China, Australia hail FTA

95 percent of Australian goods to be tariff-free

Chinese President Xi Jinping and Australia's Prime Minister Tony Abbott walk together as they leave the House of Representatives at Parliament House in Canberra on Monday. Photo: AFP

China and Australia on Monday concluded negotiations for a landmark free trade agreement, a powerful boost to ties between China and the close US ally, although it fell short of China's demand for relaxed scrutiny over investment by Chinese State-owned enterprises (SOE) in Australia.

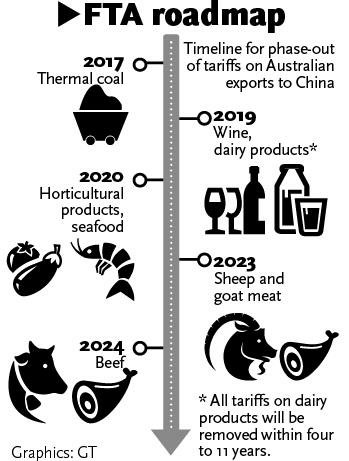

Under the deal, Australia will eventually remove tariffs on all goods imported from China, while 95 percent of Australian goods will enter China tariff-free upon full implementation of the China-Australia Free Trade Agreement (ChAFTA).

The Declaration of Intent, signed by Chinese Commerce Minister Gao Hucheng and Australian Minister for Trade and Investment Andrew Robb after more than 20 rounds of negotiations since 2005, crowned Chinese President Xi Jinping's state visit to Australia.

The agreement will help unleash wider trade opportunities for the two complementary economies. Capital-hungry Australia is eyeing massive potential Chinese demand for high-value food, intellectual services and energy resources during China's economic structural transition and urbanization, while China, the world's largest manufacturer, wants to strengthen its role in the global value chain, said analysts.

The ChAFTA removes tariffs on all Australian resources and energy products. Iron ore and concentrates and coal were the top two products resource-rich Australia exported to China in 2013.

Under the deal, Australia will be able to make additional inroads into the massive Chinese market despite headwinds caused by China's industrial restructuring and overcapacity. The low cost of sea transportation will give resources imported from Australia a price advantage, but Australia must offer better policies to attract Chinese investment, as China has other options including Brazil and Russia, said Han Xiaoping, chief information officer at energy portal china5e.com.

ChAFTA's announcement was hailed by the $13 billion Australian dairy industry. The deal will benefit Chinese consumers by offering them high-quality products and additional choices from baby formula to cheese, while providing a Chinese dairy industry still in transition with both challenges and opportunities.

"The domestic dairy industry will absorb a short-term blow due to a large amount of inexpensive, high quality imports. But it will help Chinese companies expedite their overseas strategy by providing ample resources and advanced technology, and boosting healthy competition," Song Liang, a dairy industry analyst, told the Global Times.

Although China is Australia's largest trading partner, Chinese direct investment accounts for only 3.3 percent of foreign investment in Australia, partially due to Australian concern that Chinese corporation may behave badly or harm Australia's national security.

Tracy Colgan, chairman of China-Australia Chamber of Commerce, said in a statement sent to the Global Times that the "single greatest contribution of the FTA" is that it brings Australia and China closer by removing the barriers to trade, despite concerns that Australia does not welcome Chinese investment.

Encouraging Chinese investment in Australia is a major highlight of the ChAFTA. It raises the screening threshold for private Chinese investment in "non-sensitive sectors" by the Foreign Investment Review Board (FIRB) from A$248 million ($216 million) to A$1.078 billion, while retaining lower thresholds for investment in sensitive sectors, including media, telecommunications and defense-related industries.

However, the deal will not change the current requirement that FIRB scrutinizes all investment by Chinese SOEs.

China has shown flexibility in dealing with the matter. However, it is in Australia's interest to lift investment restrictions in the future, and China is definitely well within its rights to push the issue forward, said Wang Zhenyu, a research fellow with the China Institute of International Studies.

"Chinese SOEs working on overseas investment operate under a modern system of corporate governance and should be accepted on equal footing in Australia," said Wang.

Australian Ambassador to China Frances Adamson also called for a rational attitude toward Chinese investment in June, saying that Australia should compete with other economies to attract Chinese investment and boost mutual trust.

ChAFTA is one of the few free trade agreements China has reached with developed economies. It opens the door to further agreements with more developed countries, said Wang.

The deal also contains an investor-state dispute settlement mechanism, an instrument of public international law that grants an investor the right to use dispute settlement proceedings against a foreign government and help improve investor confidence. This is a modern FTA mechanism, one which Australia has held back on, including negotiations on the US-led Trans-Pacific Partnership free trade area, said Wang.

Canberra is closely allied with the US on security issues, yet has been working to build stronger economic ties with Asia. President Xi stressed that a "big China" will stick to peaceful development, and the ChAFTA will help drive the regional economic development that China advocates by better integrating Australia into East Asia, said Wang.