HOME >> METRO SHANGHAI

Small investors share their stories of watching the market turmoil of the past year

Source:Global Times Published: 2016-2-1 16:38:01

Down in the hole

If there is one thing that made Chinese people laugh and cry in 2015, it would be the Chinese mainland's stock markets. The benchmark Shanghai Composite Index reached a multiyear high of 5,178.19 in June 2015. It then started to take a drastic nose dive, with the index falling to a low of 2,638.30 points in January. The Global Times talked to some stock investors about how the markets' slump has affected their lives and how they are dealing with it. Some of the interviewees also said how they planned to make the most of the upcoming Chinese New Year holiday in a financially difficult time.

"As a stock player with more than five years of experience, I was totally taken by last year's sudden market slump, although I haven't actually put lots of spare money in my stock trade account. But the plunge still has had its toll on me - there was once a long list of 'should-have' items ranging from handbags and shoes to home appliances and digital gadgets in my head a few months ago, and I was actually buying things from that list in the first half of 2015. But now the list has completely gone out of my mind. Instead I'm trying to live a thriftier life - spend less and work harder to get some extra money that was originally generated from the stock market. I was planning to spend my Chinese New Year holiday with the whole family in a warmer and nicer place abroad. But now, with the Chinese stock markets continuing to slide throughout the whole of January, I totally gave up that holiday plan. I think we will just have some dinners in local restaurants and spend some quality time with the family during the upcoming holiday."

Ma Songliang, 26, graduate student

"My girlfriend and I are to get engaged during the Chinese New Year holiday. She would like a diamond ring worth more than 20,000 yuan ($3,041), but I can only afford a cheaper one now. I hope that when I have enough money later, I can buy her a new one. My investment in the stock markets has shrunk roughly 50 percent in January. I bought a merger and acquisition stock, which grew more than 80 percent in December but now has fallen to lower than the price I bought it at. I didn't pay close attention to the market as recently I have been busy with my internship and my MA thesis. But now I can't sell my stock. I bought the ring and other stuff with my credit card, and I'm under huge pressure to pay off my debt. I will have to ask my friends to help me out for a while. I've totally lost my confidence in China's stock markets. Buying stock used to be my main interest besides my work and study, but now I have learned the lesson to never believe that there is a bull market in China, and never believe the so-called 'market' gossip. In China's stock markets, people had better run away after they have made some money, then wait for the next chance to make a killing. Never hastily jump in right after a slump, because it may continue to drop, and finally break your heart."

Wang Yuzhe, 27, banking

"I started with 100,000 yuan in the stock market. It had risen to about 160,000 yuan by last Chinese New Year, and exceeded 200,000 yuan last May. I was not fully alert about the dramatic fluctuations then, and over-confident about the price-to-earnings ratio and the mobility of the stocks I hold. When the crisis hit, I lost about 30 percent of the overall money. During the new hiccups in January, all my profits were wiped out, and now it has already eaten into a little of my original investment. I did not put my entire savings into the stock, but the dramatic plunge in just a few days was a real nightmare, and now I have to be really cautious. I planned to go to Japan for a trip, but today I have abandoned that idea, and other large outlays. This is happening to my former classmates too - we no longer talk about holiday plans in our WeChat groups, but discuss how much we have lost and the possibility of a rebound. The stock disaster has led me to see the big picture more clearly - a series of disappointing figures might be the prologue to a more serious recession or crisis. With that ahead, it is no longer appropriate to consume like I used to. Perhaps it is better to hold the cash or put it under more discreet financial management."

