HOME >> BUSINESS

Investors greet reform blueprint

By Wang Xinyuan Source:Global Times Published: 2014-8-7 0:18:01

Shares of Guangdong's listed SOE affiliates rise

A woman works on the production line of COFCO's plant in Jiujiang, East China's Jiangxi Province. Photo: CFP

Shares of listed corporations affiliated to Guangdong's State-owned enterprises (SOEs) rose Wednesday in response to an ambitious local reform blueprint to overhaul inefficient large SOEs, following similar initiatives elsewhere in the country.

Guangdong Guanghong Holdings Co, a listed company under Guangdong Guanghong Assets Management Co - one of the four major provincial SOEs, witnessed 3.64 percent jump at the close of market Wednesday.

Fenghua Advanced Technology Holding Co and Guangdong Advertising Co, another two Guangdong SOE subsidiaries saw their shares gain 3.27 and 1.64 percent, respectively, while the benchmark Shanghai Composite Index and Shenzhen Component Index dipped 0.11 and 0.15 percent, respectively, on Wednesday.

The share gains came after Guangdong government announced that it was considering to push forward a mixed-ownership reform to revitalize the local SOEs.

The number of SOEs with mixed ownership or investment of non-State capital will account for more than 60 percent of all local SOEs by 2017, the Standing Committee of the Guangdong Provincial People's Congress, the local legislature, said in a statement on Tuesday.

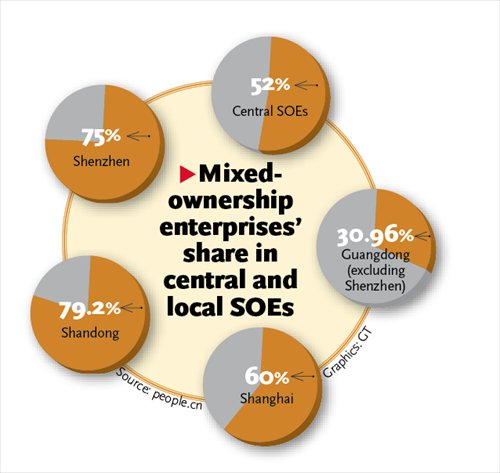

SOEs with mixed ownership in Guangdong Province (excluding Shenzhen) accounted for 30.96 percent of all local SOEs by the end of 2013, news portal people.cn reported Tuesday.

The Guangdong government will make detailed plans to push forward mixed-ownership reform of SOEs. The provincial government will use 40-50 SOEs as test cases this year, and set up a State-owned capital investment corporation to hold shares in listed companies, according to a Xinhua News Agency report on Wednesday.

The statement also lists the challenges for this ambitious blueprint. Investment return on SOEs is relatively low given the inefficiency related to huge size and administrative red tape, compared with the private firms.

Out of the 5.81 million private businesses in Guangdong, more than 4 million are individually owned businesses, which may lack the financial power to make major SOE investment, the statement cited Zhou Xingting, deputy head of the State-owned Assets Supervision and Administration Commission of Guangdong, as saying.

Getting a SOE listed is a major way to introduce private capital for the mixed-ownership reform, said Li Youhuan, an economist with the Guangdong Academy of Social Sciences.

"If it successfully attracts private capital to the local SOEs, Guangdong will get new energy for growth and make a positive impact on the nation's overall economy," Li told the Global Times on Wednesday.

The province's economy tops other local governments with the GDP of 6.22 trillion yuan ($1 trillion) in 2013, contributing about 11 percent of national total, official data showed.

Guangdong is not the only province to drive SOE reform. As of Tuesday, 14 municipalities and provinces including Shanghai, Sichuan and Shandong had worked out detailed reform plans, the 21st Century Business Herald reported Wednesday.

"The success of SOE reforms in China will primarily depend on establishing a balanced and level playing field for SOEs and private sector firms to compete with each other," Chris Leung, senior economist at DBS Bank, told the Global Times in a note on Wednesday.

SOEs have always played a dominant role in China's economy. They often receive government subsidies in forms of preferential tax rates, low dividend payouts and little or no royalties on resource exploration, and are regarded inefficient and bureaucratic.

The country's State assets regulator announced on July 15 that six centrally administered SOEs including State Development & Investment Corporation and China National Cereals, Oils and Foodstuffs Corporation (COFCO) will join in a pilot program that will seek to reform their ownership and management by allowing injections of private capital in some, while moving to empower the boards of directors in others.

Posted in: Economy