Industrial growth stays stable despite pressure: official

Investment slowdown holds economy back

China's industrial and economic growth remained stable despite existing downward pressure on its macro economy due to the deceleration of industrial production growth in the first three quarters, a Chinese official said Friday.

Relatively poor exports dragged down by the fluctuation of the global economy after the financial crisis, and the slowdown in investments are the two restraining factors for industrial growth, Zheng Lixin, spokesperson of the Ministry of Industry and Information Technology, said at a press conference in Beijing Friday.

Total industrial production growth decelerated to 8.5 percent in the first three quarters year-on-year, down 0.3 percentage points from the first half of this year, according to the National Bureau of Statistics (NBS).

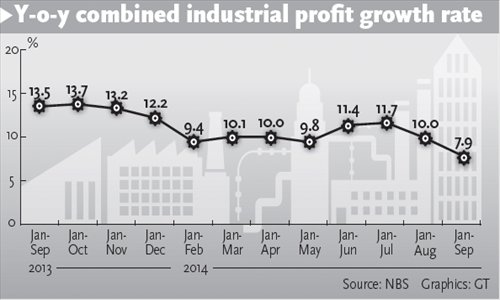

The total industrial profit growth also slowed in the first three quarters. Industrial companies with annual business revenues exceeding 20 million yuan ($3.26 million) made a combined profit of 4.37 trillion yuan in the first nine months, up 7.9 percent from a year earlier, 2.1 percentage points slower compared with the rise in the first eight months.

Despite the slowdown, Zheng still held an optimistic attitude toward China's industrial growth, and noted that the steady economic growth pattern has not changed.

"Poor demand from overseas and domestic economic structural adjustments, such as eliminating overcapacity in some industries, are the major factors that drag down the growth of the country's economy," Chang Jian, a Hong Kong-based economist with Barclays Capital, told the Global Times Friday.

China's producer price index also fell 1.8 percent in September year-on-year, its 31st consecutive monthly decline, which indicated declining factory-gate prices due to weak demand.

The country's GDP grew 7.3 percent in the third quarter year-on-year, slowing from 7.5 percent in the second quarter and 7.4 percent in the first, the weakest pace of growth in more than five years, according to NBS data.

Chang of Barclays Capital predicted that China's economy in the fourth quarter will continue at the growth speed of the third quarter.

The World Bank forecasted China's GDP growth for 2014 at 7.4 percent, still within the range of the government's preset growth target of about 7.5 percent in a report Wednesday.

"Although GDP growth slowed in the third quarter, employment and prices remain stable, indicating that the economy continues to operate within a reasonable range," NBS spokesperson Sheng Laiyun said on the release of the data on October 21.

China created more than 10 million new urban jobs in the first nine months, hitting the annual target ahead of schedule. Consumer inflation in September slowed to a near five-year low of 1.6 percent from a year earlier, NBS data showed.

Xu Hongcai, director of the Department of Information under the China Center for International Economic Exchanges, told the Global Times that both the central and local governments' mini-stimulus measures released since April, such as investment on railway constructions, will take effect in the fourth quarter, when "GDP growth is expected to rebound to 7.4 percent."

The State Council, the country's cabinet, announced in April a cut in taxes for micro and small-sized firms, as well as plans to renovate rundown areas and speed up construction of railway lines. Since then, mini-stimulus measures have continued in various sectors including real estate.

The People's Bank of China announced in late September that banks could offer a maximum 30 percent discount on loans to first-time homebuyers and to those who own a home and have paid off an existing mortgage, a move analysts generally thought would boost the real estate sector.

Real estate investment, which accounted for around 20 percent of the total fixed assets investment and affects many other sectors, including steel and cement, grew 12.5 percent in the January-September period, slowing from 13.2 percent in the first eight months.