New era

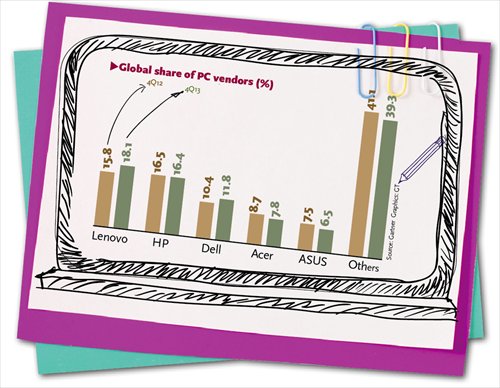

Global share of PC vendors Source: Gartner Graphics: GT

Microsoft's 13-year-old Windows XP operating system (OS) reached its official retirement age on Tuesday, and it's a good thing for the ailing PC sector according to industry analysts, even if many users may be reluctant to upgrade their computer systems.

Users of Windows XP in China, the world's largest PC market, will be offered temporary relief in delaying their plans to migrate to newer OS generations, as local technology firms including Tencent Holdings and Qihoo 360 Technology Co are working on solutions to continue supporting Windows XP for the time being.

The expiration of XP will definitely give an impetus to sales of PCs powered by newer operating systems, Cao Yujie, consultant director at Beijing-based IT market research firm CCW Research, told the Global Times on Tuesday. However, it won't be as big a boost as Microsoft's launch in 2012 of Windows 8, Cao noted.

XP's retirement is also likely to help Dell and Hewlett-Packard (HP), two major PC manufacturers who have been suffering amid a listless global PC market in recent years.

Employees work at a Dell factory in Xiamen, East China's Fujian Province in December 2013. Photo: Li Qiaoyi/GT

Not giving up yet

Both Dell and HP have followed the path taken by IBM Corp to a certain extent, in shifting their focus to the more lucrative market for business services and solutions. But they haven't yet followed IBM in quitting the PC manufacturing arena completely.

Instead, both claim to be end-to-end solution providers, featuring versatile capabilities in hardware and software as well as services.

"We are planning to launch more products," Amit Midha, president for Asia-Pacific and Japan at Dell Inc, told the Global Times on Friday on the sidelines of the Dell Field Readiness Seminar in Singapore.

Midha had told the Global Times in December in Xiamen, the company's China headquarters, that while the consumer PC market might have been suffering, the business PC market was doing much better.

The Texas-based company said in October 2013 that it had completed its landmark $24.9 billion deal to go private, with its founder Michael Dell aiming to make his eponymous PC company more efficient and flexible.

HP, Dell's closest rival, posted stronger-than-expected results for its fiscal 2014 first quarter ending January 31, with revenues of its PC-focused personal system group rising 4 percent year-on-year.

Aging computers were replaced in the quarter, while Microsoft's decision to retire Windows XP helped prompt PC upgrades as well, HP CEO Meg Whitman told analysts after the release of the quarterly financial report in February.

HP is even expected to beat China's Lenovo to reclaim the title of world's top PC vendor in the first quarter of 2014, Taipei-based Digitimes reported at the end of March.

"Hardware - including PCs, tablets, printers as well as enterprise servers, storage and networking products - still underpins HP's business, although software and business services are also significant," Chen Lei, spokesman for HP China, told the Global Times on April 2.

HP will continue its commitment to being a hardware vendor, Chen said, adding that new products for both the corporate and individual consumer mass markets are in the pipeline. But he didn't reveal any specific time frame for the release of the new products.

However, these improvements in the PC arena are of limited significance to the likes of Dell and HP, whose future profitability will depend more on fields such as higher-end storage, cloud computing, big data and mobility solutions, said Cao of CCW Research.

Among the broader trends affecting IT, there is a lot of focus on cloud computing, security and mobility, Phil Davis, vice president for enterprise solutions for Asia-Pacific and Japan at Dell, said at the seminar, pointing to the company's post-buyout strategic focus.

HP, both in the US and in China, has a clear strategic vision, with cloud computing, big data, mobility and security being key areas of focus, said Chen of HP.

Chinese market still strong

Lenovo announced its acquisition of IBM's low-end x86 server unit for $2.3 billion in late January, which will help with integration into future IT trends, although it has yet to move beyond the field of PCs and smart gadgets globally.

The acquisition instantly made Lenovo one of the top vendors of x86 servers in the Chinese market, according to US-based consultancy IDC.

Without giving any comment on the impact of Lenovo's acquisition for Dell's China operations, Midha stressed that "it's critical to invest in the [Chinese] market, the second-largest market for us globally and the largest emerging market we have."

"Not all the emerging markets are doing well, [but] I think China will continue to do well," he said.

HP, meanwhile, appears to be unfazed by competition in the Chinese market so far.

HP's business in China has stayed largely flat, which is better than for some of its rivals, according to CEO Meg Whitman.

"It's a battle. It's a knife fight every single day out there, but we feel we've got the right ammunition," Reuters quoted her as saying in February.

The Chinese market remains a land of growth for HP in terms of overall IT expenditure, said Chen, the company's China spokesman, citing the sheer size of the market and a continued need for information technology amid the nation's push for more efficient economic growth.

The domestic economy may be slowing somewhat, but the targeted 7.5 percent GDP growth for 2014 still offers considerable opportunities for IT companies, he said.

Total IT expenditure in the Chinese market is expected to increase by 7 percent year-on-year to 2.1 trillion yuan ($338.31 billion) in 2014, outperforming global growth of 3.2 percent during the year, US-based research firm Gartner Inc said in a research note e-mailed to the Global Times on Friday.

When asked about their labor strategy in China, neither Dell nor HP were willing to comment on job numbers domestically.

However, as part of its multiyear turnaround efforts, HP has said that it plans to cut 34,000 jobs globally from 2012 through 2014.

Dell also announced a global "voluntary separation program" in late 2013, under which staffers can opt for redundancy packages.