HOME >> BUSINESS

Supervision commission needed to safeguard pension fund investment in stocks

By Zhao Yongsheng Source:Global Times Published: 2015-8-31 0:28:01

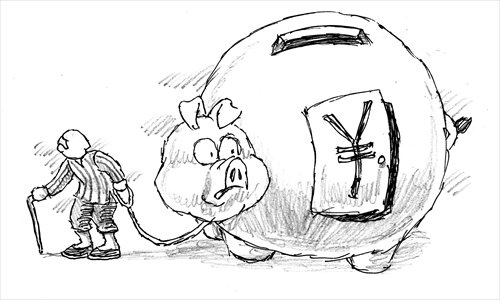

Illustration: Peter C. Espina/GT

The State Council recently published the final guidelines for pension fund investment, which will allow the fund to be invested in various areas, including the domestic stock market, but the maximum proportion of investment in stocks and equities will be limited to 30 percent of the fund's net assets.

This final plan has been released after considering different and sometimes conflicting points of view, and is undoubtedly a giant step forward for pension fund management in China. The pension fund has certain particular characteristics because it concerns millions of retired people, and no loss would be tolerated.

Nobody can guarantee profits in the market, especially in the stock market, which is characterized by uncertainty and volatility. But the State Council guidelines have effectively opened the gate for the pension fund to be invested in the stock market anyway.

Instead of simply opening the gate, there is a risk that the move could be similar to opening Pandora's box if the authorities do not take the necessary measures to safeguard the fund, including proper supervision and evaluation measures.

Even though no investment can guarantee profits, preventive measures can be taken to contain risks, such as setting up a specific supervision commission.

As it would have a unique purpose, this commission could be efficient and relatively independent. Such independence is crucial for pension fund investment, in order to be able to cope with the various distortions in the market.

Furthermore, "independent" does not mean that the commission could do whatever it wants. As an institution under the central government, it would be bound by central macro guidance, but its micro operations would be independent.

To guarantee this independence, the members of this commission should not only include civil servants appointed by the government, but also professionals in pension fund operations, as well as representatives of the pensioners who can safeguard their interests and express their preferences.

In order to make the commission efficient, proper evaluation measures should be established. This would involve evaluation of pension fund operation performance, which must generally be profitable, even if a small part of the operations can occasionally be in the red.

But in the case of a deficit, the deficit amount should be strictly controlled. This kind of evaluation system is essential to guaranteeing the effective functioning of pension fund investments, not only in the short term, but also in the long term.

However, such supervision and evaluation measures would still be far from enough to ensure the success of this round of pension fund management reform. As we know, China's reform path is different from that of the former Soviet Union and East European countries that started political reforms before economic reforms, and China has achieved unbelievable economic success during the last three to four decades.

However, China's political system still lags behind, compared with the level of its economic growth, and this remains a major obstruction to China's further economic restructuring, such as the ongoing pension fund management reform. Therefore, in order to create a solid and healthy environment for pension fund investment, Chinese policymakers should give greater impetus to deepening reforms of the country's political system.

The last, but not the least measure for safeguarding pension fund investment in the stock market is to take a differential approach during the adoption of the guidelines. The differentiation should be based on regions, provinces and cities, as rich cities like Wenzhou in East China's Zhejiang Province naturally have huge disparities with cities such as Lhasa in Southwest China's Tibet Autonomous Region. Such regional disparities should not be allowed to impede the success of pension fund investment in the stock market.

The author is a Paris-based economist & professor and vice-president of the Paris-based China-France Association of Lawyers and Economists. bizopinion@globaltimes.com.cn

Posted in: Expert assessment