HOME >> BUSINESS

Jd.com to launch online wealth platform

By Zhang Ye Source:Global Times Published: 2014-3-10 0:43:01

Photo: IC

Emerging online funds

China's leading e-commerce retailer jd.com will launch an online wealth management platform Tuesday in an attempt to expand its presence in Internet finance, media reported Saturday, even as the governor of the country's central bank said he expects stricter regulation for the sector.

The platform, dubbed "Xiaojinku," can allow users to buy monetary fund products as well as pay for online purchases on jd.com, according to the Xinhua News Agency.

The first two fund products, set to be available on Xiaojinku Tuesday, are Huoqianbao, managed by Beijing-based Harvest Fund, and Zengzhibao, managed by Shenzhen-based Penghua Fund, said the report.

The estimated seven-day annualized rates for the two products were not disclosed. JD could not be reached by press time.

Liu Changhong, head of JD's financial operation, was quoted by Xinhua saying at a press conference that more products related to Internet finance will be launched in the future.

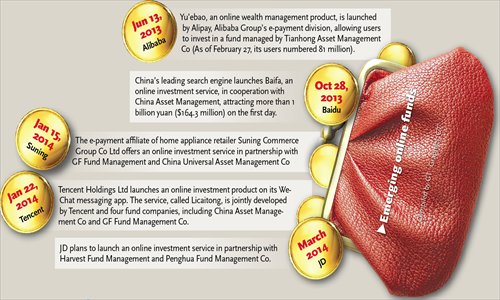

Many Internet financing products have come out in recent months in China, following the success of Yu'ebao, the first online wealth management platform released by the country's leading e-commerce company Alibaba in June 2013.

As of February 27, Yu'ebao's total assets reportedly reached nearly 350 billion yuan ($56 billion) with over 81 million users.

In January, both home appliance retailer Suning Commerce Group Co and Internet company Tencent Holdings unveiled their own online asset management platforms Lingqianbao and Licaitong respectively. Tencent's WeChat users reportedly transferred more than 800 million yuan to Licaitong on the first day of its launch on January 22.

Zhou Xiaochuan, governor of the People's Bank of China (PBC), said at the ongoing session of the National Committee of the Chinese People's Political Consultative Conference, that services like Yu'ebao will not be banned, but regulations will be improved.

"The major issue with those online wealth management platforms is their overstated claims such as promises of capital return, which must be controlled to ensure fair competition," Wu Xiaoling, deputy director with the Financial and Economic Affairs Committee of the National People's Congress, said during the two sessions.

The fund that can stand out from the fierce competition should not only provide a fairly high yield but also enable users to pay for online purchases, Feng Lin, an analyst at China E-Commerce Research Center, told the Global Times Sunday.

Data from Analysys International showed that Alibaba's e-commerce site Tmall was the largest business to consumer platform by transaction volumes with 49.7 percent of transactions in the fourth quarter of 2013.

JD came in at second place with 19 percent and Tencent's online business ranked third with 7 percent.

Suning took the fourth position with 4.6 percent.

JD's Xiaojinku may get a leg up on most rivals except Yu'ebao, Zeng Linghua, a fund analyst with Shanghai-based investment consultancy HowBuy, told the Global Times Sunday.

In addition to the fierce competition, Xiaojinku will also be confronted with uncertain government policies, said Zeng.

Zeng also said that Internet financing products led by Alibaba will surely reduce the profit margin for commercial banks, as it is getting harder and more expensive (by offering higher rates) to attract new deposits from people to fuel traditional lending.

According to the PBC, traditional bank deposits decreased by 940.2 billion yuan in January 2014 from 104.38 trillion yuan at the end of December 2013.

JD filed to launch an IPO in the US on January 30. According to the filing, the company reported a profit of 60 million yuan in the first nine months of 2013 after losing money for four consecutive years from 2009 to 2012.

Tencent may buy a 16% stake in jd.com: media

China's largest Internet company Tencent Holdings Ltd may soon announce a deal to obtain a 16 percent stake in online retailer jd.com and merge their online shopping platforms, local media reported on Saturday.

Jd.com is China's second-largest e-commerce company.

Any deal between two of China's largest online companies would help narrow the huge gap between e-retailers and Alibaba Group Holding Ltd, which dominates China's booming online commerce market.

Under the deal, both companies will combine their e-commerce business, with Tencent transferring its less popular e-commerce sites, including yixun.com, to JD, caixin.com reported, citing unidentified company sources.

The firms may announce the deal as early as Monday, the paper said, noting that the 16 percent stake was the minimum level being discussed and Tencent could raise the shareholding in JD to more than 20 percent.

China's business-to-consumer e-commerce sales may surpass $180 billion this year due to rising internet usage, expanding middle-class incomes and a better distribution network, according to New York-based market research firm eMarketer.

Tencent, Alibaba and search engine giant Baidu Inc are competing to cash in on the rising popularity of mobile Internet in China.

Tencent gets the majority of its revenue from computer games, but its mobile games are also hugely popular, according to figures from domestic app stores. Tencent's WeChat instant messaging app is also used by more than half of all Chinese smartphone users.

Reuters - Global Times

Posted in: Companies