SME tax burden too heavy: Wahaha founder Zong

Tycoon says this hampers economy’s transition

Steel pipes piled up on a factory site in East China's Shandong Province Photo: CFP

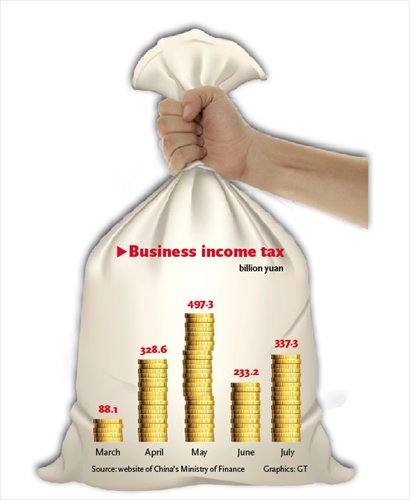

Business income tax

China's small and medium-sized enterprises (SMEs) are shouldering a heavy tax burden which falls afoul of the economy's shift toward a domestic demand-driven growth path, entrepreneur Zong Qinghou, founder and chairman of Chinese drinks giant Hangzhou Wahaha Group, said over the weekend at a forum on Saturday.

The current tax burden is too heavy for many SMEs, some of which are unable to pay their taxes, so this results in only 20 percent of all enterprises paying 90 percent of business taxes collected, Zong told a forum held in Zhengzhou, Central China's Henan Province.

The hefty tax burden borne by SMEs, coupled with cumbersome taxes for many individuals, has weighed on domestic demand, the mainstay of long-term growth of the economy, Zong said.

This is because many SMEs are forced to raise prices, which in turn makes their products or services less affordable for many consumers, according to some economists.

Enterprises operating in the country are generally subject to a corporate income tax rate of 25 percent, while individual income is taxed progressively at 3 percent to 45 percent with the exemption threshold set at 3,500 yuan ($569), according to the country's current tax rules.

Enterprises need to be allowed to receive more favorable tax policies which would instead increase tax revenues, as stronger investment activities are expected following preferential tax policies so as to broaden the tax base, Zong remarked, adding the tax exemption threshold for individual taxpayers should be raised to 10,000 yuan to revitalize consumption.

Now the tax burden shouldered by smaller businesses accounts for about 30 percent of their operating costs, which in addition to fundraising costs has made it particularly tough for SMEs groping for solutions to survive a slowing economy, Shan Dong, president of the Private Economy Academy of Zhejiang Province, told the Global Times on Sunday.

The current corporate income tax rate should be halved to ease tax burdens felt by smaller business owners, Shan suggested.

On top of that, deeper reform of the current fiscal and taxation system that would bestow local governments a share of the overall fiscal pie in line with their responsibility for expenditures may give local governments more leeway in helping enterprises loaded with tax burdens, he added.

In July, the country's collection of corporate income tax jumped 9.6 percent year-on-year to 337.3 billion yuan, quickening from a 5.8 percent growth rate in June, while total personal income tax collected grew 9 percent from the previous year to 53.8 billion yuan in July, a rise from June's gain of 7.7 percent, data from the Ministry of Finance showed.

But Chen Naixing, head of the SMEs Research Center of the Chinese Academy of Social Sciences, told the Global Times on Sunday while less developed regions are loaded with heavier tax burdens than their more developed counterparts, the tax burden as a whole has been on the decline, citing a series of measures taken by the central government to offer policy support for small businesses in particular.

The State Council, the country's cabinet, announced in April that the corporate income tax cut of 50 percent for small and micro-sized enterprises with annual income of less than 60,000 yuan will be extended to the end of 2016 from the previously scheduled expiration date of December 31, 2015.

The upper limit of 60,000 yuan will also be further raised to 100,000 yuan.

At an executive meeting on Wednesday, the cabinet also announced the reduction of the corporate income tax rate to 15 percent for technology service enterprises that are considered high-tech enterprises.