HOME >> BUSINESS

SOE ownership reforms must focus on inclusion

By Liu Tian Source:Global Times Published: 2015-1-22 18:23:02

Incentives to boost productivity should extend to all State sector workers

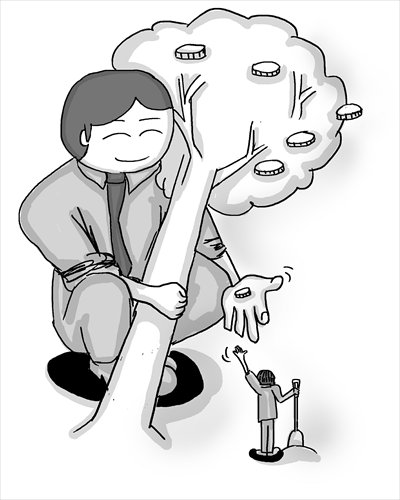

Illustration: Lu Ting/GT

Recent media reports say the State-owned Assets Supervision and Administration Commission is likely to issue fresh plans to overhaul the State sector some time ahead of the Spring Festival. What's more, employee stock ownership plans (ESOPs) will reportedly be carried out on a trial basis in several State-owned enterprises (SOEs), with wider implementation expected to follow in the future.

ESOPs are widely seen as important mechanisms in reforming China's SOEs. Experts have long advocated for the promotion of such plans along with other reforms aimed at diversifying State asset ownership. As the name suggests, ESOPs confer ownership interests on workers, entitling them to participate in management decisions.

Many of China's private companies dangle ownership rights to attract talent. Figures from the China Securities Regulatory Commission show that 1,841 onshore listed companies had implemented ESOPs by September 2012, accounting for some 74 percent of all businesses in China's A-share market.

SOEs have proven slow to offer such incentives. According to local media reports, between January 2014 and mid-November, only four publicly-traded SOEs had announced intentions to implement ESOPs.

Despite the plodding pace of change, employee-ownership reforms are needed at the country's SOEs. Based on private sector experience, ESOPs can motivate workers, improve profitability and cut waste. Data show that ESOPs can improve enterprise efficiency by as much as 30 percent. Additionally, corporate governance can also improve as more workers are given a greater say in management decisions - currently, most SOEs are helmed by high-ranking officials who frequently change companies and so may have little incentive to pursue long-term goals.

While the potential benefits of ESOPs seem quite compelling, their prospective use within the State sector raises several perplexing questions. First, while ESOPs have proven beneficial in competitive sectors, will the same hold true within State monopolies? Second, how can authorities prevent the loss of State assets with ESOPs? Third, should all staff members be allowed to hold shares or only executives and upper-level managers?

On this last question, some experts say that granting all workers share-holding interests is a poor idea. They contend that such rights should go only to key personnel. These views seem to have taken root. Reports say that all State companies with ESOPs in the pipeline will focus on core technical staff and managers, leaving little for rank-and-file workers.

At their core, these supposedly groundbreaking plans may turn out to be little different from the core-employee ownership structures which currently prevail at SOEs. This would run counter to the needs of a market-oriented economy and do little to spur efficiency.

The point of introducing ESOPs into the State sector is to realign ownership interests in a way that promotes fairness and efficiency. So-called "grass-roots" employees are the main productive force within SOEs and as such they should have the right to enjoy a share of the gains they help create. And as there is already a quite sizable pay divide separating managers and common employees, excluding the latter from ownership reforms would only make an already alarming situation even worse.

Planners and reformers should not discriminate during their efforts to remodel SOEs. Ignoring such principles will only weaken the initiative and motivation of ordinary staff, potentially damming off a major source of vitality for State-owned companies.

Of course, this is not to say that different share allotments cannot be granted based on employees' contribution to the company, the importance of their posts or their years of service. Ignoring the interests of ordinary workers though would be a mistake. Authorities can also combine ESOPs with stock option offers to create different incentive systems at various corporate levels.

Rationally designed ESOPs can serve the interests of both workers and SOEs. But with efficiency and productivity gains being the ultimate goals of SOE reforms, plans are needed to harness the energy of not only senior staff, but ordinary workers as well.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn

Posted in: Comments