Inflation remains steady, producer prices deflate eases

China posted marginally better than expected consumer inflation and producer price data on Friday, giving policymakers room for policy easing if needed to bolster the economic growth.

The consumer price index (CPI), a major gauge of inflation, rose 1.4 percent in March year-on-year, remaining unchanged from February, the National Bureau of Statistics (NBS) said Friday.

The March inflation was above the market forecast of 1.3 percent but still well below the government's full-year target of 3 percent.

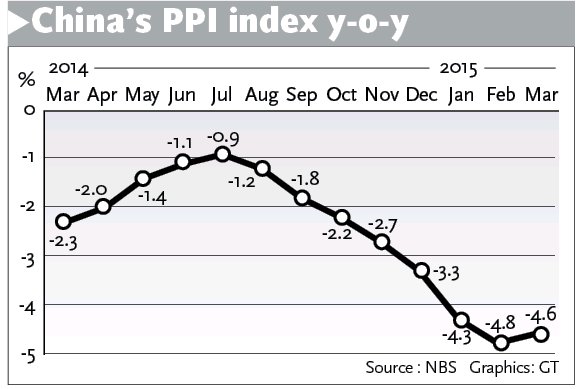

The producer price index (PPI), which measures the price changes for major commodities by manufacturers at the wholesale level, dropped 4.6 percent year-on-year in March, its 37th consecutive month of decline, the data showed.

But the slide had narrowed from the 4.8 percent decline seen in February, the first improvement in the reading since July 2014.

The stronger than forecast data may add to hopes that the economic slowdown is bottoming out and data will continue to improve with more policy easing in coming months, analysts said.

With the run of negative PPI readings extending 37 months, the economy may be experiencing deflation, but taking into account the CPI and PPI data together, one cannot conclude China's economy is unstable, Yu Bin, director of the department of macroeconomic research at the Development Research Center (DRC) of the State Council, said at a press conference on Friday.

The continuous decline of PPI reflects weak demand and chronic industrial overcapacity. Concerns that China risks heading into deflation have grown as the economy continues on a path of slower growth in what the Chinese leadership have called the economic "new normal."

Central Bank Governor Zhou Xiaochuan warned at the annual meeting of the Boao Forum for Asia in Hainan in late March that China needs to stay vigilant about signs of deflation, signaling the policymakers sensed the growing deflationary pressure.

Su Zimeng, secretary-general of China Construction Machinery Association, told the Global Times Friday that the machinery manufacturing industry is still facing vicious price competition and weak demand.

"But there are positive signs. The structural adjustment is gathering steam and demand in the high-end manufacturing sector remain brisk. With the implementation of the "Made in China 2025" strategy, we expect producer prices to rebound to expansionary territory in the second half of the year," Su said.

"The slower drop of bulk commodity prices and the slight rise of crude oil prices will moderate the fall of industrial product prices," economists led by Lian Ping at Bank of Communications said in a research note e-mailed to the Global Times Friday.

As the pace of industrial restructuring picks up to reduce overcapacity, the oversupply that causes prices to drop will fade out. So the PPI decline is expected to narrow in coming months, Yu at DRC said.

Friday's data is among the first batch of key economic indicators watched closely by the market.

The country is due to publish its first-quarter GDP on April 15, which many economists and research institutes forecast to be around 7 percent, hitting the annual growth target set in March.

With the low inflation and growing deflationary pressure, the government is left with more room to ease policy. There may be an interest rate cut later in the month, Liu Dongliang, a senior analyst at China Merchants Bank, told the Global Times on Friday.

The central bank cut interest rates for the second time in less than four months at the beginning of March.