Alibaba shares open to record debut as e-commerce firm lists in US

Alibaba CEO Jack Ma Yun (5th from left) and his company's other executives arrive at the New York Stock Exchange in New York on Friday. Photo: AFP

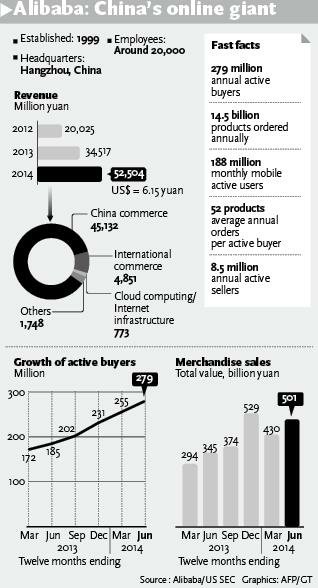

Shares of Alibaba Group Holding Ltd, China's largest e-commerce company, Friday rose by more than 40 percent in their market debut as of press time, a reflection of strong investor enthusiasm for the largest-ever flotation on the history.

Alibaba's shares opened at $92.70 a share on the New York Stock Exchange, and hit an initial high of $99.70 in active trading.

The company had proposed to offer 320 million American depositary shares (ADSs) at $68 per ADS, and could raise up to $25 billion if its underwriters choose to buy more stock from Alibaba, which will make it the world's biggest IPO ever.

Eight chosen representatives, including Taobao sellers from both China and the US, a Taobao user and a delivery man rang the opening bell for Alibaba's IPO, while Alibaba's senior executives applauded under the stage.

"Today is a milestone for Alibaba," Jack Ma Yun, founder of Alibaba, said from the NYSE to the group's employees across the world.

According to AFP, speaking to CNBC television from the trading floor, Ma said he sees enormous growth potential for Alibaba. "We have a dream," he said. "We hope in the next 15 years the world will change. We want to be bigger than Wal-Mart."

Analysts said that Alibaba's listing is not only good news for the US stock market, but also will likely boost the performance of stocks related to Alibaba's business and ecosystem.

"Domestically listed companies in which Alibaba holds stocks will probably be something Chinese private investors would turn to, as it is not very convenient for them to buy Alibaba's shares in the US market as each individual is only allowed to exchange up to $50,000 a year," said Tang Jia, an industry analyst with market research firm Analysys International.

The Hong Kong-listed Alibaba Pictures Group Ltd, formerly named as ChinaVision Media Group Ltd, may be a target. Alibaba Group now holds 60 percent stake in Alibaba Pictures. Trading for Alibaba Pictures was suspended on Friday.

But as for the whole of the Chinese stock market, Alibaba's US listing can hardly contribute any stimulus, Wang Tingting, an industry analyst with iResearch, told the Global Times.

Both Wang and Tang thought that without doubts, both the A-share market in the Chinese mainland and H-share market in Hong Kong missed the chance of a spectacular deal.

Hong Kong was expected to be the first option for Alibaba's IPO, but was alleged to have shut Alibaba out over the company's disputed corporate governance.

"In order to avoid such case happening again and boost domestic stock market, Chinese securities regulators are very likely to reform the country's listing mechanism to attract and retain promising Internet companies like Alibaba," said Tang.

The Chinese e-commerce giant handles more transaction volumes than the combination of its US counterparts Amazon and eBay.

Wang believes that the company will likely have great long-term business prospects, as it has now seized an unmatched market share among China's e-commerce operators and the online shopping market still has room for rapid growth.

However, Tang is concerned about some potential red flags for Alibaba's future, warning investors to be cautious. "What investors need to look out is that Alibaba's revenue is mainly from advertising and marketing services, and that business model is not as suitable in the mobile Internet bandwagon as on the PC front due to the smaller screen," said Tang.

Retailers' commissions at Alibaba's business-to-customer (B2C) site Tmall could likely help Alibaba decrease the company's reliance on advertising incomes, but the company should devote more efforts to develop Tmall business amid the fierce competition from Tencent-backed jd.com, she noted.

According to reports issued by iResearch, although Tmall continued leading China's B2C market by transaction volumes in the first two consecutive quarters, its market share has shrunk, hitting 57.3 percent in the second quarter of the year, down from 58.8 percent in the first quarter of the year, while jd.com ranked second with 21.2 percent in the second quarter, up from 19.2 percent in the previous quarter.