Talk of the town

A roundup of some of the key phrases and events of 2014

Editor's Note:

Although recent data has underlined concerns about China's growth prospects, 2014 seems destined to be another milestone year for the reform-bound economy. With remodeling of the economy being pushed on all fronts, closer attention has been paid this year to various aspects of the reform movement. As the end of the year approaches, the Global Times has taken an annual inventory of some of the most notable phrases and ideas relating to the Chinese economy, and some of the key moments of 2014. This will also be the first of six issues dedicated to major aspects of the economy in 2014.

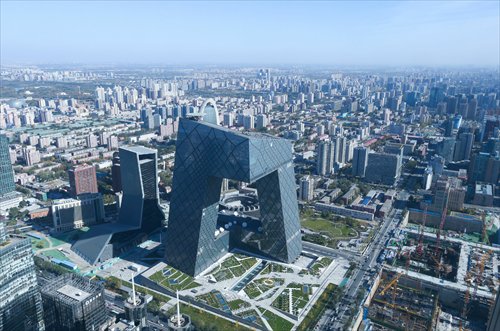

The China Central Television tower in Beijing Photo: CFP

New normal

President Xi Jinping said during an inspection tour of Central China's Henan Province in May that the nation needs to acclimatize to the "new normal" of a more modest growth pace amid the country's economic restructuring.

The phrase had been used five years before by Mohamed El-Erian, former CEO of global investment firm PIMCO, referring to the process of slow economic recovery in the wake of the 2008-09 financial crisis. Its use by the Chinese president, however, made "new normal" one of the key phrases describing the changes afoot in China this year.

In a speech at the 2014 Asia-Pacific Economic Cooperation (APEC) CEO Summit held in Beijing in November, Xi for the first time sketched out the "new normal" theory.

The Chinese economy is in a process of transition from the previous high-speed growth to a phase of medium-to-high growth. This phase will also see the necessary restructuring of the economy, with a shift toward innovation as a driver of growth rather than investment, according to Xi's explanation.

The phrase was also mentioned last week at the Central Economic Work Conference (CEWC), which set the tone for economic priorities for the coming year.

A total of nine aspects of the "new normal" were summarized in a statement issued after the conclusion of the CEWC. One of the primary characteristics is the increased sophistication among Chinese consumers, who now have more diverse purchasing intentions than in previous decades, the statement said.

In anticipation of a modest slowdown in economic growth, the Chinese Academy of Social Sciences (CASS), one of the nation's top government think tanks, said in a blue book released on Monday that China's economy is expected to grow by around 7 percent in 2015.

One belt and one road

The "One Belt and One Road" strategy, which refers to the Silk Road Economic Belt and the 21st Century Maritime Silk Road, was proposed by President Xi during his visits to Kazakhstan and Indonesia in September and October 2013. This year has seen some tangible progress in bringing the strategy forward.

Leveraging China's historical connections, the concept is seen as a way to revive the economic ties established through the ancient Silk Road.

In a move to push "One Belt and One Road" beyond just theory, the president announced at the 2014 APEC CEO Summit in Beijing that the nation will contribute $40 billion to establish a Silk Road Fund.

The fund will support infrastructure construction, development of resources and industrial cooperation for countries and regions along the Silk Road Economic Belt and the 21st Century Maritime Silk Road, the president said.

"With regard to the trans-Eurasian nature of the Silk Road Economic Belt initiative, Russia welcomes China's proposal to build transport corridors between Europe and Asia," said Andrey Denisov, Russia's ambassador to China, during an Ambassador's Forum hosted by the Global Times on December 6.

Shanghai-HK Stock Connect

The establishment of the stock connect scheme linking bourses in Shanghai and Hong Kong went through a number of twists and turns before finally being launched on November 17.

In April, the China Securities Regulatory Commission and the Securities and Futures Commission of Hong Kong both gave their approval for the Shanghai-Hong Kong Stock Connect scheme. The scheme allows mutual investment between the two markets, and is part of the ongoing efforts to liberalize the capital markets.

Between August and September, various rehearsals were conducted by both sides, ahead of the scheduled launch in October.

An eruption of protests in Hong Kong, however, interrupted the original plan, and the launch came a month later than expected.

The start of the scheme, coupled with the central bank's unexpected announcement on November 21 of a cut in interest rates, triggered a frenzy of activity in the country's stock markets, with a number of new investors swarming into the market and many dormant accounts being reactivated.

Since the scheme's launch, there has been an imbalance between southbound and northbound trading, with the average daily turnover for northbound trading in Shanghai-listed stocks far in excess of that for southbound trading in Hong Kong-listed shares, according to a statement on Sunday by Hong Kong Exchanges and Clearing Ltd.

APEC blue

The term "APEC blue" was coined in November when the 2014 APEC CEO Summit was held in Beijing and has become a popular catchphrase.

The term, invented by Internet users, describes the temporary relief from smoggy skies thanks to the Chinese government's highly efficient blitz against pollution before APEC forum leaders arrived in Beijing.

To clear the skies, tight traffic rules and curbs on industry were imposed in Beijing and in neighboring regions.

While the term indicates dissatisfaction about the environmental pollution brought by pursuit of rapid growth, it also gives a glimpse into the potential to focus on quality of growth rather than pace of growth, and the relief for citizens that this could provide.

China will host the Group of Twenty (G20) Summit in 2016, and if pollution has not been substantially eased by then, "APEC blue" might be replaced by "G20 blue."

Beijing-Tianjin-Hebei plan

The regional block covering the municipalities of Beijing and Tianjin and North China's Hebei Province has been thrust into the limelight since President Xi called for integrated and coordinated development of the region at a seminar in Beijing in late February.

With a combined GDP of more than 6 trillion yuan ($979.49 billion) in 2013 and a population totaling over 100 million, the region is set to see more integrated development as part of an effort to tackle Beijing's pollution and traffic jam concerns, Hebei's industrial restructuring problems and Tianjin's over-reliance on property development.

The National Development and Reform Commission (NDRC), China's top economic planner, is currently drafting the integration plan, and a Beijing-Tianjin-Hebei development bank is also being considered as a way to provide support for infrastructure and major public projects.

To help ease congestion at the Beijing Capital International Airport, the NDRC also gave formal approval on Monday for plans to build a second international airport, which will be located in Daxing district in the south of Beijing, close to the borders with Tianjin and Hebei.

Alibaba's record IPO

While numerous firms have been successful in the past year, few can match the progress made by e-commerce giant Alibaba Group Holding. The Hangzhou-based firm set a record as the world's largest-ever flotation by raising $25 billion on the New York Stock Exchange in September, and it has become a symbol of China's new wave of entrepreneurship.

Jack Ma Yun, the company's founder, has also become one of the most talked-about executives in China.

The Bloomberg Billionaires Index, which was released on Friday, put the 50-year-old Alibaba founder at No.1 on the list for Asia, passing Hong Kong property and ports tycoon Li Ka-shing, who had held the top spot in Asia since April 5, 2012.

Global Times