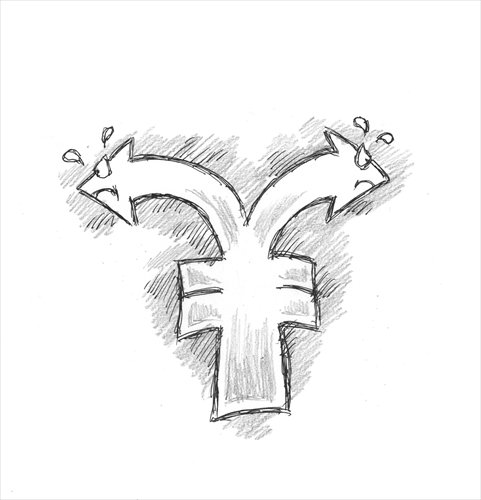

Divergence seen in Chinese companies’ development

Illustration: Peter C. Espina/GT

The Chinese economy has entered a significant and sensitive phase, and there are differing attitudes toward its future development.

The China Employer-Employee Survey (CEES) project I work for conducted field investigations among China's enterprises between 2012 and 2015 and collected nearly 6,000 questionnaire responses that comprehensively reflected the conditions in 570 Chinese enterprises, including profits, business operation, sales, technology, and salaries. Based on the research results, we came to the conclusion that China's economy shows a strong pattern of divergence.

The divergence means that enterprises that are an important part of China's micro economic health show two different traits. On the one hand, those that remain open despite poor business performance, namely "zombie enterprises," gradually exit from the market. On the other hand, firms that excel in innovation survive and prosper. Over the past three decades of reform and opening-up, Chinese firms have become polarized. Their business performance is no longer exactly in line with the overall economic cycle as in the past when almost all firms prospered along with sound macroeconomic fortunes, and suffered when the macro environment deteriorated. A fundamental change is that instead of passively accepting the economic cycle, some Chinese enterprises manage to weather adversity and succeed even in the same economic environment in which other firms are suffering.

The divergence among Chinese firms can be summarized in the following five aspects.

The first is divergence in business performance. From 2013 to 2014, the average profit margin of 80 percent of the 570 companies surveyed increased by 0.94 percentage points year-on-year, whereas 10 percent of the companies surveyed continuously recorded losses over the two years. Statistics have also shown the divergence between profit-generating companies and loss-making ones tends to widen.

The second is divergence in profit model. One category of enterprises makes profits by taking advantage of opportunities arising from fast growth in the country's GDP. Another category of enterprises is more focused on developing the companies' own abilities, in particular product quality, and is less dependent on the macro economic circumstances. In addition, regarding fluctuations in the economic situation such as regional GDP growth, enterprises that have built their own branding are less likely to be influenced by the macroeconomic environment than those that conduct contract manufacturing for other brands.

The third is divergence in utilizing resources. Currently, the increase in salaries has outpaced the improvement in productivity, so the cost advantage that certain companies used to get thanks to low labor costs is vanishing, making it hard for such companies to survive. But a different group of companies has chosen to enhance investment in human capital, replace unskilled labor with skilled workers, and enhance the contribution of total factor productivity to business performance.

The fourth is divergence in market entry and exit among different firms. According to the survey conducted in 2014, based on the time of a company's registration and indicators of business operation, among more than 700 companies, 17.6 percent failed and exited from the market. In terms of specific industries, the failure ratio in industries like ferrous metals was more than 40 percent, while the figure for the food manufacturing industry was only between 1 and 2 percent.

The last factor is divergence in innovation ability. Better-performing companies are usually the ones that have strong ability to innovate, which can be seen in their increased investment in R&D, and higher proportion of developers among total employees. Although greater research spending may not necessarily bring about better performance in the short run, it can help with increasing output eventually.

More importantly, the divergence among Chinese firms has changed China's economic growth model. It is obvious that enterprises' own ability to generate growth affects China's economic growth and pure macroeconomic policy stimulus won't necessarily boost a company's earnings. These changes will allow the market to play a deciding role, and can help the economy move away from the old-fashioned and unsustainable development model, and head toward one that is of higher quality and more market-based.

Facing such realities of the great divergence among Chinese firms, the economy may struggle to recover because resources are sometimes mismatched in the capital market and labor market, which can hinder innovation, and path dependence still results in inefficient institutional systems.

The Chinese economy is at a crossroad. The country must choose between a path that strives for better economic quality, or a path that blindly pursues economic growth. And whether the decision we make is wise or not can be tested in the reshaping of the country's entrepreneurial spirit and reform of the existing system.

The author is director of the Wuhan University Institute of Quality Development Strategy. bizopinion@globaltimes.com.cn