Careful examination needed of reasons behind Chinese stock market slump

Relatively little damage done to real economy from market crash

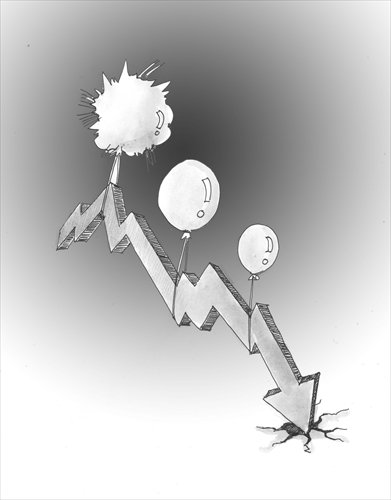

Illustration: Luo Xuan/GT

The Chinese equity bubble has obviously burst. Notwithstanding massive government support actions, there's no telling where the market may reach the bottom. Post-bubble implosions tend to take on a life of their own.

This had all the ingredients of a classic asset bubble. After underperforming other major equity markets for six years, the Chinese stock market started to come to life in the second half of 2014 as the government moved to stimulate a slowing economy. It then took off like a rocket ship immediately after the launch of the Shanghai-Hong Kong Stock Connect scheme on November 17, 2014. Fully 87 percent of the spectacular 145 percent surge in the 12 months ending June 12 this year occurred after the cross-border connection was opened.

As is typically the case in other asset bubbles, Chinese market regulators lacked discipline during the blow-out phase of this bubble. This speculative frenzy was fueled by an equally potent surge of margin financing, which nearly trebled as a share of tradable market capitalization in the 12 months ending this June.

Meanwhile, an overhang of excess supply was building, as security regulators approved a sharply increased volume of initial public offerings in the first half of 2015. And leading Chinese officials expressed encouraging signs of support for this apparent renaissance in equity financing.

Asset bubbles invariably burst under their own weight. China's implosion over the past month is no different. The key questions pertain less to the potential downside of the market - impossible to know - and more to the ultimate impact on the real economy, which is at a critical juncture on the road to reform and rebalancing.

On this basis, there is an important silver lining. The bursting of equity bubbles impacts shareowners, or consumers, in the real economy through what economists call "wealth effects" - in essence, the capital gains and losses (both real and psychological) that stem from the ups and downs in the stock market. Ironically, China's unbalanced economy works to its advantage in this instance - with private consumption representing only about 36 percent of its GDP. If China had a more balanced economy - something it clearly aspires to - then a larger consumer sector would have raised the possibility of much greater macro risk in the face of a post-equity bubble implosion.

A comparison with the US is especially pertinent in this key respect. Prior to the global financial crisis of 2008-09, personal consumption was nearly 70 percent of US GDP, essentially double that of China. Moreover, consumers were heavily leveraged, borrowing freely from a massive property bubble to support consumption. When the twin bubble burst - property and credit - American consumers went into a wrenching balance sheet recession, which endures to this day. The annualized growth of real consumer expenditure has averaged just 1.4 percent over the past seven years - down sharply from the 3.6 percent trend in the 12 years before the crisis and, in fact, the weakest period of consumption growth since the 1930s.

Asset bubbles have occurred all too frequently around the world over the past 25 years. First it was Japan with its property and equity bubbles, then America with its dotcom, property and credit bubbles, and of course Europe with its "convergence bubble" that saw artificial growth in Southern Europe and Ireland stemming from an interest rate convergence play. China needs to be mindful of the important lessons from these earlier experiences.

First, while it is impossible to avoid the cycles of fear and greed that have given rise to speculative asset bubbles for centuries, regulators and policymakers must draw the line when bubbles threaten to distort the real economy. Fortunately, as stressed above, China's embryonic consumer sector works to its advantage in this key respect.

Second, bubbles and the policy responses they evoke, are a serious threat to financial stability.

For China, the current carnage is a major setback on the road to capital market reform - a linchpin of its rebalancing strategy. The good news is that China still has plenty of ammunition left to deal with the carnage in its equity market - in sharp contrast to major economies in the developed world, which are stuck in liquidity traps at zero interest rates.

Third, this time is never different. Regulators and policymakers must avoid the seductive temptation of believing that surging markets are validating a new approach to economic management and development. A seven-month doubling of the Chinese equity market was, in retrospect, an accident waiting to happen. It was a time for discipline, not complacency.

Chinese authorities are obviously taking this problem very seriously. It remains to be seen if the wide-ranging actions now being initiated are sufficient to arrest the decline. That day will eventually come, hopefully sooner rather than later.

When the dust settles, it will be time for a careful retrospective examination of what happened and why. China can ill afford to make the same mistake twice.

The author is a faculty member at Yale University and former chairman of Morgan Stanley Asia. He is the author of Unbalanced: The Codependency of America and China. bizopinion@globaltimes.com.cn

Newspaper headline: Careful examination needed of reasons behind slump