HOME >> CHINA

China inks auto, aircraft trade pacts with Germany

By AFP – Global Times Source:AFP – Global Times Published: 2014-7-8 0:53:01

Beijing grant of $13 billion investment quota a positive step: expert

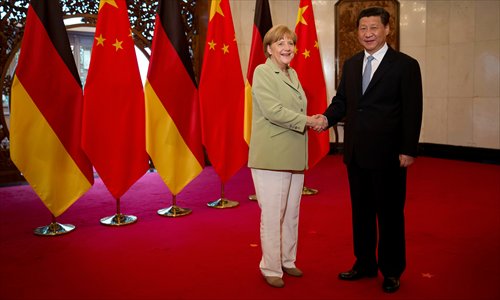

German Chancellor Angela Merkel (left) shakes hands with Chinese President Xi Jinping before a meeting in Beijing on Monday. Merkel is in China on her seventh visit since 2005, with economic ties topping the agenda. Photo: AFP

China and Germany signed a series of trade and investment deals on Monday during a visit to China by Chancellor Angela Merkel, including agreements on two new Volkswagen factories and the sale of 123 Airbus helicopters.

Merkel was accompanied by executives from Siemens, Airbus, Lufthansa and Deutsche Bank among other companies, according to German media.

Chinese Premier Li Keqiang and Merkel oversaw the signing of a series of agreements on Monday.

German auto maker Volkswagen and its Chinese partner First Automobile Works (FAW) on Monday signed a joint declaration affirming the construction of two new vehicle plants in China, which will be located in the coastal cities of Tianjin and Qingdao.

The Tianjin plant, which will produce dual-clutch gearboxes for Volkswagen in China, is expected to be inaugurated toward the end of 2014.

China has become Volkswagen's largest and most important market, said the company in a press release sent to the Global Times on Monday, confirming it will "substantially expand its capacity in China with its Chinese partners."

Its two joint ventures, FAW Volkswagen and Shanghai Volkswagen, delivered about 1.51 million vehicles in the first five months this year, a 17.7 percent increase from the same period last year, Volkswagen said.

"Volkswagen was the first [foreign auto company] to enter the Chinese market. For that reason it has benefited for the longest period of time, as China is its top regional market for car sales," said Li Lezeng, a professor at Shanghai's Tongji University.

European aerospace giant Airbus announced that its helicopter division has signed contracts to sell a record 123 aircraft over up to six years to three Chinese companies.

The helicopters - mainly light single-engine aircraft from the Ecureuil family and the light twin-engine EC135 - will be used for general aviation activities, it said in a statement.

"It is evident that China's relaxation of its low-altitude airspace regulations is enabling the country's burgeoning helicopter market to realize its potential," Airbus Helicopters CEO Guillaume Faury said in the statement.

Also on Monday, German airline group Lufthansa said it had signed a memorandum of understanding to form a joint venture with Air China.

The new partnership, which will come into force in October, will give passengers additional travel options and flight connections and allow Lufthansa "to have even better access to the second largest aviation market after the US," according to the German carrier.

The two will provide 81 flights a week during the summer and autumn seasons, according to the Xinhua News Agency.

On the financial front, China granted an 80 billion yuan ($13 billion) investment quota to Germany under the RMB Qualified Foreign Institutional Investors (RQFII) program.

Since its rollout at the end of 2011, the program has allowed investors in Hong Kong, London, Singapore and France a new way to participate in the Chinese capital market, according to the State Administration of Foreign Exchange (SAFE).

"The RQFII program is driving the yuan's internationalization process and pushing more openness in domestic capital markets by introducing offshore yuan-denominated investment. It has also had a positive impact on the yuan's presence in Europe," Zhao Xijun, deputy director of the Finance and Securities Institute at the Renmin University of China, told the Global Times Monday.

Zhao said that although 80 billion yuan is a small step given the size of the financial institutions involved, it is a positive step nonetheless, and will contribute to Frankfurt's position as a European financial center, Zhao said.

As of June 30, SAFE has approved 71 overseas asset managers with an investment quota of 250.3 billion yuan.

Li, the professor at Tongji University, said the signing of these deals reflects the bigger picture of Sino-German economic cooperation.

There are many German companies that have developed rapidly in China during the past year, including German chemical company BASF.

Germany last year sold goods worth 67 billion euros ($91 billion) to China, its number-two export market outside Europe after the US. German imports from the Asian powerhouse, meanwhile, topped 73 billion euros.

Merkel later met President Xi Jinping, who said her country was an "important strategic partner."

"Germany is a country with sizable influence in the world," he said. "China places high importance on the development of our relationship."

He also wished Germany good luck in the World Cup in Brazil.

Posted in: Diplomacy