Hong Kong currency better off pegged to yuan

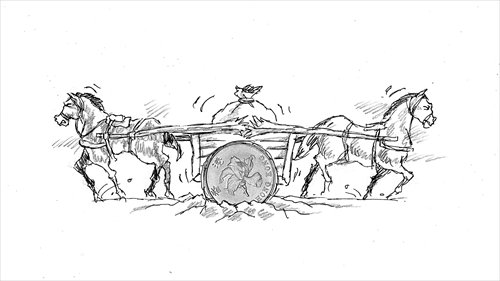

Illustration: Peter C. Espina/GT

Hong Kong's economic fundamentals have continued to weaken following the restructuring of the Chinese mainland's economy, while the US dollar, to which the Hong Kong dollar is pegged, has strengthened following the economic recovery in the US. The deviation between Hong Kong's economic fundamentals and its currency is like two gears pulling in opposite directions and the longer the deviation exists, the more the Hong Kong dollar will face downward pressure. From the perspective of economic fundamentals, this could explain the recent depreciation in the Hong Kong dollar. The pressure has provided international speculators opportunities to make bets that could exacerbate overshooting - short-run excessive movement - in the financial market, dragging down the recovery of economic fundamentals.

The economy of a country or region that adopts the system of currency boards, which requires an exchange rate pegged to a foreign currency, can be stable only when its economic cycle is basically the same as that of the foreign country or region. Considering that Hong Kong's economy is gradually aligning with the conditions on the mainland, in the short run, the stability of the peg will not be determined by the Hong Kong economy but on whether the US and Chinese mainland's economic cycles are synchronized. In the medium to long run, a peg to the yuan rather than the US dollar might be a better choice for the Hong Kong dollar, but a rigorous and sound design and arrangement is needed.

Over the past two decades, economic changes in the mainland and Hong Kong have basically been similar. Especially since the 2008 US subprime mortgage crisis, the consistency of the mainland and Hong Kong economies has been strengthened.

Meanwhile, weak fundamentals have also affected Hong Kong's ability to deal with the crisis. According to Bloomberg statistics, Hong Kong's public debt as a percentage of GDP was around 2 percent in 2005, and between 2006 and 2010, the debt-to-GDP ratio had averaged at around 15 percent, excluding that of 2009 - a high ratio influenced by the US subprime mortgage crisis. But since 2011 when the Hong Kong government attempted to stimulate the economy by increasing public debt due to a sluggish global economy, the average ratio had been close to 40 percent by 2014, leaving little room for fiscal stimulus.

On the adequacy of reserves, the latest data from the Hong Kong Monetary Authority shows that Hong Kong's $357 billion foreign exchange reserves at the end of January 2016 is 1.72 times the amount of its monetary base, declining from the range of 2.86 to 3.67 times in 1998.

Following the yuan's rapid internationalization and the gradual opening of the mainland's capital accounts, Hong Kong's financial market has established a complex web of connectivity with the mainland economy, which can be gleaned from three aspects.

First, many mainland enterprises have listed in Hong Kong, and accounted for 62 percent of the market cap by the end of 2015, according to the Hong Kong Exchanges and Clearing Limited (HKEx). The mainland's economic slowdown has hurt the profits of these enterprises, weakening the value of their shares.

Second, Hong Kong banks are burdened with increasing mainland exposure. As the US quantitative easing after its subprime mortgage crisis had greatly lowered overseas financing costs for mainland institutions, many domestic institutions borrowed foreign currencies such as the US dollar and invested in yuan assets to conduct currency and interest rate arbitrage, a huge portion of which was provided by Hong Kong banks.

As the mainland's economy slows down, the risk of debt default rises, and given the mainland's tight control over foreign exchange, it might be difficult to transfer domestic capital for repayment across the border, which will unintentionally damage Hong Kong banks.

Third, since Hong Kong is the main offshore yuan market, and now that the Hong Kong dollar, offshore yuan and onshore yuan have developed a complex relationship, the situation could encourage global speculators to initiate more complex, hidden and multidimensional attacks.

In Hong Kong's highly open and small economy, the system of currency boards helps to stabilize economic expectations but lacks monetary policy independence. As a result, when there is a deviation in the economic fundamentals between Hong Kong and the US, where the Hong Kong dollar is pegged to the US dollar, Hong Kong cannot adjust its economy through independent monetary policy, thus causing delinking pressure.

In the short run, the mainland and Hong Kong governments should join hands to fight international speculators. On the one hand, the authorities should facilitate the exchange of data and information, and monitor international speculative activities in a holistic manner; on the other hand, they should figure out the methods speculators could use and respond accordingly.

The author is a senior analyst at China Merchants Bank. bizopinion@globaltimes.com.cn