China to boost infrastructure investment

Govt aims to maintain GDP growth in reasonable range

A construction worker walks along a railway line connecting Guiyang in Southwest China's Guizhou Province and Guangzhou in South China's Guangdong Province. The railway is expected to start trial operation in December. Photo: CFP

China will speed up investment in major infrastructure projects including water conservancy to maintain economic growth within a reasonable range in the fourth quarter, the country's top economic planner said on Tuesday.

As China's economy is under downward pressure, boosting consumption and quickening investment will be key to steady growth in the last quarter of this year, Li Pumin, spokesman of the National Development and Reform Commission (NDRC), said at a press conference on Tuesday.

"Economic growth will remain within a reasonable range in the fourth quarter and we are confident of achieving the full-year growth target," he said.

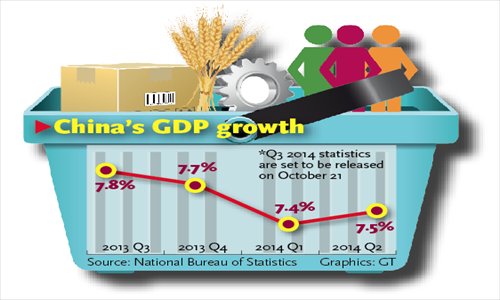

China has set its growth target at 7.5 percent for 2014.

Li noted that the pace of decline in investment will be eased in coming months as the country has initiated major investment projects, and policies will gradually show results.

The investment projects include construction of water conservancy facilities, revamp of shanty houses and development of rail networks in the central and western regions, he noted.

For this year, investment on water facilities is budgeted at 76.7 billion yuan ($12.5 billion), an increase of 5 billion yuan from 2013, said the NDRC.

China will launch 172 key water conservancy projects between this year and 2020, and those already under construction have an investment of around 600 billion yuan, the NDRC official said without giving the total investment figure for all 172 projects.

The government will involve private investors in some water projects, allowing them to join via equity investment or build-operate-transfer arrangements, and further cut red tape to boost investment, said the NDRC.

The rate of growth of China's fixed-assets investment, "one of the three horses of the troika", dropped 3.8 percentage points to 16.5 percent in the first eight-months of this year, compared to the same period of 2013, National Bureau of Statistics data showed.

"The housing slowdown has driven the steady decline in growth in industrial production and fixed-assets investment. Adding to this is the central government's efforts to reduce overcapacity in many industrial sectors," Alaistair Chan, an economist at Moody's Analytics, told the Global Times in a research note on Tuesday.

Exports, another major growth driver, rose 15.3 percent year-on-year in September in a sign of rebound, while imports grew 7 percent, both beating market expectations, official data showed on Monday.

Currently, infrastructure investment gives policymakers more leeway to bolster the economy, compared with consumption and industrial production, Xu Hongcai, director of the Department of Information at the China Center for International Economic Exchanges, told the Global Times on Tuesday.

The property market slowdown is weighing on consumption to some extent, with drop in incomes of workers in the construction, home renovation and furniture industries, while industrial production is plagued by overcapacity, Xu said.

The pace of industrial output growth eased to 6.9 percent in August, down 2.1 percentage points from July.

China's economy grew at 7.4 percent rate in the first half of this year, and is expected to grow by an annual 7.4 percent in 2014, still within a reasonable range of the official target, according to Xu.

The projects launched by the NDRC will be helpful in offsetting a sliding trend in investment, but will not generate a substantial effect, Chen Long, an economist at Gavekal Dragonomics in Beijing, told the Global Times Tuesday.

As property accounts for about 20 percent of the country's total fixed-assets investment, to rejuvenate the sluggish property market, the country has taken a raft of measures including exempting fees for homebuyers on borrowing from a public housing fund and allowing borrowers to use the fund in cities other than that of their residence.

The central bank also eased lending rules for second-home buyers on September 30 by granting a 30 percent discount on mortgage rates and cutting the down payment requirement to 30 percent from a minimum 50 percent, as long as second-home buyers have repaid their previous home loans.