Wu Xulei, 22, student

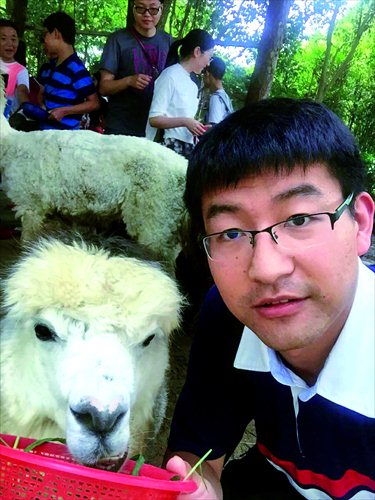

The benchmark Shanghai Composite Index reached a multiyear high of 5,178.19 in June 2015. It then started to take a drastic nose dive, with the index falling to a low of 2,638.30 points in January. Photos: CFP and courtesy of the interviewees

Cathy Yang, 34, business development director

"As a stock player with more than five years of experience, I was totally taken by last year's sudden market slump, although I haven't actually put lots of spare money in my stock trade account. But the plunge still has had its toll on me - there was once a long list of 'should-have' items ranging from handbags and shoes to home appliances and digital gadgets in my head a few months ago, and I was actually buying things from that list in the first half of 2015. But now the list has completely gone out of my mind. Instead I'm trying to live a thriftier life - spend less and work harder to get some extra money that was originally generated from the stock market. I was planning to spend my Chinese New Year holiday with the whole family in a warmer and nicer place abroad. But now, with the Chinese stock markets continuing to slide throughout the whole of January, I totally gave up that holiday plan. I think we will just have some dinners in local restaurants and spend some quality time with the family during the upcoming holiday."

Ma Songliang, 26, graduate student

"My girlfriend and I are to get engaged during the Chinese New Year holiday. She would like a diamond ring worth more than 20,000 yuan ($3,041), but I can only afford a cheaper one now. I hope that when I have enough money later, I can buy her a new one. My investment in the stock markets has shrunk roughly 50 percent in January. I bought a merger and acquisition stock, which grew more than 80 percent in December but now has fallen to lower than the price I bought it at. I didn't pay close attention to the market as recently I have been busy with my internship and my MA thesis. But now I can't sell my stock. I bought the ring and other stuff with my credit card, and I'm under huge pressure to pay off my debt. I will have to ask my friends to help me out for a while. I've totally lost my confidence in China's stock markets. Buying stock used to be my main interest besides my work and study, but now I have learned the lesson to never believe that there is a bull market in China, and never believe the so-called 'market' gossip. In China's stock markets, people had better run away after they have made some money, then wait for the next chance to make a killing. Never hastily jump in right after a slump, because it may continue to drop, and finally break your heart."

Wang Yuzhe, 27, banking

"I started with 100,000 yuan in the stock market. It had risen to about 160,000 yuan by last Chinese New Year, and exceeded 200,000 yuan last May. I was not fully alert about the dramatic fluctuations then, and over-confident about the price-to-earnings ratio and the mobility of the stocks I hold. When the crisis hit, I lost about 30 percent of the overall money. During the new hiccups in January, all my profits were wiped out, and now it has already eaten into a little of my original investment. I did not put my entire savings into the stock, but the dramatic plunge in just a few days was a real nightmare, and now I have to be really cautious. I planned to go to Japan for a trip, but today I have abandoned that idea, and other large outlays. This is happening to my former classmates too - we no longer talk about holiday plans in our WeChat groups, but discuss how much we have lost and the possibility of a rebound. The stock disaster has led me to see the big picture more clearly - a series of disappointing figures might be the prologue to a more serious recession or crisis. With that ahead, it is no longer appropriate to consume like I used to. Perhaps it is better to hold the cash or put it under more discreet financial management."

Wu Xulei, 22, student

"I entered the stock market in October 2014. Generally speaking, I made money in the A-share market in 2015. When the Shanghai Composite Index sank during the summer vacation last year, I had already taken a short position. So I dodged a bullet. After that, I made some profit from some short-term investments. I think it is important to have a balanced state of mind in the stock markets. When I make a short-term investment, I won't linger on the profit, and will leave well enough alone. When I make a long-term investment and get locked up, I will wait before I release. Though I am still locked up now, I won't lose money so long as I don't sell it off. Inside news is also important. I get the news from my parents. Sometimes it can be inaccurate, but this is really rare. I'm so lucky. Currently my earnings accounts for one-third of my total investment. I will deduct a small amount of the earnings as my pocket money and put the rest into shares. I think dabbling in the stock markets is a good opportunity for me to explore some unknown fields. Now I have a better sense of the technical terms appearing on the economic news."

Posted in: Metro Shanghai, About Town