monday that around 4 million users deposited their year-end bonuses in Yu'ebao in one week, from January 20 to 26.

The popularity of Yu'ebao has enticed a number of other ventures including appliances retailer Suning Corp and Tencent Inc, another of China's leading Internet companies, to join the online finance market.

On January 22, Tencent teamed up with China AMC to launch a similar financial product called Licaitong, targeting the 600 million users of WeChat, a popular instant messaging application developed by Tencent.

Licaitong offers a 7.338 percent seven-day annualized return, 18 times more than the banks' one-year fixed deposit rate and higher than Yu'ebao's rate by almost 1 percentage point.

Licaitong pulled in 1 billion yuan in the two days after its launch, according to data provided by Tencent to the Global Times on Monday.

Other Internet firms such as Baidu and NetEase are preparing to launch similar services.

Challenge to banks

The rise of online finance has put pressure on the country's traditional banks, which have seen a slowdown in deposit growth recently.

The country's household deposits increased by 5.49 trillion yuan in 2013, compared with 5.71 trillion in 2012, the central bank said on January 15.

According to a report released in January by the Financial Research Center of Bank of Communications, the average growth in profits for the country's listed banks was estimated to have dropped to 11.9 percent in 2013 from 17.36 percent in 2012.

The growth of net interest income and business revenue for the banking sector will drop to 9.0 percent and 10.7 percent, respectively, in 2014, according to the report.

"Although commercial banks have obvious advantages in terms of scale, the rapid growth of Internet finance will have a further impact on commercial banks in the future," the report said.

In response to the challenge from Internet finance, some city commercial banks and joint stock banks have begun to raise their deposit rates to the upper limit in the floating range allowed by the central bank, China News Service reported on Monday.

In June 2012, the central bank announced it would allow banks to raise deposit rates by up to 10 percent above the benchmark rate.

Some branches of Agricultural Bank of China, China Construction Bank (CCB) and Bank of Communications allowed the deposit rate to rise by 10 percent from the benchmark rate for some clients.

"The moves by major banks shows they feel the pressure and are concerned about the challenge from Internet finance," Zeng Linghua, an analyst with Shanghai-based fund consultancy Howbuy, told the Global Times on Monday.

Sustainable or not?

Despite the popularity of Internet finance, there is some doubt about whether the high return rates they offer are sustainable.

Internet finance products can offer high return rates because they invest most of the funds they attract into agreement deposits with banks, which offer high yields, Zeng said

According to Zhu from Alipay, more than 90 percent of the funds they attracted through Yu'ebao have been invested in agreement deposits.

As interbank liquidity has been tight recently, banks have been thirsty for the cash needed to meet year-end regulatory requirements, so they have been willing to offer higher interest rates in order to gain funds from Internet finance products.

The fixed seven-day repurchase rate, which measures liquidity in the country's banking system, rose to 8.84 in December, not far below a record high of 10.77 reached in June 2013. Liquidity remained tight in early January, so the interest rates for agreement deposits stayed high.

However, the interbank rate will not remain high forever, and nor will the yield from agreement deposits and Internet investment products, Zeng noted.

The yield from funds such as Yu'ebao will return to a normal level of 3 or 4 percent after the Lunar New Year holidays when liquidity eases, Zeng said.

"When all Internet finance products rush to invest in agreement deposits, the yield will drop. The potential risks come from uncertainty about these products' ability to manage the growing volume of funds," Zhao Xijun, deputy director of the Finance and Securities Institute at Renmin University of China, told the Global Times Sunday.

According to Zhao, Internet finance cannot replace conventional banks because there are few ideal investment channels in China, and Internet finance firms rely on banks to roll out good financial products they can invest in to make a profit.

"The current Internet finance boom provides banks with an opportunity to restructure and change. Internet finance and conventional banking are complementary," Zhao said.

Tapping his phone to check on return rates from Yu'ebao has become a daily routine for Zhao Zhenyu, the IT engineer.

But he said that even though he had deposited a significant amount of money in Yu'ebao, he split the rest of his wealth among different channels.

"One should never put all the eggs in one basket," he said.