Newsprint firms pause production

Every morning, Zhou Ying reads Baidu News, a mobile news application, and checks out WeChat, a popular instant messaging application, on her smartphone.

"I have not bought a newspaper for at least two years," Zhou, a 23-year-old IT worker in Beijing, told the Global Times Monday. "If I can get something free online, why pay?"

Her friends made the same choice: free news rather than a paid-for newspaper. Her parents and grandparents in East China's Zhejiang Province still subscribe to a newspaper.

The younger generation's choice is hurting newspaper sales, leading to heated discussion and concern about the future of print media on the Chinese mainland.

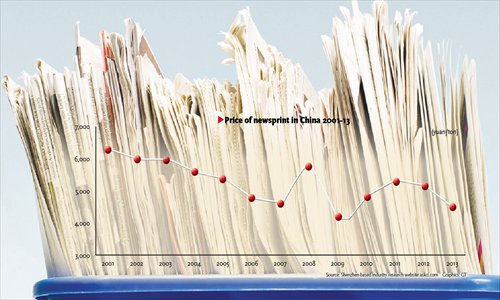

The price of newsprint supplies a handy measure of that decline.

The average price of newsprint has declined from 5,100 yuan ($841.4) a ton at the end of 2012 to 4,350 yuan a ton at the end of 2013, China Press and Publishing Journal reported on December 12, 2013.

Zhang, a purchasing department director of a national newspaper who only gave her surname, told the Global Times on Monday that the price could be even lower.

"We make a large order for newsprint every year, so we can get a discount from newsprint manufacturers," said Zhang, although she refused to reveal the specific price.

Compared with previous years, she said, the newsprint price in 2013 was low.

Since 2001, the average price of newsprint in China has fluctuated from 3,950 to 6,300 yuan per ton, Yan Hainan, an analyst from Shenzhen-based industrial research website askci.com, told the Global Times on Monday. The current price is close to bottom, he believed.

From 2001 to 2007, the price of newsprint dropped continuously, then rose and peaked at 6,300 yuan a ton in 2008 during the Beijing Olympic Games. It fell again to 3,950 yuan in 2009 in the wake of the financial crisis, Yan said.

Declining newsprint needs

The weak performance of newspapers has hit newsprint hard, Zhang said.

China had 1,918 newspapers in 2012, 19 fewer than in 2009, according to the State Administration of Press, Publication, Radio, Film and Television. Retail revenues plunged.

Compared with 2012, the retail revenue of newspapers on the Chinese mainland fell 10.8 percent, the sharpest decline in recent years, the journal China Newspaper Industry reported on January 23.

Newspaper advertising revenue continued to shrink. Advertising revenue saw an 8.1 percent year-on-year decline in 2013, the China Press and Publishing Journal reported on January 29, citing data released by the China Advertising Association Newspaper Branch.

Suppliers of Chinese newspapers held an annual meeting in Fuzhou, Fujian Province in December 2013, Zhang said, noting the plunging price of newsprint was a chief concern at the South China meeting.

The China Newspaper Association (CNA) announced at the meeting that 81 major newspapers, the largest buyers of newsprint in China, consumed 1.51 million tons of newsprint in 2013, a 9.6 percent year-on-year fall, Beijing-based China Press and Publishing Journal reported. Forty-eight out of 81 newspapers reduced newsprint consumption in 2013. Twenty-seven increased, the newspaper reported.

In addition to the weak domestic market, the overseas market has seen declining demand for newsprint in 2013, the report said.

Newsprint needs in North America fell 10 percent in 2013 and production also shrank, according to the report.

Overcapacity

Many factors contributed to the price decline, but the main reason is overcapacity, Zhang and Yan said.

Total newsprint consumption in China in 2013 was 3.07 million tons, 330,000 tons less than 2012, but newsprint output reached 3.7 million tons last year, China Press and Publishing Journal reported, citing data released by CNA at the suppliers' annual meeting.

The newsprint industry in China grew fast after 2000, Yan said.

In 2005 and 2006, Norske Skog (Hebei) Paper, Huatai Group and Chenming Group in East China's Shandong Province all launched new production projects with annual production capacity of more than 300,000 tons, leading to a continuous price drop, media reports said.

The market in 2008 held optimistic expectations that newspapers would flourish with the Beijing Olympic Games as newsprint manufacturers enhanced productivity, Yan said.

Afterward even as prices plunged in 2009, Huatai Group still started a production project with 400,000 tons annual output capacity in South China's Guangdong Province in 2011, according to its website.

The new production project in Guangdong is a part of Huatai's development strategy in the Pearl River Delta, Huatai told the Global Times Monday via e-mail, noting the new project did not increase Huatai's total newsprint output because the headquarters in Shandong Province had reduced production.

Future of newsprint

Facing oversupply, newsprint suppliers decided at the meeting that the industry would halt production for 15 or 20 days in January, Zhang said.

Pausing production is only a temporary solution, which could not solve overcapacity, Yan said.

Overcapacity will shake up the industry and the smaller factories will shut down first, Yan predicted.

Increasing environmental awareness also places higher requirements on newspaper production, Yan said.

Huatai's newsprint production project in Shandong Province was suspended by the Ministry of Environmental Protection due to its sludge landfill not meeting environmental standards, according to a filing on Shanghai Stock Exchange website released on June 28, 2013.

The suspension was lifted after the project was improved to meet environmental protection requirements, according to another filing released by the company on January 6.

Newsprint industry output in 2014 will stay at 3.7 million tons, the same as 2013, and consumption may be about 3.09 million tons, the report said, citing CNA data.