Small rise in CPI shows growth still slack: experts

June inflation reading up just 1.4%

Consumers shop at a supermarket in Taiyuan, capital of North China's Shanxi Province. Photo: CFP

China's consumer prices edged up in June, but remained at a relatively low level, an indication of the continuing economic sluggishness and showing that there is still room for further monetary easing, experts said Thursday.

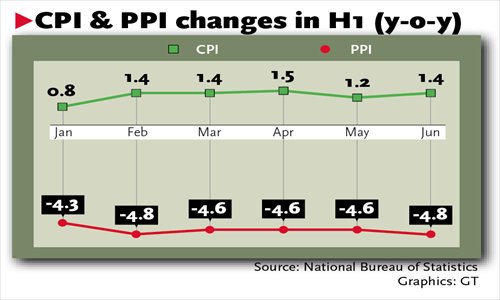

The country's consumer price index (CPI), a main gauge of inflation, rose 1.4 percent year-on-year in June, the National Bureau of Statistics (NBS) said Thursday.

This marks the 10th consecutive month that the CPI was below 2 percent.

China's CPI target has been set at around 3 percent for this year.

The figure in June was slightly higher compared with the reading of 1.2 percent in May, and also just above the 1.3 percent level that was forecast by analysts in a Reuters poll.

"The latest CPI reading shows that China's inflation remains at a relatively low level on the whole, which is a sign of economic slackness," Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times Thursday.

He also pointed out that unlike the inflation data often used in some Western countries, China's inflation data does not exclude food prices, which usually grow much faster compared with other products.

In June, food prices picked up 1.9 percent from a year earlier, while non-food inflation increased 1.2 percent, with services prices up by 2.2 percent, the NBS data showed.

"With food inflation at 1.9 percent, an overall CPI reading of 1.4 percent actually suggests a lot of deflationary pressure," Xi noted.

Meanwhile, the NBS also announced on Thursday that China's producer price index (PPI), which measures inflation at the wholesale level, fell 4.8 percent from a year earlier in June, marking a 39th consecutive month of decline.

Following a 4.6 percent drop in May, the PPI fall was also greater than forecasts of a 4.5 percent decline.

On a monthly basis, the PPI contracted 0.4 percent in June, compared with a 0.1 percent decline in the previous month.

Yu Qiumei, a senior statistician with the NBS, said the PPI decline was largely due to sliding prices in the oil processing, chemical and nonferrous industries, which slipped 0.2 percent, 0.2 percent and 1.8 percent, respectively, month-on-month in June.

Sheng Laiyun, a spokesman for the NBS, said in a statement published Monday on the NBS website that major economic indicators in recent months have shown signs of improvement thanks to government stimulus measures, and that the national economy is likely to continue this recovery trend.

But experts and institutions generally believe the economy remains slack, and they hope there will be further monetary easing and stimulus measures.

According to a report by China International Capital Corp (CICC) on Thursday, China's inflation level may see a mild rise in the coming months, but the CPI for the whole year will probably stay at a low level.

The CICC report also anticipated more supportive monetary and fiscal policies to provide help for the economy in the second half of this year.

With the economy remaining sluggish, the central bank will likely inject more liquidity into the market in the near future, Yu Fenghui, a senior officer with Agricultural Bank of China, told the Global Times Thursday.

Xi agreed with Yu, saying that the Ministry of Finance recently pledged to expand its budget deficit, so more fiscal stimulus measures can be expected in the rest of the year.

"Also, there is still room for further cuts to banks' reserve requirement ratio (RRR), even though the central bank lowered the RRR recently," Xi noted, adding that China's RRR level "is still relatively high compared with other countries.