HOME >> BUSINESS, OP-ED

Is China’s investment environment deteriorating?

By Mei Xinyu Source:Global Times Published: 2015-8-23 20:23:01

Old advantages fading, but new ones taking their place

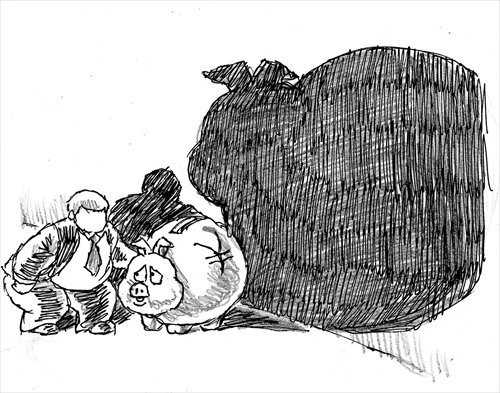

Illustration: Peter C. Espina/GT

Is it really true that China's investment environment has worsened? Western media coverage and research reports have suggested that it has. But these allegations do not stand up to proper analysis. Admittedly, China's former advantages in encouraging investment, both domestically and from abroad, have weakened, but new advantages are emerging in their place.

China used to be able to offer low labor costs, but the country's economic development has diminished this advantage. However, new strengths are appearing, such as the rapid growth of the domestic market, which offers unprecedented opportunities for investors.

China's economy now ranks second globally, and is actually the world's largest on a purchasing power parity basis, according to the IMF. A large economy symbolizes stability, and offers more room for maneuver when it comes to macroeconomic regulation and stabilizing economic growth.

For example, in the 1960s, during open-market operations aimed at curbing the impact of cross-border capital flows, central banks in smaller European countries were vulnerable to speculators and lacked the necessary financial instruments to deal with the problem, while central banks in larger countries were untroubled.

There has been a lot of discussion about the yuan's depreciation recently. But the yuan remains strong against the euro and yen. And the root cause for the changes in the exchange rate is that the dollar has been getting too strong. It should be noted that in the past few months, among the 24 most-frequently traded currencies in emerging markets, 20 of them have depreciated at different levels. Since May 2015, the Russian ruble, Chilean peso and Brazilian real have all depreciated by more than 10 percent, and the Indian rupee has depreciated to a 17-year low.

China is also playing a greater role in international trade rules. In the past, China could only passively accept external trade protectionism, but now the nation is capable of persuading its trade partners to treat products "Made in China" fairly. Correspondingly, risks from trade protectionism for China's outward-looking manufacturers are being minimized.

In addition, certain so-called economic advantages held by other countries are only temporary, or can be entirely offset by other factors.

Let us take energy costs for example. Low energy prices in the US are attractive to China's textile and other manufacturing enterprises, but the US' low energy prices are thanks to its "shale gas revolution" and export controls on oil and gas. Given that we are currently seeing a bear market for primary goods, which could continue for another 10 to 15 years, the US energy cost advantage has been greatly narrowed. And the loosening of US export controls on crude oil and gas could further narrow that advantage. Furthermore, the Clean Power Plan unveiled by President Obama could push up US energy costs to a level higher than that in East Asia.

As for those developing countries that are trying to compete with China in terms of manufacturing, a large proportion of their comparative labor cost advantages is offset by defects in their systems.

For instance, labor costs in India are a lot lower than in China, but even if we put aside differences in labor-force quality between the two countries, the higher land use costs in India weigh against its labor cost advantage.

Considering China's strengths in infrastructure, supporting industries, public services, human resources, and efforts to boost the economy, investors pursuing long-term investment opportunities are probably not too concerned about China's current investment environment.

The author is a research fellow with the Chinese Academy of International Trade and Economic Cooperation. bizopinion@globaltimes.com.cn

Posted in: Expert assessment, Biz Comments