China bans US pork containing feed additive

Intended to bar ractopamine used in hog farms from entering nation

A customer buys US-imported pork in a Century Mart supermarket in Zhengzhou, Central China's Henan Province, on March 22. Photo: CFP

China has banned imports of pork from six US processing plants and six cold storage facilities, effective from Wednesday, a Reuters report said on Tuesday (US time), citing the US Department of Agriculture.

The ban reportedly aims to prevent ractopamine, which is an additive used in US hog farms that could leave toxic residual in pork products such as bacon and ham, from entering China.

The US companies affected by the ban include Tyson Foods' units in Perry and Storm Lake in Iowa, and Logansport in Indiana, as well as Hormel Foods Corp's plant in Fremont, Nebraska.

The companies were not immediately available to comment as of late Wednesday.

Inquiries to China's top quality watchdog, the General Administration of Quality Supervision, Inspection and Quarantine, went unanswered as of press time.

China banned the use of ractopamine in feed and animal husbandry in 1997, and the country also barred exports and imports of several additives including ractopamine and clenbuterol in 2009, after several food safety scandals sickened people who ate additive-added pork.

Currently, China requires third-party verification of imported US pork, according to a regulation announced on March 1, 2013.

However, the use of such additives in animal feed is legal in countries such as the US and Canada.

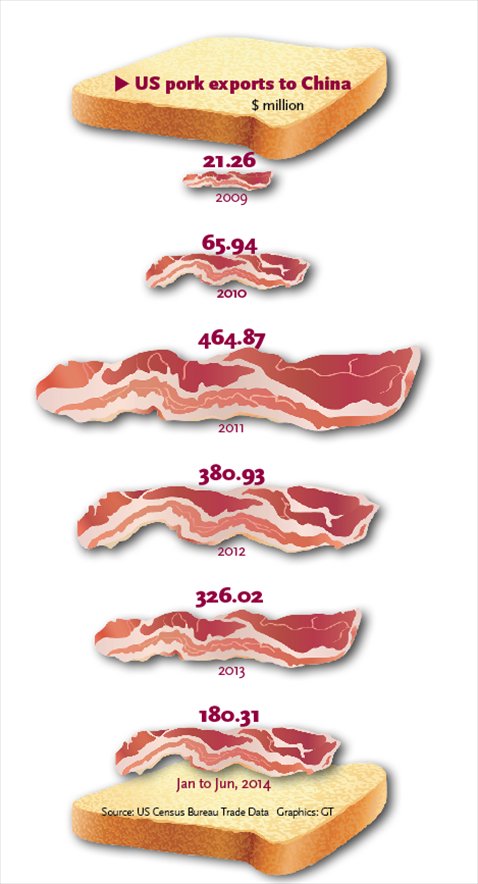

China is one of the biggest buyers of US pork. The country imported $180.31 million worth of pork products in the first half of 2014, up 28 percent from the same period last year, according to data from the USCensus Bureau.

Experts said that the ban of pork from the US plants and facilities is a continuation of China's policy to eradicate the existence of dangerous additives in meat products, and will have little immediate impact on pork prices in China.

"Pork imported from the US only accounts for a small portion of total pork products on the Chinese market, so the ban won't have a dramatic influence on the pork price," Ma Wenfeng, an analyst at Beijing Orient Agribusiness Consultant, told the Global Times Wednesday.

China produced 54.93 million tons of pork in 2013, China's National Bureau of Statistics said, while it imported 312,138 tons from the US, Reuters cited Global Trade Atlas as saying.

"The act shows that the Chinese government is steadfast in its pursuit to get rid of dangerous additive residues in pork," Pan Chenjun, a senior analyst at Rabobank, told the Global Times Wednesday.

The US is a leading exporter of agricultural produce and related products, thanks to its large-scale business and advanced technology.

"The ban is not biased. WH Group, a large domestic pork producer, was also punished severely over the issue of ractopamine," Ma noted.

While China itself has long banned the use of these additives, some of the additive-affected pork found its way into the country through imports, Pan from Rabobank noted.

Ma said the ban shows that lax management could also be found in big, multinational companies.

"The US pork market has been hit by low prices and hog farmers' profits were affected, so this has led to slack management in the production process of pork, resulting in consumers getting final products with residues," Ma said.

The standard and safe procedure should be for farmers to stop feeding hogs with additive-added feed for a while before sending the animals to the slaughterhouse, he noted.

The event would help boost domestic pork production and underpin the pork price, which fluctuates cyclically but is currently on a rising curve, according to Pan.

The US is not only China's largest live swine supplier but also the largest pork exporter to China, according to a research report released in February by the US Department of Agriculture.