HOME >> BUSINESS

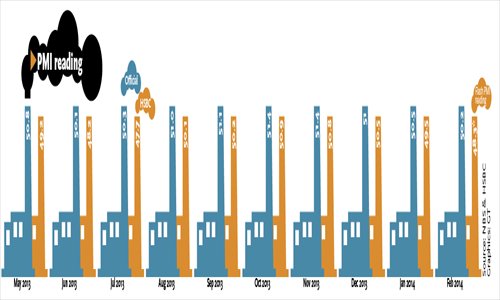

Official PMI falls to eight-month low

By Li Qiaoyi Source:Global Times Published: 2014-3-2 23:23:01

View of a plant run by Dalian Petrochemical Branch Company on Saturday Photo: CFP

Activity in China's manufacturing sector remained anemic in February, official data showed over the weekend, but market observers pointed to seasonal distortions and said there are no concerns of any serious decline in the economy.

The official Purchasing Managers' Index (PMI), which mainly covers large and State-owned enterprises, was released Saturday by the National Bureau of Statistics (NBS), and the reading for February fell to an eight-month low of 50.2.

The sub-indexes measuring output, new orders, new exports and employment all registered a decline in February from the previous month, while the sub-indexes for inventories of finished goods, and production and business activity expectations saw a pickup during the month.

The data marked the 17th consecutive month of the official PMI being above the line of 50 - a reading below 50 indicates contraction, while a reading above it indicates expansion.

But the fall in the February reading came after the release of a preliminary private survey that also pointed to a slowdown in manufacturing activity in February, adding to concerns over softening growth momentum for the economy.

The flash PMI reading released by HSBC, which mostly focuses on small and private enterprises, was announced on February 20 and showed a fall to a seven-month low of 48.3 from the previous month's final reading of 49.5.

The HSBC final reading for February is scheduled to be released Monday.

The drop in the official February reading is mainly down to seasonal factors, senior NBS statistician Zhao Qinghe said in a statement posted on the bureau's website on Saturday.

The Spring Festival holidays had an impact on overall manufacturing activity, Zhao noted.

The HSBC PMI was even more influenced by the Chinese Lunar New Year holidays, so seasonal factors should also be seen as the main reason for its drop in February, Lu Ting, chief China economist with Bank of America Merrill Lynch, said in a note sent to the Global Times over the weekend.

"Markets will likely respond negatively to the reading but the impact could be limited," Lu said.

Business activity in the manufacturing sector is expected to gain traction in coming months as seasonal factors fade, according to Zhao of the NBS, who pointed to an improvement in the sub-index of the official PMI for production and business activity expectations, which saw a jump of 10.5 points to 61.8 in February.

Nonetheless, the sustained decline in PMI readings is reflecting a broad-based softening of both internal and external demand, Zhang Lei, a macroeconomic analyst with Minsheng Securities in Beijing, told the Global Times Sunday.

"The economy is unlikely to pick up steam soon, amid a rebalancing process during which the nation has to wean itself off the investment-driven growth model that has been relied upon for years," Zhang remarked.

China's economy is expected to maintain steady growth this year, he went on to say, forecasting that the 2014 growth target is likely to be unchanged at 7.5 percent when it is announced Wednesday in Premier Li Keqiang's government work report to the annual session of the National People's Congress.

Revealing a full-year GDP growth forecast of 7.4 percent, JP Morgan Chief China Economist Zhu Haibin said Saturday in a note sent to the Global Times that macro policy in 2014 will be based on "the balance between structural reforms and near-term growth stabilization."

Posted in: Economy