Record trade surplus despite missed targets

Spring Festival holiday distorts January data

Photo: GT

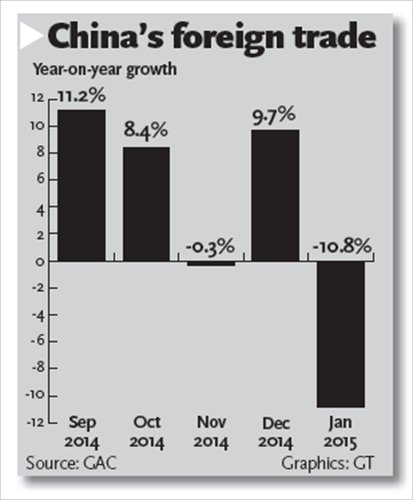

China's imports and exports both missed expectations in January, a routine weakness that is often seen ahead of the Spring Festival, official data showed Sunday, but experts believe foreign trade will pick up and benefit from a set of pro-growth measures.

Exports fell 3.2 percent in January from a year earlier, compared to a growth of 9.9 percent in the previous month, while imports slid 19.7 percent, its lowest since June 2009, the General Administration of Customs (GAC) said in a statement on its website. But that led to a record monthly trade surplus of 366.9 billion yuan ($60 billion) last month, expanding 87.5 percent year-on-year, customs officials reported.

The Spring Festival always has a big impact on foreign trade at the beginning of every year, GAC said.

This year's Spring Festival

holidays will run from February 18 to 24.

Analysts attributed the unusual decline in trade to high export growth in January last year, falling commodity prices and weakening domestic demand.

China's exports grew by 10.56 percent compared to January 2014, the highest in the first half of last year.

The customs data also showed differences among export destinations. China's exports to Japan dropped by 20.4 percent, which, according to Liu Xuezhi, an analyst from the Bank of Communications, was the biggest reason why total exports were dragged down and are a result of cooling Sino-Japan economic ties and a weakening Japanese yen.

Exports to the European Union also fell by 4.4 percent. However, China's exports to the US and ASEAN economies grew by 4.9 percent and 15.6 percent, respectively, the GAC said.

"The exports data shows the depreciation of the yuan may be having a diminishing effect on boosting exports," Bai Ming, a research fellow at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times Sunday. The yuan's exchange rate shed 0.7 percent on a monthly basis in January.

Trade could increase depreciation pressure on the yuan. However, it is not in China's interest to let the yuan depreciate sharply (more than 5 percent) as it will endanger the country's financial stability, Liu Ligang, chief China economist of the ANZ Banking Group, wrote Sunday.

In terms of imports, the sharp decline was led by a slide in commodity imports such as coal, iron ore and crude oil, GAC said.

"China's economic slowdown has weakened domestic demand and global commodity prices have been falling, resulting in a drop in both import volume and value," analysts from Minsheng Securities said Sunday.

Liu said the drop in imports was also due to China's crackdown on commodity financing.

But others warn against reading too much into the January data because of seasonal distortions.

"A single-month data does not reflect the foreign trade situation, and we need to keep an eye on data following the Spring Festival holidays," Xu Hongcai, an economist with the China Center for International Economic Exchanges, told the Global Times Sunday.

Analysts expect China's foreign trade to improve in the coming months.

"There are bright spots in China's economy, including recent monetary easing, the streamlined approval of new projects, and stronger policy support for the 'One Belt, One Road' initiative," Xu said.

China will also adjust its policies to boost rail and nuclear power exports, according to a State Council meeting chaired by Premier Li Keqiang in late January.

In December, the Chinese Academy of Social Sciences forecast that China's annual exports and imports will grow by 6.9 percent and 4.6 percent, respectively, in 2015, up from 6.1 percent and 0.4 percent in 2014.