HOME >> BUSINESS

SOE mergers needed to compete on global stage

By Wang Jiamei Source:Global Times Published: 2015-3-24 18:53:01

Industry consolidation can help prevent unnecessary competition, lower costs

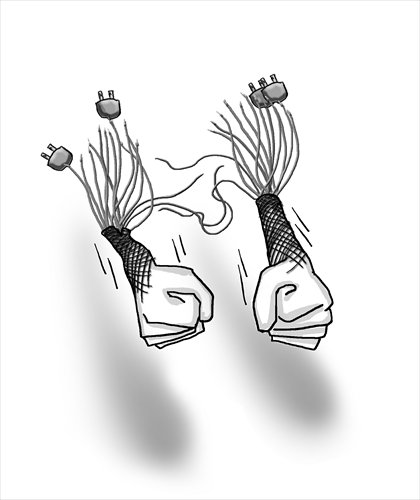

Illustration: Lu Ting/GT

Two anticipated mergers of large State-owned enterprises (SOEs) were in the news last week, one between domestic nuclear giants China Power Investment Corp (CPIC) and State Nuclear Power Technology Corp (SNPTC), and the other between the railway construction companies China Railway Construction Corp (CRCC) and China Railway Engineering Corp (CREC).

The first made headlines last week after word came out that the State-owned Assets Supervision and Administration Commission (SASAC) would soon approve the merger of the two nuclear power companies. During a nuclear energy conference in South Africa Tuesday, SNPTC Chairman Wang Binghua said that the combined company would be called State Power Investment Group, with total assets exceeding 700 billion yuan ($112.72 billion). He added that the tie-up is part efforts to boost China's exports of third-generation nuclear power technology to South Africa.

That same day, the two State-backed railway construction giants denied a rumor of their own impending merger. In two separate statements filed with the local bourse, CREC's listed arm, China Railway Group (CRG), and CRCC each said they had not discussed a merger, not had they received any information or notice about one from the proper authorities.

The denials came at a time when both companies' shares on the Shanghai Stock Exchange recorded strong gains after media reports, citing Wang Mengshu, deputy chief engineer at China Railway Tunnel Group, said that the State Council was discussing the feasibility of combining the two companies. CRG shares jumped 5.96 percent that day, and CRCC shares rose 5.33 percent.

The recent merger speculation hints at expectations that the central government is set to embark on a new wave of consolidation among big SOEs. Although mergers of the country's State-backed industrial giants may add to concerns that the government is creating monopolies, the truth is that these deals make a lot of sense.

Although the speculation about the railway merger has been dismissed for the time being, many among the public believe a merger is justified given the central authorities' recent push for consolidation among the big SOEs.

The denials of the railway companies called to mind the events leading up to last year's merger of China CNR Corp and China CSR Corp. Just three months after China's two top railway manufacturers issued statements refuting media reports about a rumored tie-up, they announced a merger in December. It is said that the deal aims to prevent vicious price competition and strengthen the companies' competitiveness during their overseas expansion. Similarly, a merger between CRCC and CREC would strive to achieve the same results.

High-speed rail is not the only industry poised to embrace a new round of consolidation in the coming years. In fact, a number of centrally administrated SOEs have been rumored to be planning mergers, including one between China Unicom and China Telecom, and one between China National Petroleum Corp (CNPC) and China Petrochemical Corp (Sinopec Group). While some of these rumors ended up being refuted, it doesn't change the overall picture that mergers and restructuring have become an integral part of China's SOE reform agenda.

Some may worry that promoting the mergers among the country's largest SOEs may put an end to market competition and strengthen their monopolistic positions. Critics have also raised concerns that such mergers would also run counter to efforts to carry out mixed-ownership reforms of SOEs through the introduction of private capital.

Yet, it should be pointed out that mergers like the one between SNPTC and CPIC or the one between CNR and CSR would not have much impact on the general public or their domestic market positions. Fundamentally speaking, it is not uncommon for SOEs to split or merge due to changes in external environment and development objectives. For instance, China National Railway Locomotive & Rolling Stock Industry Corp was split into CNR and CSR in 2000, in a bid to promote competition in the rail sector. China's nuclear energy industry was broken up in the 1980s, leading to redundant construction and other problems, at least to some extent.

These days, Chinese enterprises face not only domestic competition, but overseas competitors as well. The times have changed. Chinese companies now need to upgrade their technology and boost their scale through mergers amid the "go global" push. In this sense, facilitating consolidation among large SOEs would effectively help them avoid vicious competition, reduce operating costs and improve competitiveness in the global arena.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn

Posted in: Comments