HOME >> OP-ED

Consumption can boost China’s influence

By Ding Gang Source:Global Times Published: 2016-1-13 19:53:01

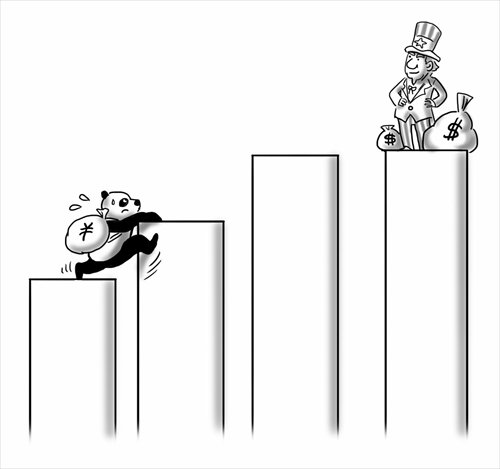

Illustration: Liu Rui/GT

The strong reactions of Asian markets to the rapid slide of the Chinese stock market in recent days indicate that the economic connection between China and Asian nations is deepening.

Until recently, Asian markets were experiencing ups and downs along with the rising and falling of Wall Street. But now, they are all looking at China. On the one hand, the Chinese market is becoming increasingly influential. On the other, concerns over China's economy are dragging down US stock prices, which has indirectly affected Asian markets.

As China is becoming the major engine of the region's economic growth, it will be bound to become a main pillar of Asian confidence. However, various factors have shown that the momentum of China's sustainable growth is weakening, while the difficulty of economic transformation is growing.

When the 1997 Asian financial crisis and the 2008 global financial crisis occurred, China boosted confidence twice in Asia. Today, the region needs the advances of the Chinese consumer market more than ever.

An increasing number of small and medium-sized economies in Asia have shown vigorous growth in recent years, but most of them are still dependant on export. Their hope therefore rests on the Chinese market, which is the only market that has the potential to replace that of the US.

China needs to ensure its stable investment, and in this way increase employment. But only when combining investment with improving long-term consumption ability and building a stable middle consumer class, instead of just maintaining short-term stability, can forge China into a dominant power in the region.

Asia relies heavily on the US because the later is a major market for Asian manufacturing. The key to future US dominance in the region is the Trans-Pacific Partnership (TPP), not the growing military forces. A trade framework based on the TPP system will consolidate the central position of Washington. As long as the US is still the biggest buyer in Asia, it will continue its dominance.

If Beijing wants to share leadership in the area, it has to make itself a consumer market that can stay abreast with the US. This is the key to China's economic transformation and the construction of Asia's new order in the future.

Given Asia's current economic structure, even if China carries out large-scale investment as it did in the previous financial crisis, it will not necessarily bring Asia the same positive effects as before. The confidence that China can pass on to Asia can only be created by stimulating consumption.

China has now already entered a significant phase of increasingly growing consumption needs as well as an increasingly rapid attempt to upgrade consumption structure, which is the most difficult change since reform and opening-up began.

The driving forces of this change have turned from expansionary stimulating policies to reforms to increase consumption, and upgrade private consumption through innovation.

Eventually, connections between Asian economy and Chinese economy might no longer just form complete chains of export products toward the US and European market, but will shape an Asian economic and trade circle where China plays a central role.

Today's Asia requires not only the expansion or investment in the region, but needs the nation to transform into a major consumption power. As long as China can nail this, it will without doubt become the firm core of Asia's economy.

The author is a senior editor with People's Daily. He is now stationed in Brazil. dinggang@globaltimes.com.cn. Follow him on Twitter at @dinggangchina

Posted in: Columnists, Viewpoint